11 November 2024

Written by MYTHEO

Key Takeaways

- The US Dollar (USD) strengthened against the Malaysian Ringgit (MYR) for the first time after three months of depreciation

- Global equity markets experienced their second monthly decline of 2024, falling 2.3% in October, remain up 15% for the year

- Gold has reached a new all-time high, trading historical high at approximately US$2,801 per ounce, with prices surging more than 30% this year.

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in October 2024.

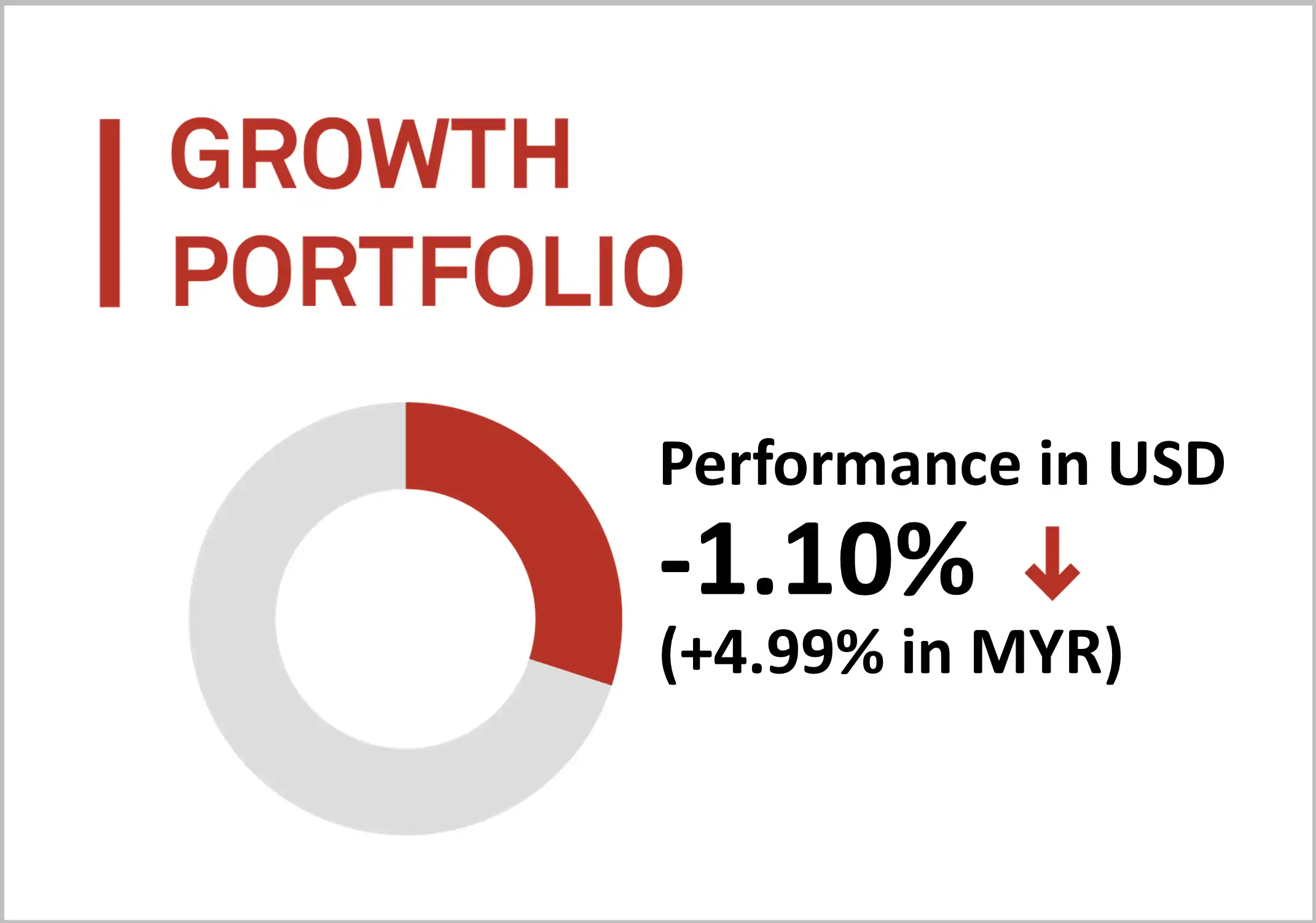

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 1.10% (up 4.99% in MYR) in October 2024.

For the month of October 2024, the portfolio did not shift by much and the US market remains as our largest investment exposure.

The portfolio’s allocation to S&P growth (RPG) of about 9% was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE GROWTH (RPG)

INVESCO S&P 500 PURE VALUE (RPV)

INVESCO NASDAQ 100 (QQQM)

+0.05%

-0.30%

-0.86%

Bottom 3 ETFs performance (Growth portfolio)

ISHARES MSCI UNITED KINGDOM (EWU)

VANGUARD FTSE PACIFIC (VPL)

SPDR EURO STOXX 50 (FEZ)

-4.97%

-5.45%

-5.62%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2024.

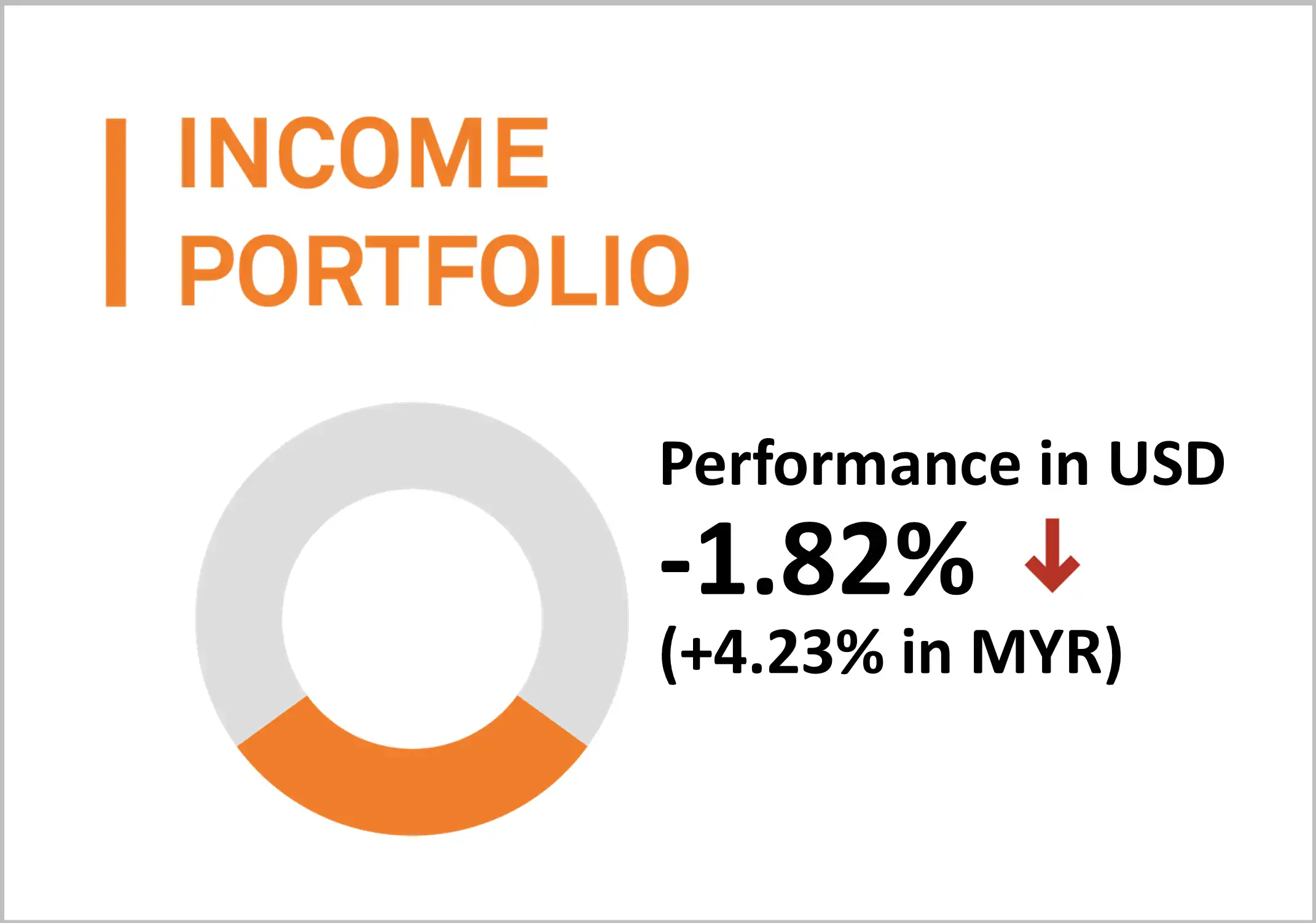

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a loss of 1.82% (up by 4.23% in MYR) in October 2024.

In October 2024, the income portfolio underwent its quarterly re-optimization with an increased allocation to longer term international treasury bonds to enhance overall portfolio duration. Overall portfolio remained relatively stable, maintaining substantial positions in short-term duration corporate bonds and treasury bonds, which were strategically balanced with longer-term US Treasury holdings. The current yield-to-maturity of the bond ETFs in the portfolio (excluding preferred stock) stands at approximately 4.81% reflecting a strategic focus on yield enhancement while managing risk effectively.

The portfolio’s exposure to Senior loan ETF (SRLN) of about 10% was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES FLOATING RATE BONDS (FLOT)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

+3.21%

+3.09%

-0.44%

Bottom 3 ETFs performance (Income portfolio)

ISHARES INTERNATIONAL TREASURY BOND (IGOV)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-4.02%

-4.46%

-5.46%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2024.

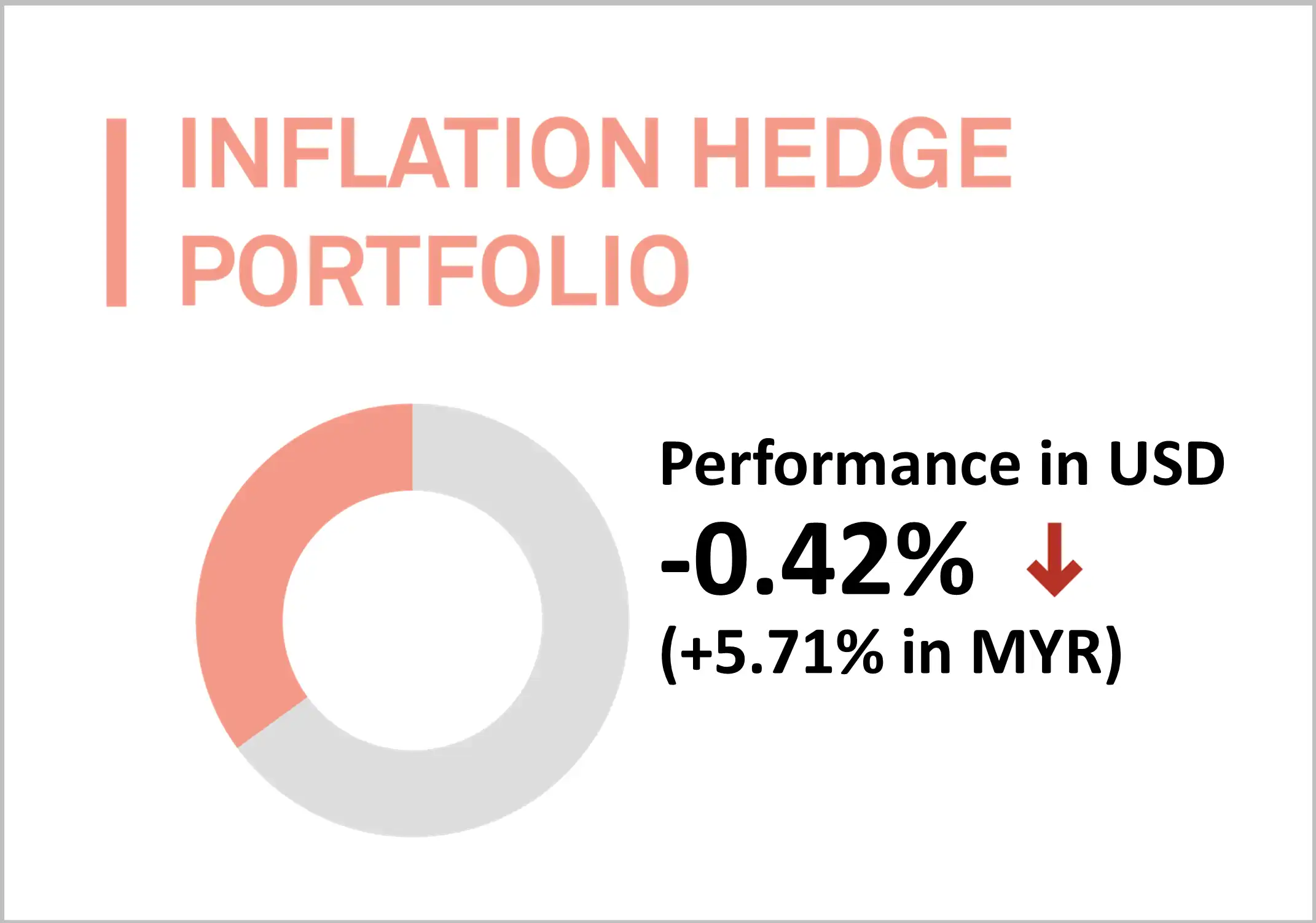

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a negative USD return in October 2024, down by 0.42% (up by 5.71% in MYR).

The core holdings of this portfolio are meticulously structured to prioritize resilience amid market volatility, particularly within equities and bonds. Emphasizing US real estate and inflation-linked bonds, the allocation to these assets is strategically designed to navigate fluctuations adeptly. US real estate, infrastructure, and base metals allocations are chosen for their ability to mitigate long-term inflation risks. Simultaneously, investments in inflation-linked bonds and gold offer added stability and diversification benefits, acting as buffers against the inherent turbulence of equity and bond markets.

The portfolio’s allocation to Gold (IAU) of about 15% was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES SILVER TRUST (SLV)

ISHARES GOLD TRUST (IAU)

INVESCO DB OIL FUND (DBO)

+4.93%

+4.31%

+3.94%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES MORTGAGE REAL ESTATE (REM)

SPDR DJ INTERNATIONAL REAL (RWX)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

-5.52%

-8.85%

-10.82%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2024.

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is down by 1.26% (up by 4.83% in MYR) in October 2024.

In line with the growth portfolio strategy, MYTHEO Global ESG portfolio exhibits a preference and exposure of around 60% to the US market. This substantial weighting is justified by the United States' prominent role in Environmental, Social, and Governance (ESG) investments, coupled with its well-established track record. By carrying a higher allocation to US markets, MYTHEO recognizes not only the maturity of these markets but also underscores its commitment to effective risk management strategies.

Top 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI USA (ESGU)

ISHARES MSCI USA ESG SELECT (SUSA)

-0.12%

-1.24%

-1.97%

Bottom 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE (NULV)

ISHARES ESG AWARE MSCI EM (ESGE)

ISHARES ESG AWARE MSCI EAFE (ESGD)

-2.35%

-3.19%

-5.35%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2024.

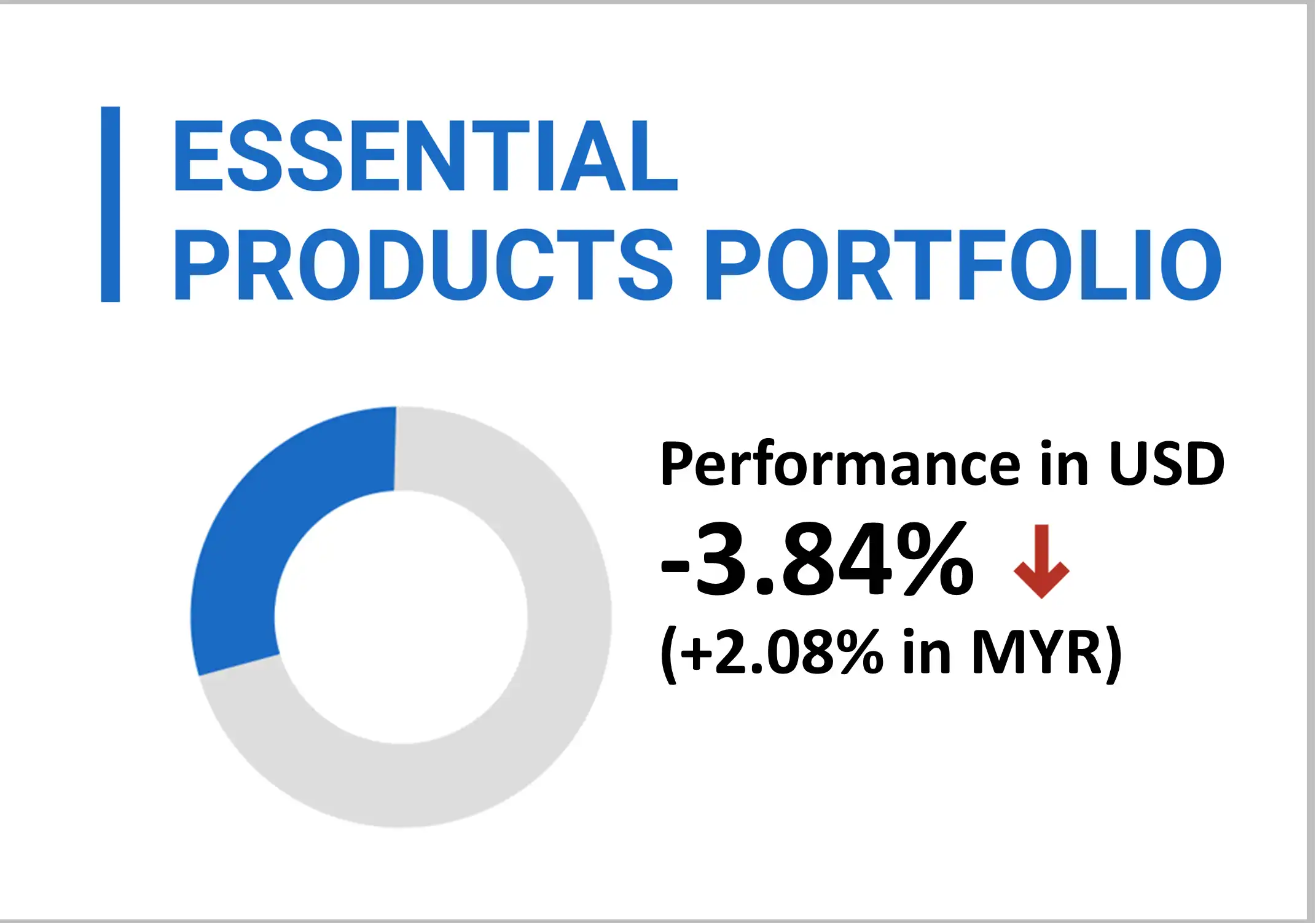

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was down by 3.84% (+2.08% in MYR) in October 2024.

The portfolio emphasis on ETFs reflecting pivotal themes of food, water, and energy, encompassing both new energy and traditional energy resources. With an allocation of around 60% to the US market, this strategic positioning is weighed to seize promising investment prospects arising from technological innovations and evolving business models within these sectors on a global scale.

The clean energy sector is facing significant losses due to several challenges, including the struggle of energy projects with high interest rates, which have increased the cost of capital, as well as rising inflation that has driven up development costs. Additionally, bottlenecks in the network and supply chain difficulties are further hindering progress in the sector.

Top 3 ETFs performance (Essential products portfolio)

VANECK AGRIBUSINESS (MOO)

GLOBAL X LITHIUM & BATTERY TECHNOLOGY (LIT)

ISHARES MSCI AGRICULTURE ETF (VEGI)

+2.66%

-0.53%

-2.55%

Bottom 3 ETFs performance (Essential products portfolio)

FIRST TRUST GLOBAL WIND ENERGY (FAN)

ENERGY SELECT SECTOR SPDR FUND (XLE)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

-7.78%

-8.70%

-10.82%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2024.

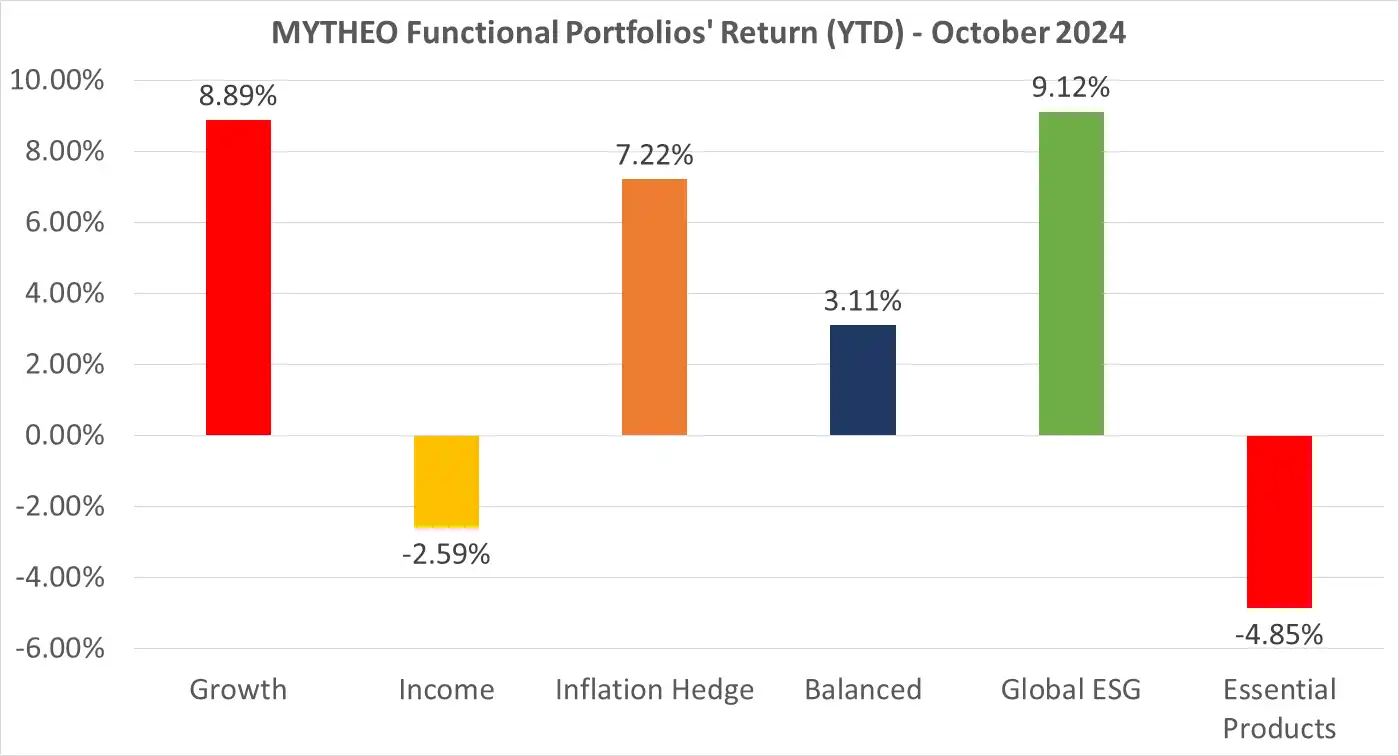

Chart 1: October 2024 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, November 2024

Note: Past performance is not an indication of future performance

Balanced allocation of functional portfolio consists of 30% Growth, 47% Income and 23% Inflation Hedge

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio return is derived from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 47% to the Income portfolio and 23% to the Inflation Hedge Portfolio, the actual portfolio return in MYR for October would be 4.80%, calculated as follows: [(30% x 4.99%) + (47% x 4.23%) + (23% x 5.71%)].

Our Thoughts

In October 2024, the US Dollar (USD) strengthened against the Malaysian Ringgit (MYR) for the first time after three months of depreciation, with the MYR weakening against USD by 6.16%, from MYR 4.1210 to MYR 4.3750 by October 31, 2024. This helps to offset some of the foreign exchange (FX) losses experienced in MYR for the past three months. Shift had a negative impact, causing all portfolios denominated in USD to deliver negative returns.

Global equity markets experienced their second monthly decline of 2024, falling 2.3% in October, though they remain up 15% for the year. The loss was exacerbated by a rebound in the US dollar, which strengthened by more than 3% as US 10 years treasury bond yields rose nearly 50 basis points (bps). Amid concerns that a Republican clean sweep could lead to higher inflation and budget deficits because of Trump’s agenda of tax cuts, higher import tariffs clampdown on immigration and higher borrowing costs will increasingly become headwinds through his presidential term. While third-quarter earnings reports were generally positive, forward guidance has been disappointing. Weak results from major technology companies like Apple, Meta, and Microsoft contributed to the US market's decline by the end of the month.

Last month, the Federal Reserve reduced short-term interest rates by half a percentage point, marking the beginning of its first rate-cut cycle since 2020. The central bank’s benchmark rate now stands between 4.75% and 5%. Lowering interest rates helps in reducing costs throughout the economy, potentially stimulating demand, and hope for a "soft landing," aiming to curb inflation without causing a significant rise in unemployment.

Gold has reached a new all-time high, trading historical high at approximately US$2,801 per ounce, with prices surging more than 30% this year. This rally comes despite a strong US economy and persistently high government bond yields, both of which typically diminish gold's attractiveness. Major central banks, including the European Central Bank, have been lowering interest rates, and the market now sees a 99% likelihood of another US rate cut in November. Falling rates reduce the opportunity cost of holding gold, as it does not generate any yield. Gold is not the only precious metal benefiting from this trend. Silver has also surged, reaching its highest level in nearly 12 years, around US$35 per ounce. This broader rally reflects growing investor demand for safe-haven assets.

As market dynamics continue to evolve, MYTHEO remains committed in providing investors with options aligned with their financial goals. As a digital investment platform, MYTHEO aims to support you in achieving your long-term financial objectives through a seamless and cost effective diversified investment portfolio. Discover how MYTHEO can enhance your portfolio diversification today, and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.