"Let’s protect the environment and nurture a better society with MYTHEO Global ESG."

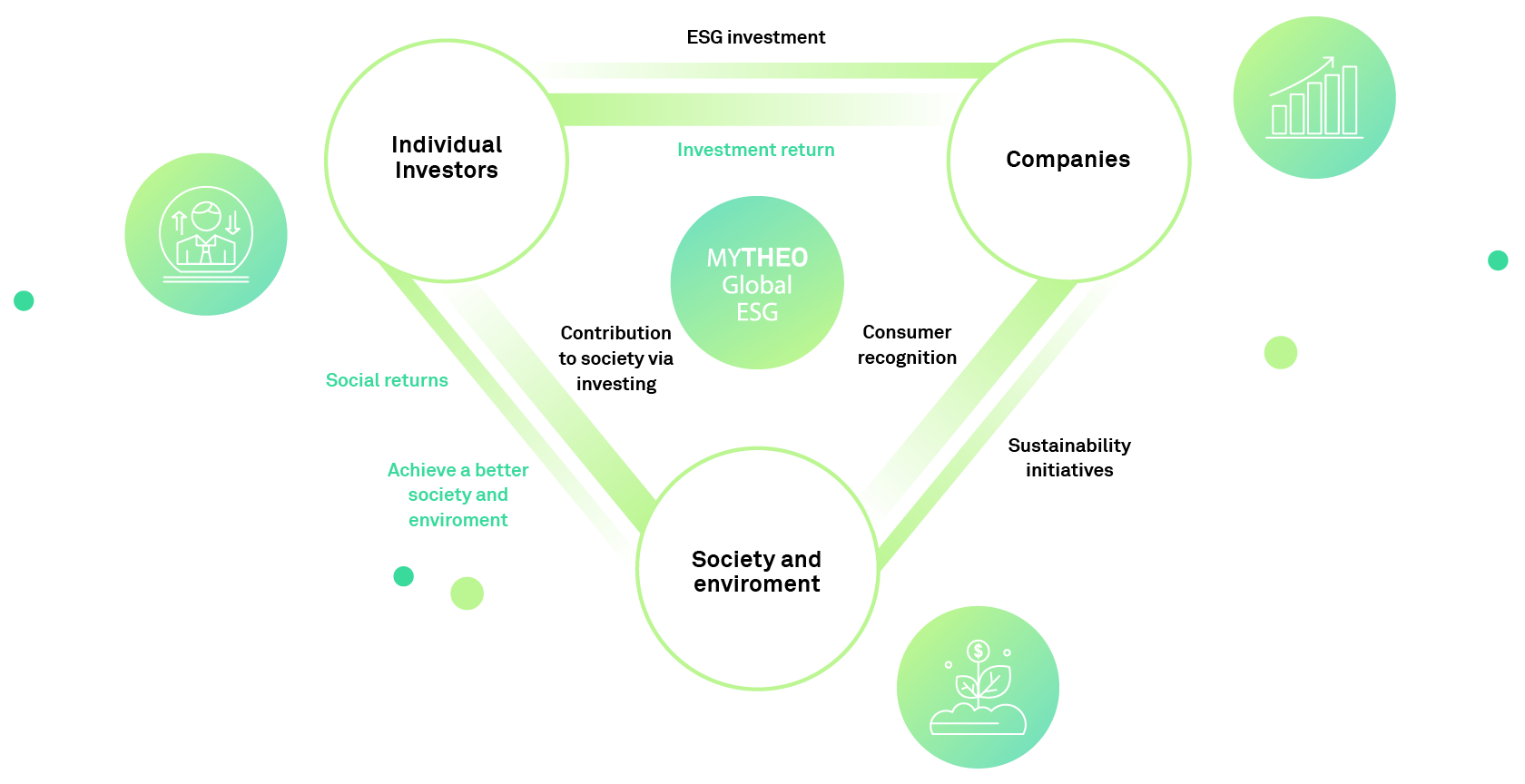

MYTHEO Global ESG allows you to create a portfolio comprising only ESG-related ETFs. This way, you can play your part as a responsible citizen every step along the way in your investing journey.

ESG investing refers to evaluating companies based on their Environmental (E), Social (S) and Governance (G) characteristics when making investment decisions.For example, investing in companies that actively use clean energy to lower carbon dioxide (CO2) emissions or increase employment to help regional economies. These companies reduce the burden of growth on the natural environment and society and aim for sustainable growth by taking into account the environment and society in their business models. A company with good corporate governance has a clear strategy that guides the organisation’s long-term growth, coupled with executives that would always actin the best interest of shareholders.

The merits of ESG investing is that it provides “double returns”. The first one is the social return or benefits to the society, achieved through selecting companies from an ESG viewpoint. This way, investors can contribute to the society via the sustainable development goal (SDG) activities of the companies. The second return is the economic return. Companies with high ESG ratings and those that are helping to solve social issues are expected to be more resilient and may create more value for investors in the long term.

The size of ESG investments continues to grow. The Global Sustainable Investment Alliance (GSIA) estimated that the global ESG investments in 2020 was USD35 trillion, an increase of 55% since 2016 and 15% since 2018. While the growth of ESG investments was sluggish in Europe due to stricter ESG standards, the rise was rather significant in the United States and Japan, which now account for 35.9% of global investment assets.

The SDGs (Sustainable Development Goals) adopted by the United Nations (UN) in 2015 aimed to achieve 17 common goals by 2030, including tackling climate change, eradicating poverty and reducing inequality. There are a rising number of companies incorporating SDG targets in their businesses. By investing in ESG, we too are participating in the SDG initiatives.