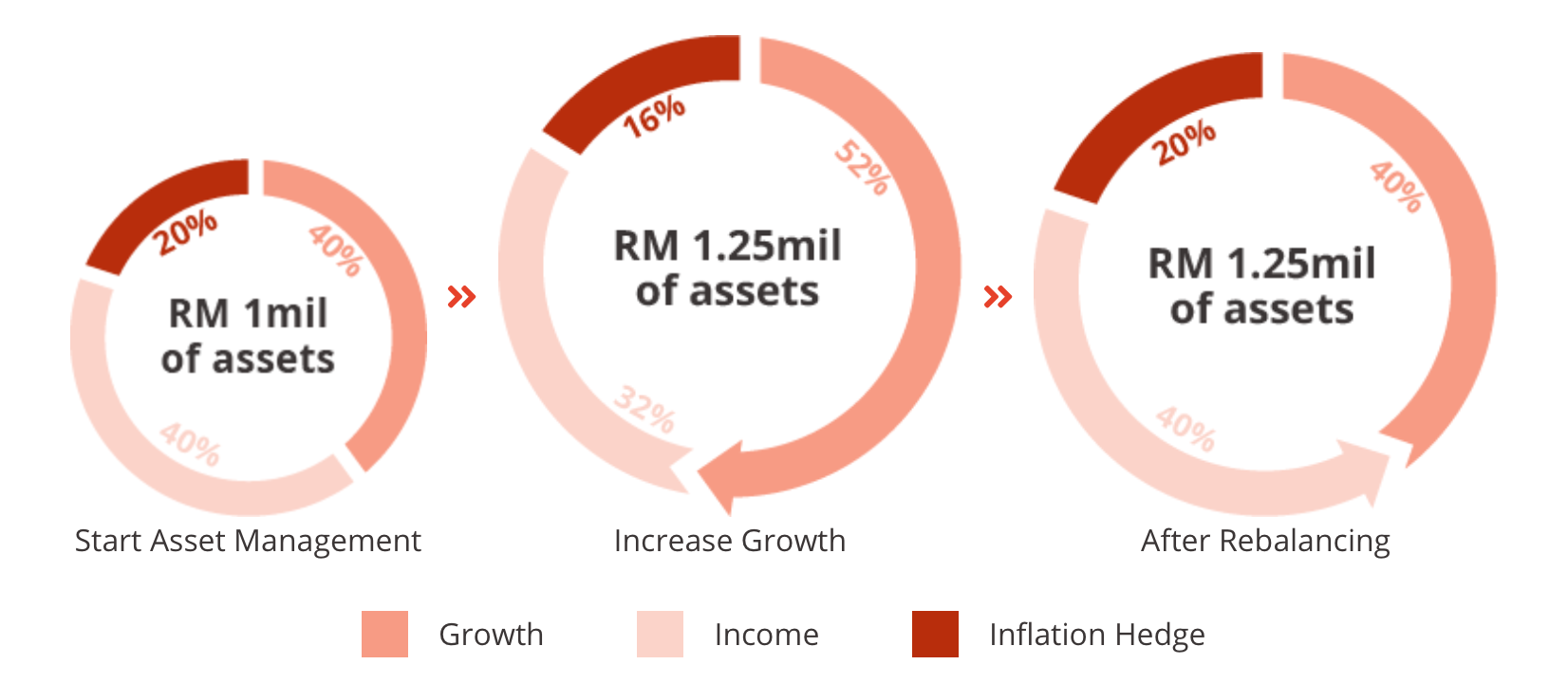

Maintains Your Portfolios All The Time

Key to delivering good investment performance over the long term, MYTHEO’s fully automated portfolio maintenance capabilities deliver the following benefits:

Efficiency

MYTHEO’s experts are continuously improving the algorithms to optimally manage your assets with the latest investment techniques.

Effective

MYTHEO makes rational investment decisions without the risk of human bias as rash investment decisions often lead to disappointing results.

Easy

MYTHEO maintains your portfolio so that you can relax and focus on the other important things in life.