MYTHEO Protect - Complimentary Insurance Coverage Plan to secure your future and safeguard your wealth

Tackling life's uncertainties can feel like navigating through a maze blindfolded. But fear not! Introducing MYTHEO Protect* - your beacon of assurance amidst the unpredictability, exclusively designed for MYTHEO investors

As you venture into the realm of investment, we understand the myriad of challenges you may face. That's why we've crafted this complimentary insurance coverage plan to serve as your shield, protecting your wealth as you embark on your financial journey. 🚀💼

Grow, Protect, Thrive with MYTHEO Protect.

- Comprehensive Coverage: Protection coverage for Life & Total Permanent Disability (TPD) until the end of campaign period (30 April 2025)

- Dynamic Protection: Sum insured grows alongside your investment deposit.

- Auto-enrollment: No Underwriting is required. . The underwriter of this complimentary life and TPD insurance is Tokio Marine Life Insurance Malaysia Berhad.

- Freedom to Flourish: Enjoy the flexibility of a no-lock period.

How to be entitled for MYTHEO Protect*?.

✅Maintain ONE portfolio with a minimum Asset Under Management (AUM) of RM3,000

✅Set up a Regular Savings Plan (RSP) of minimum RM100 monthly per portfolio

🎉Voila! You are now shielded with MYTHEO Protect

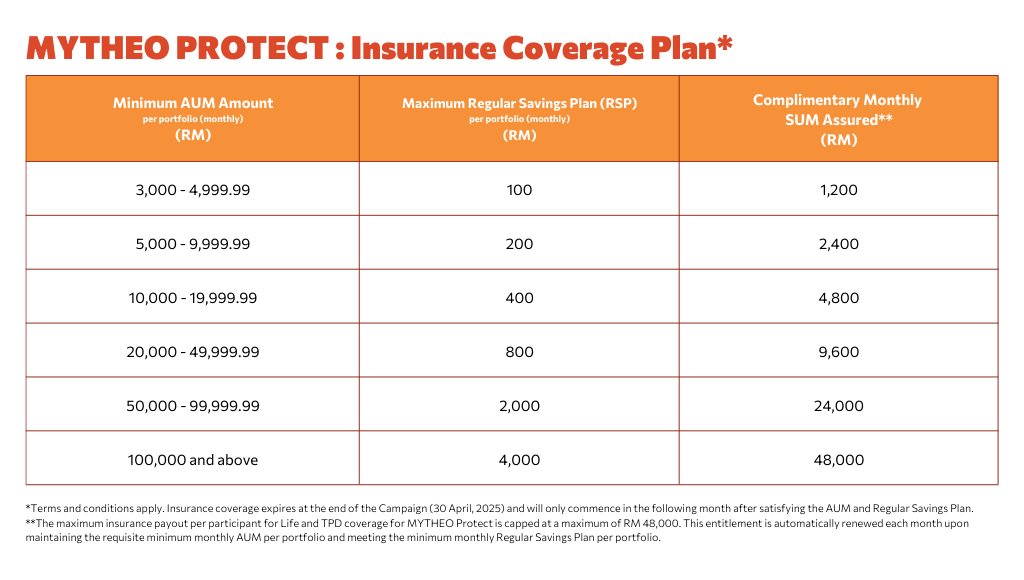

MYTHEO Protect offers six (6) tiers of coverage

based on the Asset Under Management (AUM) and Regular Savings Plan (RSP) per portfolio for each MYTHEO user.

Any participant who meets the minimum monthly AUM per portfolio and contributes a monthly (of at least RM 100) RSP per portfolio will automatically be entitled for the complimentary monthly sum insured. The complimentary monthly sum insured is x12 of the RSP amount. However, the maximum amount of the complimentary sum insured is based on the Maximum Monthly RSP per portfolio. Please refer to the table above.

With MYTHEO Protect by your side, you're not just protecting your wealth – you're unlocking a world of possibilities, where growth, security, and freedom converge to help you thrive.

*MYTHEO Protect is a complimentary insurance coverage plan provided by MYTHEO exclusively for MYTHEO investors. The underwriter of this complimentary life and TPD insurance is Tokio Marine Life Insurance Malaysia Berhad. Terms and conditions apply.

Terms & Conditions for MYTHEO’s Insurance Campaign

- This campaign ("Campaign") is organized by GAX MD Sdn Bhd ("MYTHEO") ("the Organiser"). This Campaign shall commence on 1 May 2024 until 30 April 2025 (“Campaign Period”). The Organiser reserves the right to terminate, modify, or extend the Campaign earlier than 30 April 2025 without any prior notice.

- Participants (as defined hereinafter) are automatically enrolled in this Campaign upon meeting the Terms & Conditions established by the Organiser, that may change from time to time.

- This Campaign is exclusively for Participants who are direct clients of the Organiser. Clients enrolled through MYTHEO+ Advisory app are not eligible to participate in this Campaign.

-

The Campaign provides complimentary life and total permanent disability (TPD) insurance coverage to every Participants who maintains:

- a minimum monthly asset under management (AUM) per portfolio; and

- a monthly regular savings plan (RSP) with the Organiser;

during the Campaign Period.

- a minimum monthly asset under management (AUM) per portfolio; and

- The monthly RSP must be successfully debited each month. Failure to do so would void the Participant’s complimentary insurance coverage.

- The underwriter of this complimentary life and TPD insurance coverage is Tokio Marine Life Insurance Malaysia Berhad.

- There are no additional fees, charges, or cost to be borne by Participants under this Campaign.

- The Campaign is open to every Participant who is aged 18 to 59 years old. Upon attaining the age of 60 years old, Participants will no longer be eligible for the Campaign.

- No underwriting is required.

- Any pre-existing conditions are excluded.

- Repatriation benefit is applicable.

- The sum assured is based on 12 times the monthly RSP amount, subject to Participants fulfilling the AUM tier (Refer to section 15).

- However, the maximum sum assured per Participant for life and TPD coverage is capped at a maximum of RM 48,000 under this Campaign.

- The Campaign offers six (6) tiers of AUM and monthly RSP that must always be satisfied by Participants to receive the sum assured in the event of a claim.

-

The 6 tiers are as follows:

The above table categorizes participants into six distinct tiers based on their AUM amounts per portfolio, outlining the corresponding maximum sum assured calculated as 12 times the eligible monthly Regular Savings Plan (RSP) amount.

- Subject to the Participant’s tiered AUM amount, Participants are insured from a minimum of RM 1,200 to a maximum of RM 48,000.

- The sum assured is calculated by multiplying the eligible monthly Regular Savings Plan (RSP) amount by 12, subject to the maximum sum assured specified in the table.

- If a Participant increases their RSP and/or AUM during a month, thus reaching a higher tier, the insured amount will also increase. This increased insured amount will take effect in the subsequent calendar month and not on the same month.

- Conversely, if the Participant decreases their RSP and/or AUM during a month, thus reaching a lower tier, the insured amount will also decrease. The lower insured amount will take effect in the subsequent calendar month and not on the same month.

- Monthly RSP amount exceeding the maximum monthly RSP of their tier will not result in an increase in the sum assured. The maximum sum assured for that tier will apply (Refer to section 15 above).

- Participants that meet the required monthly RSP, but did not meet the minimum AUM of that tier will not be entitled for the sum assured.

- The minimum monthly AUM per portfolio to be eligible for the complimentary monthly sum assured shall be observed on the last calendar day of every month.

- In the event, a Participant’s monthly RSP is paused, terminated, unsuccessfully debited or in any way not debited for a particular month, the complimentary sum assured will no longer applicable and participation it is deemed null and void.

- Participants may reinstate their complimentary sum assured by fulfilling the AUM and monthly RSP based on the table illustrated in section 15 above.

Scenario Examples

The Campaign Period is from 1 May 2024 until 30 April 2025, being one (1) year.

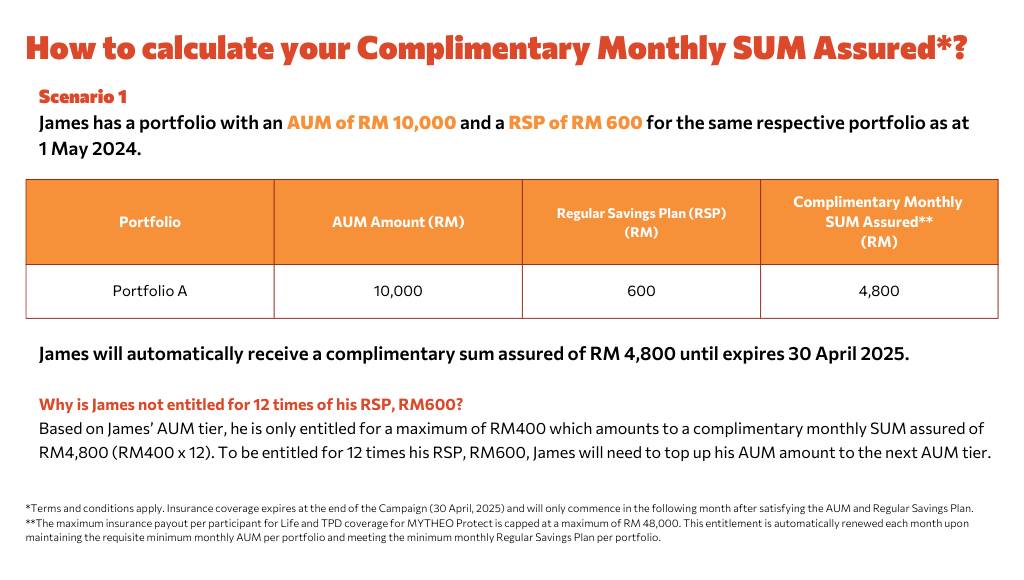

Example 1

Participant A has an existing portfolio with an AUM of RM 10,000 and a monthly RSP of RM 600 for the same respective portfolio as at 30 May 2024. Therefore, Participant A will automatically receive a complimentary sum assured of RM 4,800 for May 2024.

The maximum sum assured for an AUM of RM 10,000 is RM 4,800 with a monthly RSP of RM 400. The sum assured is 12 times the monthly RSP based on the respective tier. To increase the sum assured, Participant A may top-up their AUM and monthly RSP amount to RM 20,000 and RM 800 respectively. In this case, Participant A will receive a sum assured of RM 800 x 12, which is RM 9,600.

This entitlement is automatically renewed each month until 30 April 2025 upon maintaining the requisite minimum monthly AUM and meeting the minimum RSP per portfolio.

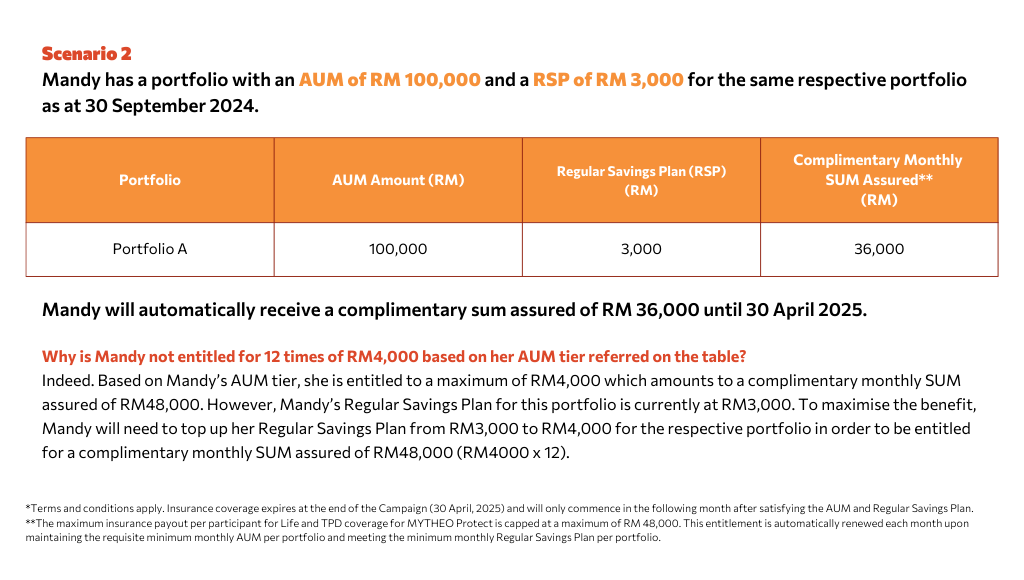

Example 2

Participant B has created a new portfolio with an AUM of RM 100,000 and a monthly RSP of RM 3,000 for the same respective portfolio as at 30 September 2024. Therefore, Participant B will automatically receive a complimentary sum assured of RM 36,000 for October 2024.

This entitlement is automatically renewed each month until 30 April 2025 upon maintaining the requisite minimum monthly AUM and meeting the minimum monthly RSP per portfolio.

To maximize the maximum sum assured in their tier, Participant B may increase their monthly RSP to RM 4,000 which will entitle them to a maximum coverage sum assured of RM 48,000.

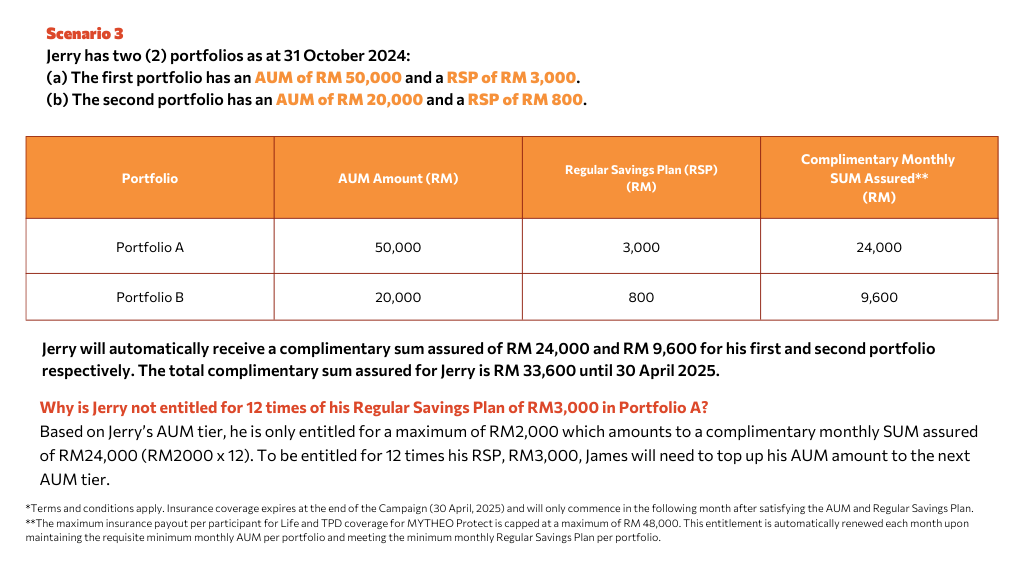

Example 3

Participant C has two (2) existing portfolios. The first portfolio has an AUM of RM 51,000 and a monthly RSP of RM 3,000. The second portfolio has an AUM of RM 21,000 and a monthly RSP of RM 800 as at 31 October 2024. Therefore, Participant C will automatically receive a complimentary sum assured of RM 24,000 and RM 9,600 for their first and second portfolio. The total complimentary sum assured for Participant C is RM 33,600 for October 2024.

This entitlement is automatically renewed each month until 30 April 2025 upon maintaining the requisite minimum monthly AUM and meeting the minimum monthly RSP per portfolio.

- Participants may have multiple portfolios to be eligible for the Campaign. However, the maximum sum assured per Participant is capped at RM 48,000.

- The Organiser reserves the discretion to halt, extend, or modify both the terms and duration of the Campaign as deemed necessary and without prior notice.

- In the event, a Participant claims for TPD, the Organiser shall have the discretion to invest the sum assured into the Participants respective portfolio(s) that were eligible for this Campaign.

- Participants may choose to opt-out from the campaign at any time by emailing or contacting our customer service at contact@mytheo.my or +603-8408 1613.