Friday, 20 September 2019

Written by Matthew Stuart-Box, COO, Head of Investment Platform

MYTHEO is an “automated asset management service”, but many people have asked to know more about how MYTHEO actually performs the Omakase (‘I’ll leave it up to you’) approach.

The MYTHEO Omakase journey begins with a portfolio diagnosis we provide for our potential investors. Once they are onboard, we execute transactions such as currency trades from Ringgits to US Dollars with no exchange fees and at a competitive rate, ETF purchases with no trading fees, efficient trade executions on better terms and monthly rebalancing of your portfolio. The objective of these actions is to get the best possible return on the investment.

I will explain in more detail the actual steps involved when MYTHEO does a transaction on behalf of an investor.

Hopefully, this should be useful if you are considering using MYTHEO or if you are already using MYTHEO.

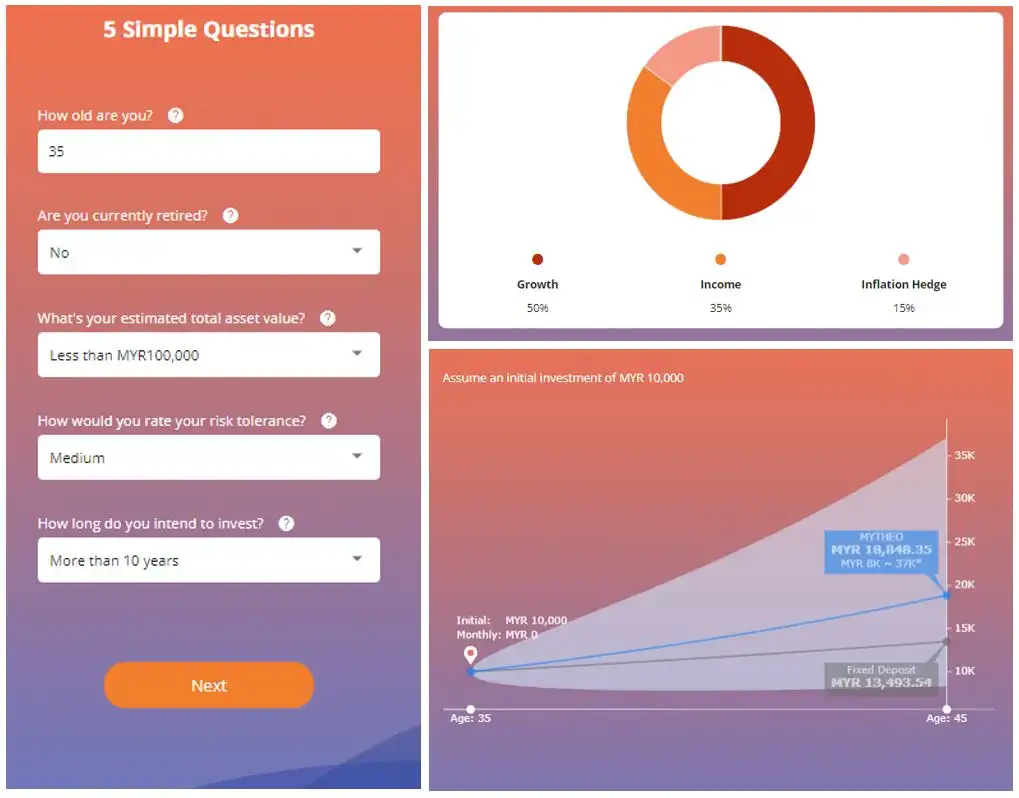

Portfolio Diagnosis

A portfolio diagnosis is the first step in setting up an account at MYTHEO. Based on information provided such as the investor's investment purpose and risk tolerance, MYTHEO selects the optimal asset management policy tailored to the investor from a total of 231 MYTHEO portfolios.

MYTHEO aims to provide investment services that are really beneficial for investors' lives. Therefore, we categorized the typical asset management needs of investors into three categories and created portfolios that meet each of these needs. These are called “functional portfolios”. Specifically, there are three functional portfolios: growth (stock-centric), income (bond-centric), and inflation hedge (real asset-centric).

As its name suggests, Growth is focused on “long term increase in value”, and we recommend that it be included portfolios of investors who have regular labor income such as salary and want to build assets over the long term.

Income is “stability-oriented”, and it is recommended for people who are retired or do not want to take risks that might lead to a sudden decrease in assets while obtaining stable profits at low risk.

The last portfolio, Inflation Hedge, is focused on “offsetting the effects of inflation”, and it is recommended for people who already have a lot of assets and want to prevent the asset value from decreasing due to inflation.

These three are combined in a well-balanced manner according to the individual needs of each investor. This allocation strategy is a customer centric lifestyle approach basing on individual profiles, risk tolerance and investment horizon regardless of your goals. Goals may change in the future but a sound and disciplined lifestyle of investing may not. MYTHEO instills this investment discipline by automatically monitoring, rebalancing and optimizing your portfolios.

After you have opened your account and deposited cash, all operations and maintenance can be left to MYTHEO.

Unique to MYTHEO, zero currency exchange fee!

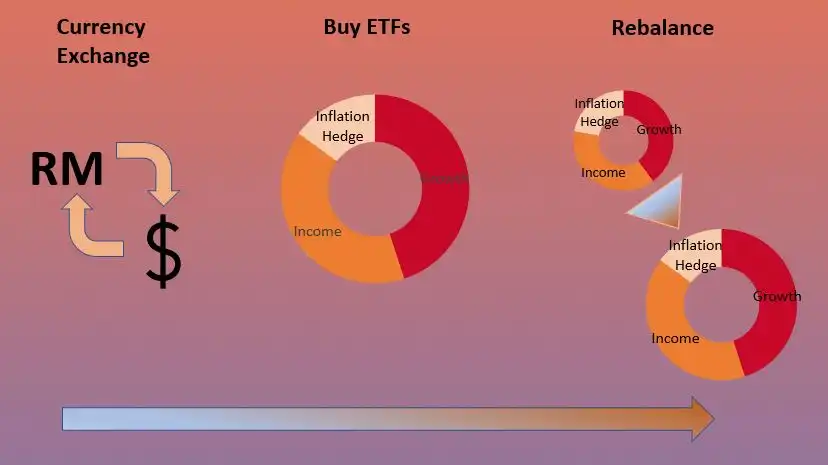

Once the account is opened and the deposit is made, the main transaction that will be executed is the “currency exchange”, “ETF (Exchange-Traded Fund) purchase” and “rebalance”.

When executing transactions for investors, MYTHEO uses various techniques to get the best possible results.

Investors deposit Ringgit in the trust account. The ETFs purchased for investors are denominated in US Dollars so MYTHEO does a currency trade to switch the Ringgits to US Dollars. Most asset managers charge a commission for currency exchanges but MYTHEO does not charge any commission. In other words, the exchange fee is zero. This means that the exchange rates enjoyed by investors are actually at a more favorable rate than that displayed at the bank.

Generally, foreign exchange transactions are divided into “interbank transactions” and “customer transactions” for general investors.

“Interbank transactions” refers to transactions in the “interbank market” where exchanges are made between financial institutions, and multiple financial institutions around the world present their selling and buying prices. They trade at the most favorable rate (the cheapest buy price for the buyer and the highest sell price for the seller). Banks refer to interbank market rates and indicate “customer-to-customer transactions” with fees. It is difficult for individuals to exchange money in this interbank market.

MYTHEO exchanges at the rate of the interbank market at the time of exchange, and the exchange fee is charged by MYTHEO. For this reason, it is advantageous for investors compared to doing currency exchanges themselves using the rates quoted by banks to investors.

Zero commission on ETF trades

Next, MYTHEO purchases ETFs (Exchange-Traded Funds) on behalf of the investor.

As a refresher, let’s recall what is an “ETF”. An ETF is an investment trust that is listed on a stock exchange and aims to track an index such as a stock index.

For example, a representative ETF product is an ETF linked to the S&P500 Index. S&P500 is a stock index that reflects the movement of 500 large stocks listed on stock exchanges in the United States. An ETF linked to the S&P500 will be managed so as to move in almost the same way as the S&P500. In other words, holding this ETF will have almost the same effect as investing in the S&P500 as a whole.

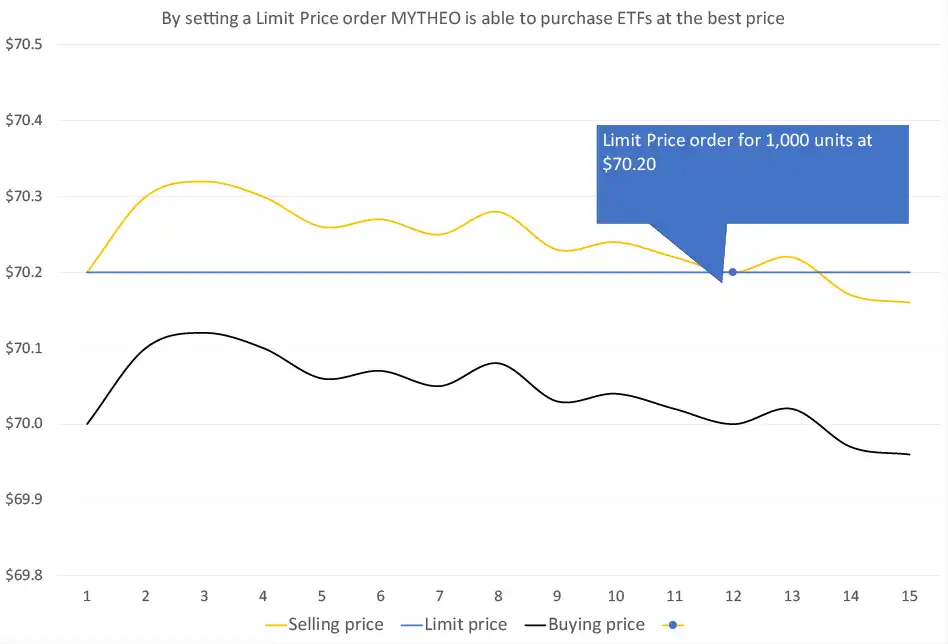

When purchasing ETFs, there is a system in place that allows trading on better terms. Normally, when buying and selling, you do not specify a price. This means you trade at the market price at that time. On the other hand, a “limit order” allows you to wait for the right conditions by specifying a price at which you are willing to trade.

MYTHEO conducts trading by using “limit orders” while monitoring US market prices in real time. By adjusting the limit price, even stocks with a large market spread (the difference between the selling price and the buying price) will be traded on better terms that market orders. The difference between the selling price and the buying price in each transaction may be small, but if we accumulate over time, it can have a large long-term impact on performance.

In addition, we check every day for all investors to see whether there is any surplus cash in the account and, if there is, we will buy stocks to make sure that the investor stays fully invested.

In these ETF transactions, MYTHEO bears the transaction fees and exchange fees paid to the US securities company that executes the trade. In other words, the investor pays zero trading fees!

Monthly rebalancing function

MYTHEO performs monthly rebalancing for all investors. Rebalancing is a way to restore the investment allocation back to the target after it has changed due to market movements during the month.

Depending on your purpose and the assets you have, what you buy and how much you buy will vary. On the other hand, market prices are constantly changing. MYTHEO continuously monitors the market, calculates the optimal order quantity for each investor and ensures that all portfolios are kept up to date.

MYTHEO’s Omakase approach strives to help investors achieve the best possible long-term results.

INVEST NOW

and start your digital investment journey with MYTHEO!

DOWNLOAD THE APP