Wednesday, 8 June 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in May 2022.

You can also learn about MYTHEO portfolio performances by joining our live webinar below.

1. Growth Portfolio

MYTHEO’s Growth Portfolio jumped 0.81% in May 2022 as global equity rebounded strongly from a steep rout that drove the market down for seven straight weeks. In the US, the Nasdaq Composite tumbled 2.04% in May, while the S&P 500 recorded a positive return of 0.15% and ended the month at levels last seen in May 2021.

Meanwhile, The Federal Reserve raised its benchmark interest rate by half a percentage point, the most aggressive step yet in its fight against 40 years high inflation.

In Malaysia, the Ringgit depreciated against the US dollar in May by 0.6% to RM4.379 on 31st May 2022, compared to RM4.352 on 30th April 2022.

Top 3 ETFs (Growth portfolio)

ISHARES MSCI HONG KONG (EWH)

ISHARES CHINA LARGE-CAP (FXI)

ISHARES MSCI UNITED KINGDOM (EWU)

3.74%

2.97%

2.69%

Bottom 3 ETFs (Growth portfolio)

WISDOMTREE INDIA EARNINGS (EPI)

ISHARES MSCI FRONTIER 100 (FM)

ISHARES RUSSELL MID-CAP GROWTH (IWP)

-5.88%

-5.04%

-3.86%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a positive return of 0.84% in May 2022. The yield on the 10-year US Treasury bond inched lower by 2.76% to close at 2.85% in end-May, down from 2.93% on 30th April 2022, as fears over the Federal Reserve’s plans to aggressively hike interest rates appeared to ease and a key inflation reading showed a slowing rise in prices.

Top 3 ETFs (Income portfolio)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

xISHARES IBOXX HIGH YIELD CORPS (HYG)

1.63%

1.38%

1.24%

Bottom 3 ETFs (Income portfolio)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES INTERNATIONAL TREASURY (IGOV)

-3.26%

-2.42%

-0.05%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio declined slightly by 1.33% in May 2022, mainly due to the negative performance of some of the commodities ETFs.

In the commodities markets, crude oil prices continued to trend upwards in May with Brent crude oil added 6.3% to US$116.26 per barrel on 31st May 2022, up from US$109.34 per barrel on 30th April 2022. Meanwhile, the West Texas Intermediate (WTI) crude oil was also up by 9.9% to US$115.06 per barrel on 30th April 2022, from US$104.69 per barrel on 30th April 2022. Gold futures were down by 3.8% to US$1,838.8 per ounce, while silver futures and copper futures declined by 6.7% and 2.7% respectively.

Top 3 ETFs (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

ISHARES GLOBAL INFRASTRUCTURE (IGF)

9.33%

5.52%

4.65%

Bottom 3 ETFs (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

INVESCO DB BASE METALS F (DBB)

ISHARES GOLD TRUST (IAU)

-4.44%

-3.37%

-3.25%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio jumped by 2.04%.

Top 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

1.52%

1.33%

0.20%

Bottom 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

-2.76%

-0.10%

-0.09%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

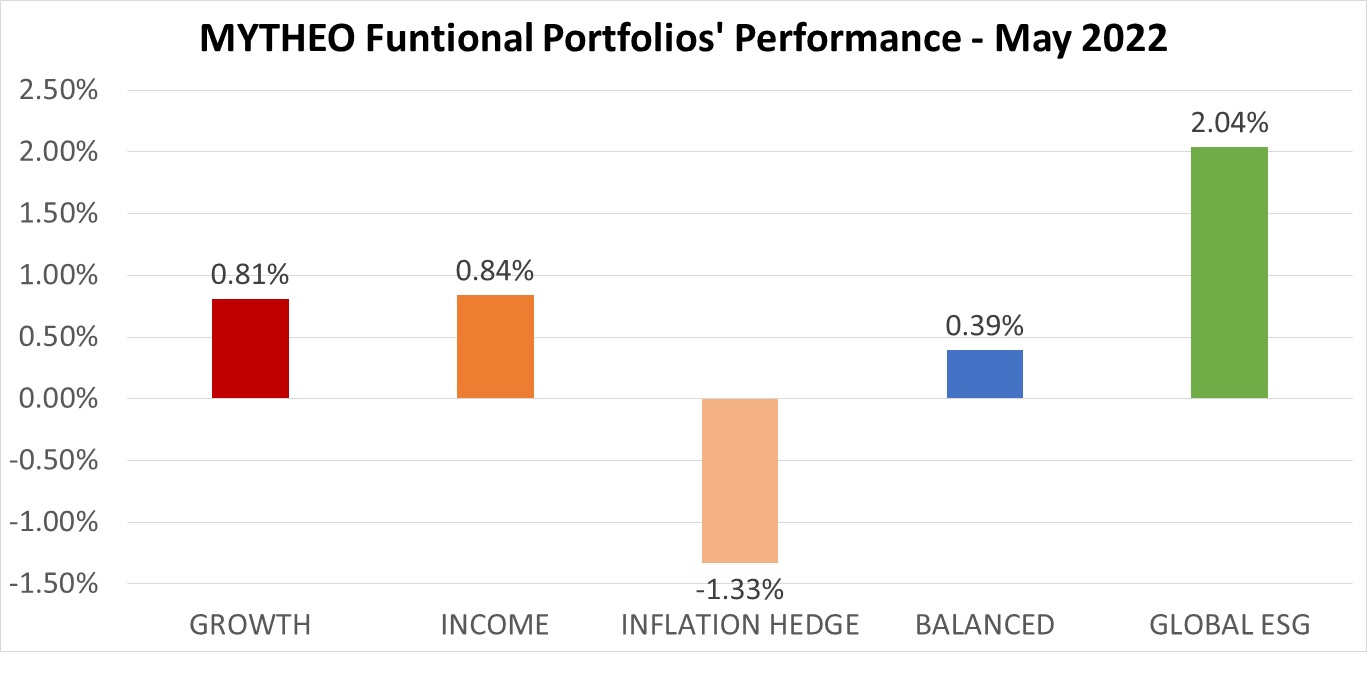

Chart 1: May 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, June 2022

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is 0.39% (40% x 0.81% + 40% x 0.84% + 20% x -1.33%)

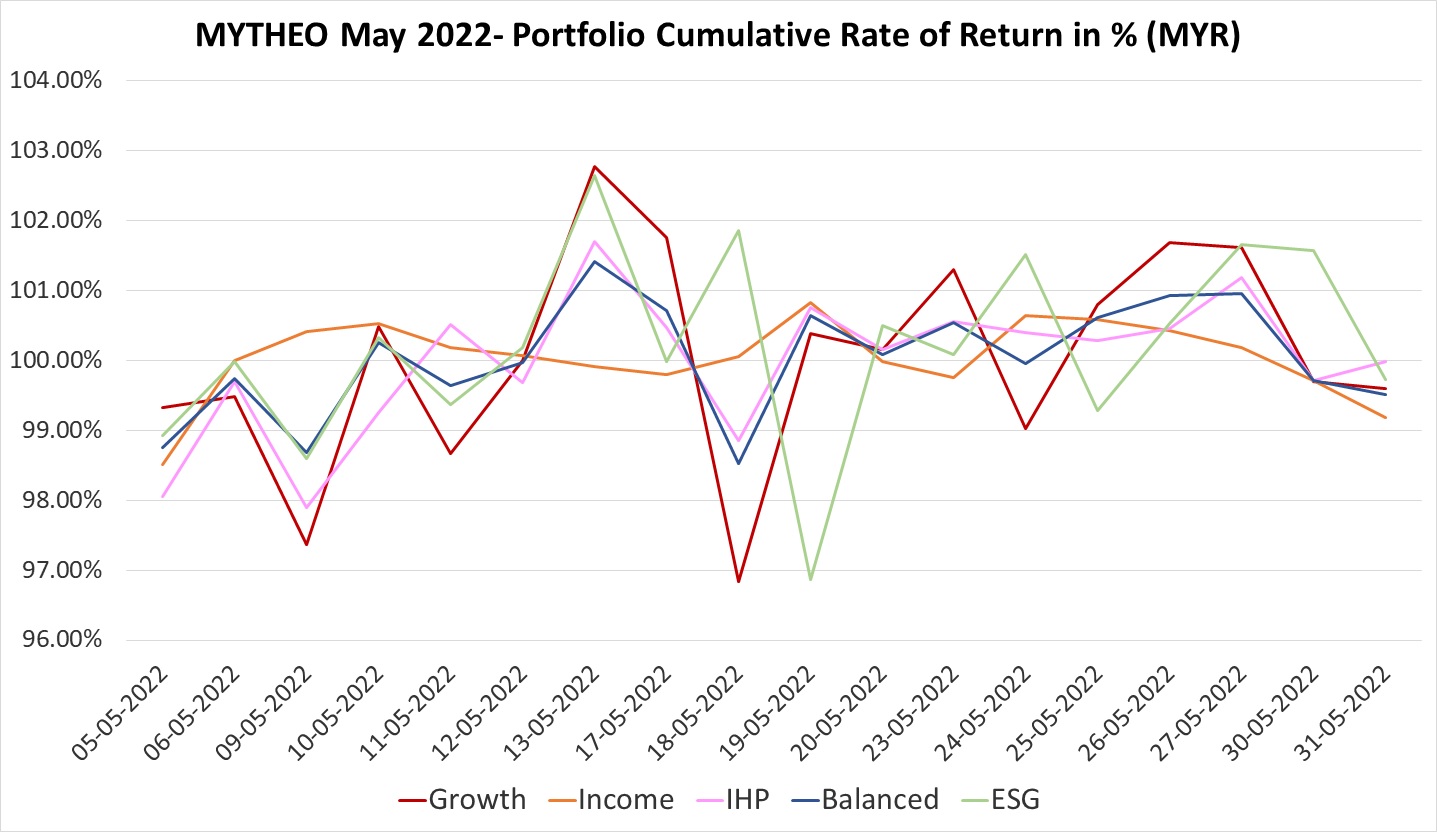

Chart 2: May 2022 – Portfolio Cumulative Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, June 2022

Note: Past performance is not an indication of future performance

*Please note that this is the cumulative performance based on model portfolios in May 2022. Your portfolio performance may differ from the model portfolio as it is subject to any deposits and/or withdrawals, as well as asset allocations made during the month.

Our Thoughts

Persistently high inflation has been the key driver behind the weakness in equities and bonds this year. There are signs that the worst of inflation may be behind us, with the latest US headline CPI moderating to 8.3% in April from 8.5% in March and inflation expectations having eased significantly. However, the end of COVID-19 lockdowns in China and the EU’s partial ban on Russia oil imports, the higher wages and rental costs in the US and the supply chain disruptions could continue to keep inflation at an elevated level.

May’s equity market relief rebound notwithstanding, we expect market volatility is likely to continue throughout much of this year due to high level of uncertainty. One opportunity that is relatively less debatable today is the yields on fixed-income investments have become attractive again. Meanwhile, a high inflation environment remains favourable for inflation hedge assets such as real estate, commodities and gold. While the performance of some of these hedges could turn lower under more optimistic scenarios where inflation falls more quickly than we expect, these assets should nevertheless enable investors to build diversified allocations prepared for a range of scenarios.

In a well-diversified portfolio, the performance of any single investment should not have a disproportionate impact on the overall portfolio. Losses in one investment may be offset by gains in other holdings. Hence, over the long term, it improves the chances of investors staying the course and achieving more stability in their overall portfolio. We believe that having a portfolio with the right mix of investments that suits your risk and return profile is an important starting point to future wealth accumulation.

MYTHEO’s Omakase portfolio combines Growth, Income and Inflation Hedge functional portfolios based on your needs. It offers global diversification to protect against extreme fluctuations in any single asset class. At MYTHEO, you can invest with peace of mind as we do the heavy lifting of helping you achieve your long-term financial goals so that you can focus and enjoy your life’s biggest moments.

This material is subjected to MYTHEO's Notice and Disclaimer.