Wednesday, 12 February 2025

Written by MYTHEO

☕️🍫 Brace Yourself: Your Morning Coffee and Chocolate Fix Might Get More Expensive!

Have you noticed the rising cost of your daily coffee or chocolate treat? If you haven’t yet, you likely will soon. Global coffee and cocoa prices have been surging due to extreme weather conditions and geopolitical events, and the impact is trickling down on consumers.

The Soaring Cost of Coffee

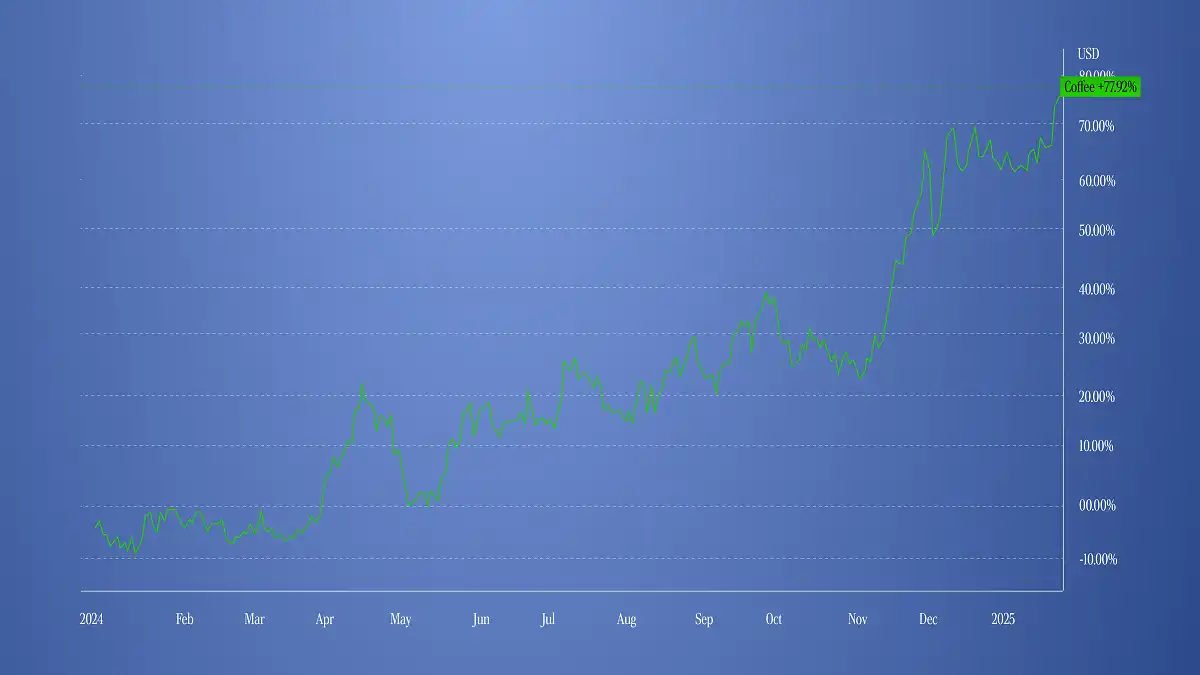

In 2024, coffee prices surged by 61.8%, largely due to severe droughts in Brazil—the world’s largest coffee producer. Brazil accounts for around 30% of global coffee production and nearly 50% of the world’s Arabica beans, making its weather patterns a crucial factor in coffee pricing. The country recently faced one of its worst droughts in history, leading to supply shortages and price spikes.

In early 2025, coffee prices continued their upward trend after newly elected President Trump might implement a 25% tariff and economic sanctions on Colombia. Colombia is the world’s fourth-largest coffee producer, holding a 7% market share. These geopolitical tensions are adding further pressure on supply and prices.

Cocoa Prices Hit Record Highs

Since early 2024, cocoa prices have skyrocketed by 184%, reaching unprecedented levels. What’s behind this surge? The main culprit is a severe supply shortage in Ivory Coast and Ghana, which together produce around 60% of the world’s cocoa. Both countries have faced extreme weather conditions, with unpredictable rainfall patterns leading to lower-than-expected yields.

According to the World Bank, global cocoa production declined by 14% in 2024, dropping from 4.9 million metric tons (mt) in 2023 to just 4.2 million mt. With demand remaining strong, this supply crunch is pushing cocoa prices to record highs.

What Does This Mean for Consumers?

💰 Higher Prices Ahead – Coffee shops and chocolate manufacturers will likely pass on these costs to consumers. A simple cup of coffee or a chocolate bar could become significantly more expensive in the coming months.

⚠️ Limited Supply – Expect potential shortages of high-quality coffee and cocoa products as producers struggle to meet demand.

How Investors Can Turn This Crisis into an Opportunity

Instead of just absorbing these rising costs, investors can benefit from them. How? By investing in assets that track the price movements of key commodities like coffee and cocoa.

💡 Invest in MYTHEO's Inflation Hedge Portfolio

📈 MYTHEO’s Inflation Hedge was up 1.44% in January 2025 - Designed to perform well during inflationary periods, MYTHEO’s Inflation Hedge Portfolio invests in a mix of real assets, including the Invesco DB Agriculture Fund (DBA)—an ETF that holds various agricultural commodities.

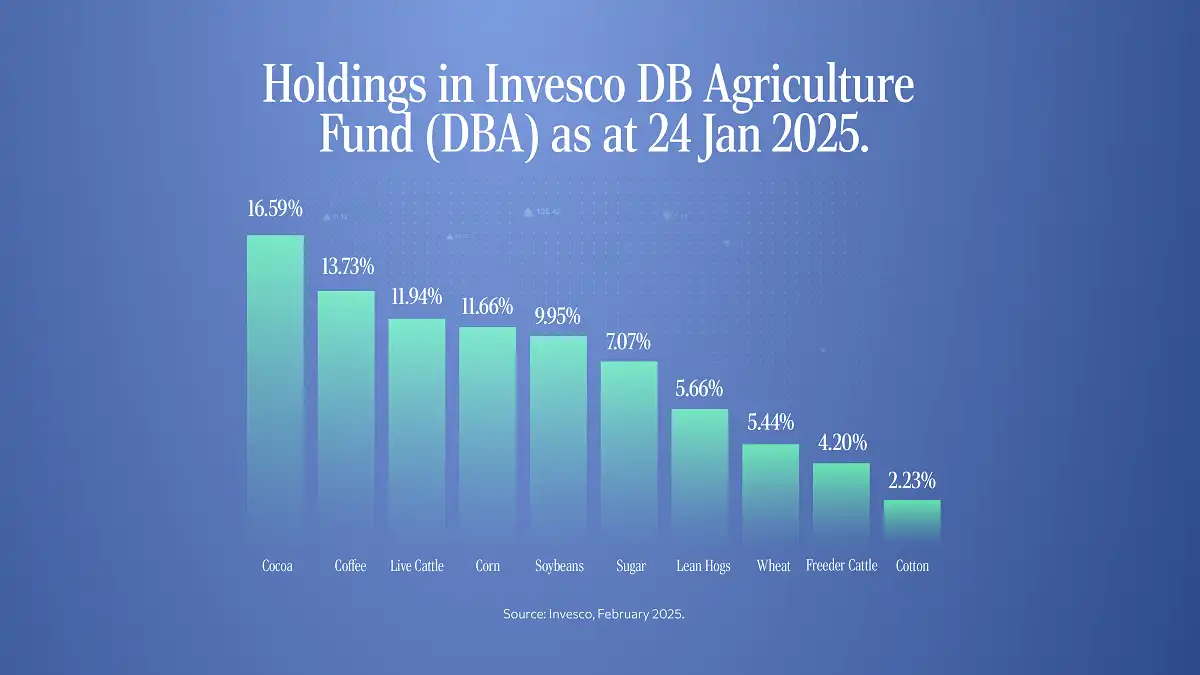

✅ As of January 2025,cocoa and coffee are the two largest holdings in Invesco DB Agriculture Fund (DBA), with weightings of 16.59% and 13.73%, respectively.

✅ Weather-driven commodity price movements are not just a short-term trend. As climate change leads to more unpredictable weather patterns, investing in real assets like agricultural commodities can be a smart long-term strategy.

📌 Holdings in Invesco DB Agriculture Fund (DBA) as of 24 January 2025

Source: Invesco, January 2025.

Beyond Agriculture, MYTHEO’s Inflation Hedge portfolio is also strategically positioned in Gold, Silver, Real Estate, and Crude Oil—assets that historically perform well during inflationary periods. This strategic allocation allows investors to capture potential gains from rising prices.

Over the years, the portfolio has consistently outperformed its objective of protecting investors from inflation, delivering strong returns and resilience in uncertain markets.

MYTHEO Inflation Hedge Portfolio performance as at 31 January 2025*

Period

1 Year

3 Year

5 Year

MYTHEO Inflation Hedge

6.88%

13.37%

30.56%

*In today’s inflationary environment, protecting your wealth is just as important as growing it. Investing 100% in MYTHEO Inflation Hedge Portfolio may not reflect your risk profile and appetite. The past performance of the portfolio is not indicative of future results and no representation or warranty is made regarding its future performance.

Why MYTHEO?

📈 A Unique Offering in the Malaysian Market – MYTHEO’s Inflation Hedge Portfolio gives investors direct exposure to commodities impacted by inflation.

🌱 A Hedge Against Rising Costs – While everyday consumers feel the pinch, MYTHEO investors can benefit from price increases.

🔎 Fully Managed Portfolio – Unlike direct commodity investments, MYTHEO’s Inflation Hedge Portfolio is professionally managed, ensuring optimal diversification and risk management.

💡How to invest in 100% MYTHEO Inflation Hedge Portfolio?

The MYTHEO Inflation Hedge Portfolio is one of the functional portfolios within MYTHEO Omakase, a personalised investment solution that blends three key portfolios: Growth, Income, and Inflation Hedge. Your MYTHEO Omakase portfolio’s allocation is tailored based on your risk profile (e.g., 60% Growth, 15% Income, 25% Inflation Hedge). However, you also have the flexibility to customize these weightages according to your preference.

If you prefer to invest solely in the MYTHEO Inflation Hedge Portfolio, you can set the allocation to 100% Inflation Hedge. Below is a step-by-step guide to creating a fully MYTHEO Inflation Hedge portfolio:

How to Create a 100% MYTHEO Inflation Hedge Portfolio

- Create a new portfolio from your home screen.

- Select “MYTHEO Omakase” and click “Confirm”.

- Choose “No, I have a portfolio in mind”.

- Adjust the Inflation Hedge weightage to 100%, ensuring that Growth and Income are both set to 0%. Click “Save”.

- Click “Deposit”, name your portfolio, and complete the setup.

Your 100% MYTHEO Inflation Hedge Portfolio is now successfully created! 🚀

Take Control of Your Financial Future

Rather than just watching prices rise, why not invest in the forces driving them? With MYTHEO’s Inflation Hedge Portfolio, you can turn market volatility into an opportunity.

👉 Start investing today and hedge against inflation with MYTHEO.

This material is subject to MYTHEO’s Notice and Disclaimer.