Wednesday, 6 July 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in June 2022.

You can also learn about MYTHEO portfolio performances by joining our live webinar below.

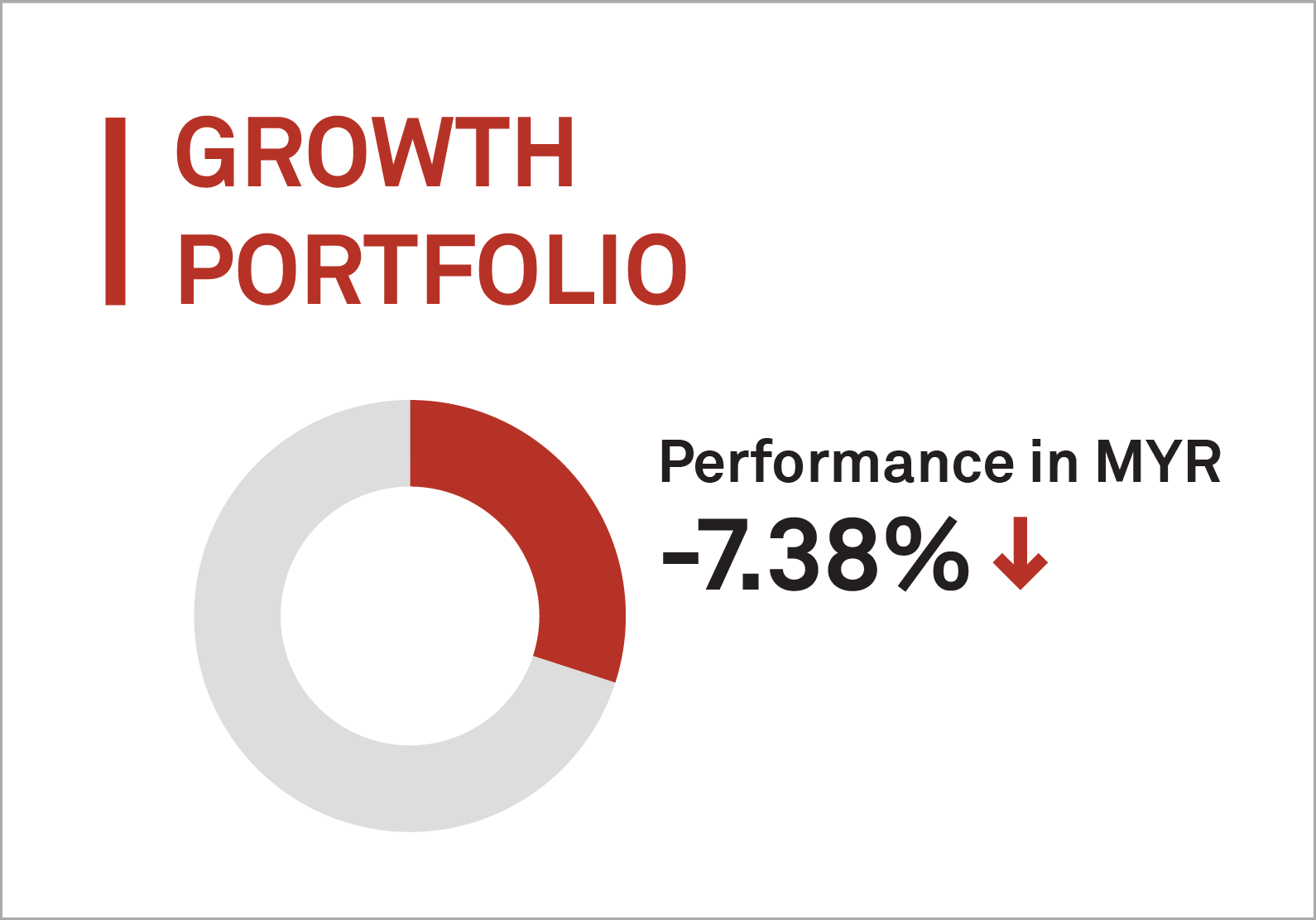

1. Growth Portfolio

MYTHEO’s Growth Portfolio declined 7.38% in Jun 2022 as global equity markets have just gone through one of the most turbulent months since March 2020. In the US, both Nasdaq Composite and S&P 500 ended the month at almost -10%.

Meanwhile, on the back of higher inflation than expected (8.6% vs 8.3%), the Federal Reserve raised its benchmark interest rate by 75 basis points, which equates to the most aggressive hike since 1994, further spooking worried investors.

In Malaysia, the Ringgit depreciated against the US dollar in June by 0.62% to RM4.406 on 30th Jun 2022, compared to RM4.379 on 31st May 2022.

Top 3 ETFs (Growth portfolio)

ISHARES CHINA LARGE-CAP (FXI)

ISHARES MSCI HONG KONG (EWH)

ISHARES RUSSELL MID-CAP GROWTH (IWP)

6.43%

0.14%

-7.62%

Bottom 3 ETFs (Growth portfolio)

ISHARES MSCI SOUTH KOREA (EWY)

WISDOMTREE INDIA EARNINGS (EPI)

ISHARES RUSSELL MID-CAP VALUE (IWS)

-14.48%

-11.38%

-11.35%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

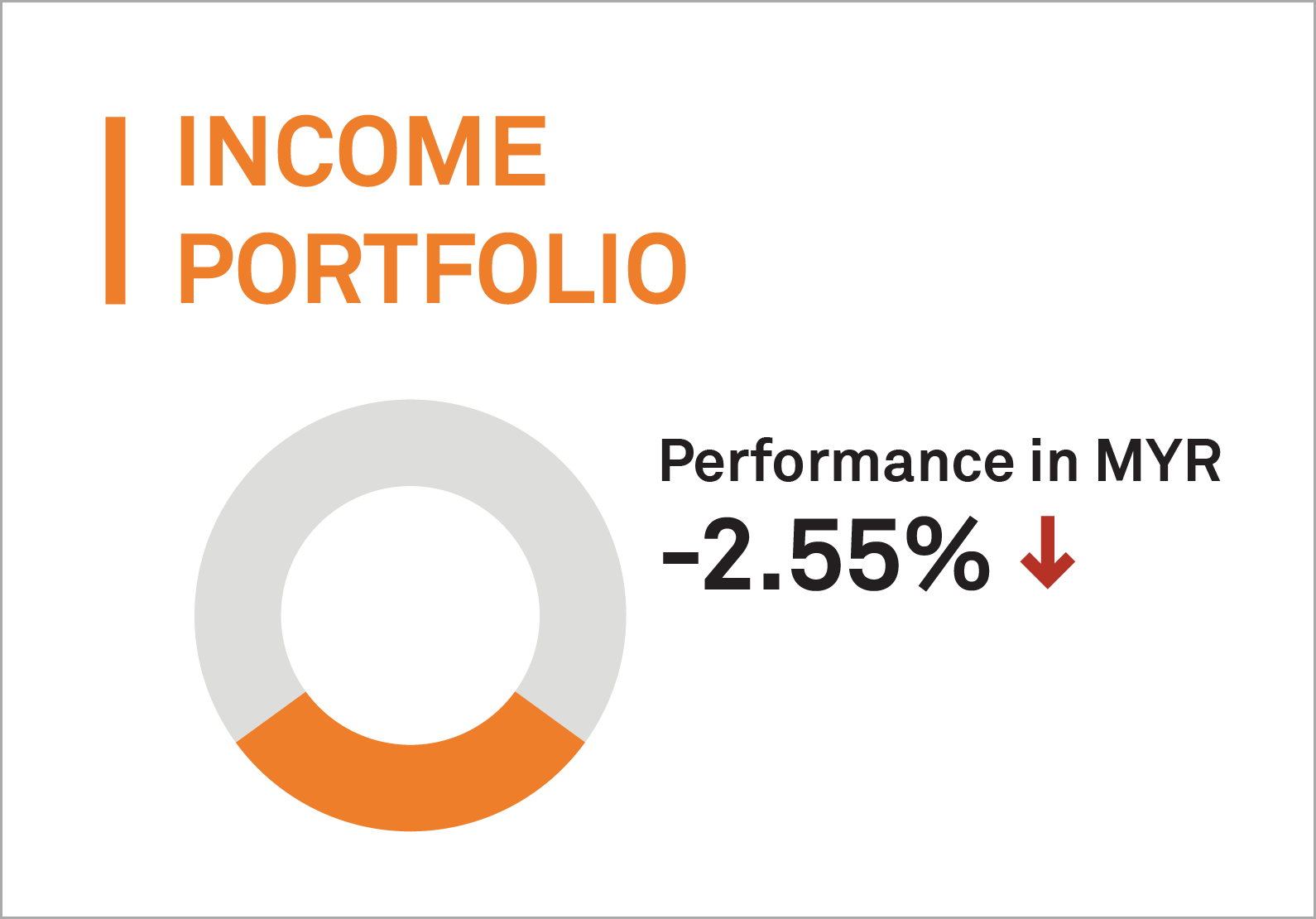

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a negative return of 2.55% in Jun 2022. Bond markets generally had a difficult month. The yield on the 10-year US Treasury bond gained 1.36% to close at 2.98% in end-June, this came as US Fed Chairman Jerome Powell said that the central bank could be more aggressive in the months ahead with its rate hikes to keep inflation under control.

Top 3 ETFs (Income portfolio)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

ISHARES SHORT-TERM CORPORATE (IGSB)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-0.81%

-1.40%

-1.45%

Bottom 3 ETFs (Income portfolio)

ISHARES IBOXX HIGH YIELD CORPS (HYG)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

ISHARES INTERNATIONAL TREASURY (IGOV)

-7.41%

-5.85%

-4.69%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

In response, we have conducted portfolio rebalancing with portfolio reallocation to the income portfolio;

New Exclusion: ISHARES INTERNATIONAL TREASURY (IGOV)

Increased: ISHARES 3-7 YEAR TREASURY BONDS (IEI)

Decreased: ISHARES MBS (MBB)

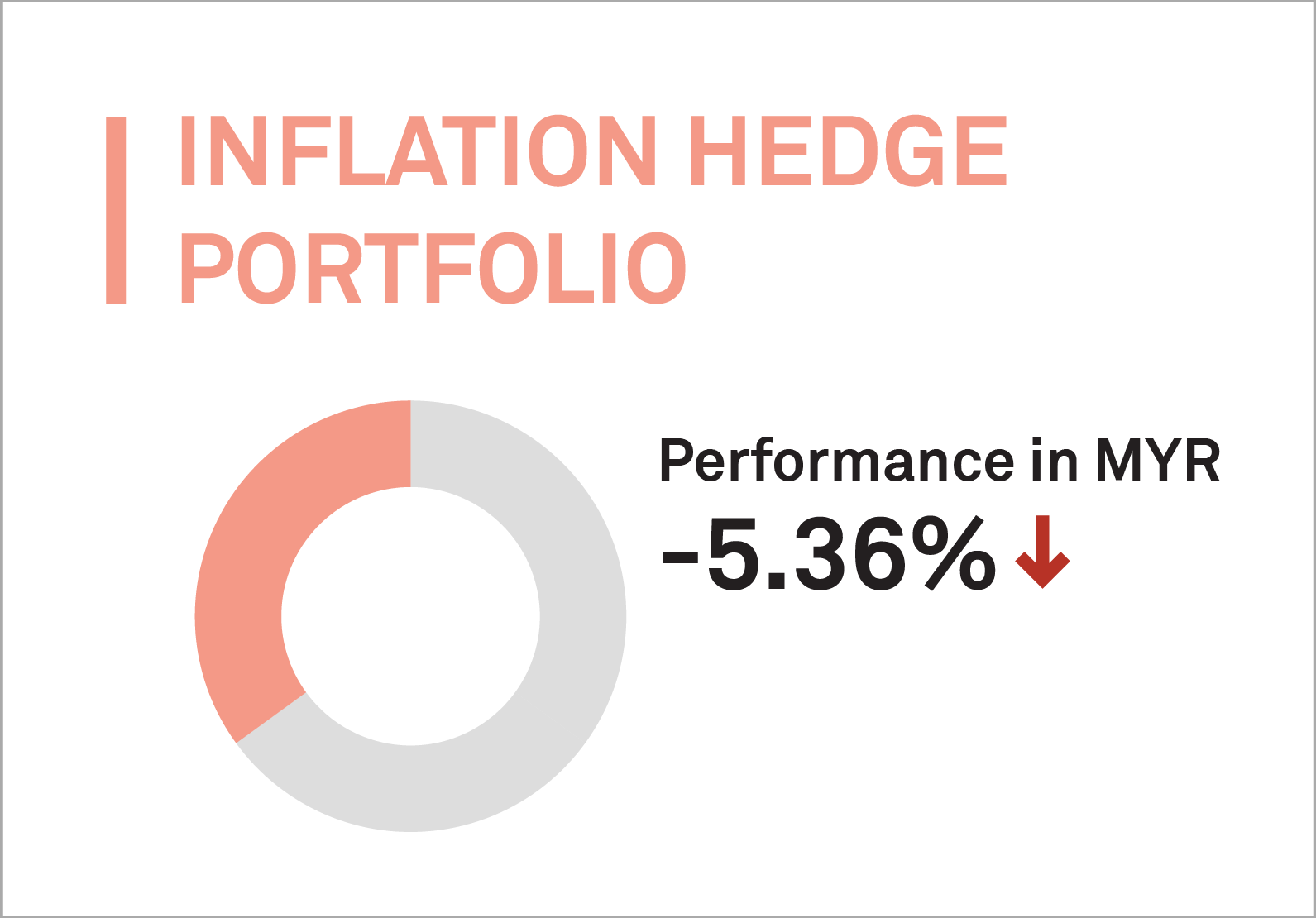

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio declined by 5.36% in Jun 2022, due to the negative performance of most of the commodities ETFs. Consumer Price Index (CPI) for MAY 2022 was 8.6%, the highest level in 40 years. The rise in the US consumer price index has strengthened the view that FED could accelerate rate hikes to curb the inflation.

As inflation continues to be the main concern these days, it may make sense to invest in inflation-sensitive assets like commodities, cyclical stocks that historically did well when prices are rising, Treasury Inflation-Protected Securities (TIPS) and U.S Real Estate ETF (IYR). TIPS are a type of U.S treasury security whose principal value is indexed to the rate of inflation. When inflation rises, TIPS principal value is adjusted up. Like traditional treasuries, TIPS are backed by full faith and credit of the U.S government and are worth considering over the long run to protect against inflation.

Meanwhile, U.S Real Estate (IYR) is also considered an approach to hedge against inflation, given the asset class usually has little correlation with stocks and bonds. IYR is an investment vehicle that can deliver income, portfolio diversification and a potential hedge against inflation. Despite near-term hurdles, industry participants continue to remain optimistic about this fairly valued sector and believe it is poised for further expansion.

In the commodities markets, a broad-based commodity sell-off (Copper -13%, Natural Gas -33%, Wheat -20%, Oil -6.5%. Gold -1.7%, Silver -6.1%, Copper -13.9%) as higher interest rates are beginning to have a restraining effect on broader demand generally as the ‘Covid-recovery’ comes to an end.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES GOLD TRUST (IAU)

ISHARES S&P GLOBAL (ICLN)

ISHARES TIPS BOND ETF (TIPS)

-1.61%

-4.18%

-4.23%

Bottom 3 ETFs (Inflation hedge portfolio)

INVESCO DB BASE METALS F (DBB)

ISHARES MORTGAGE REAL ESTATE (REM)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

-15.45%

-12.73%

-11.23%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

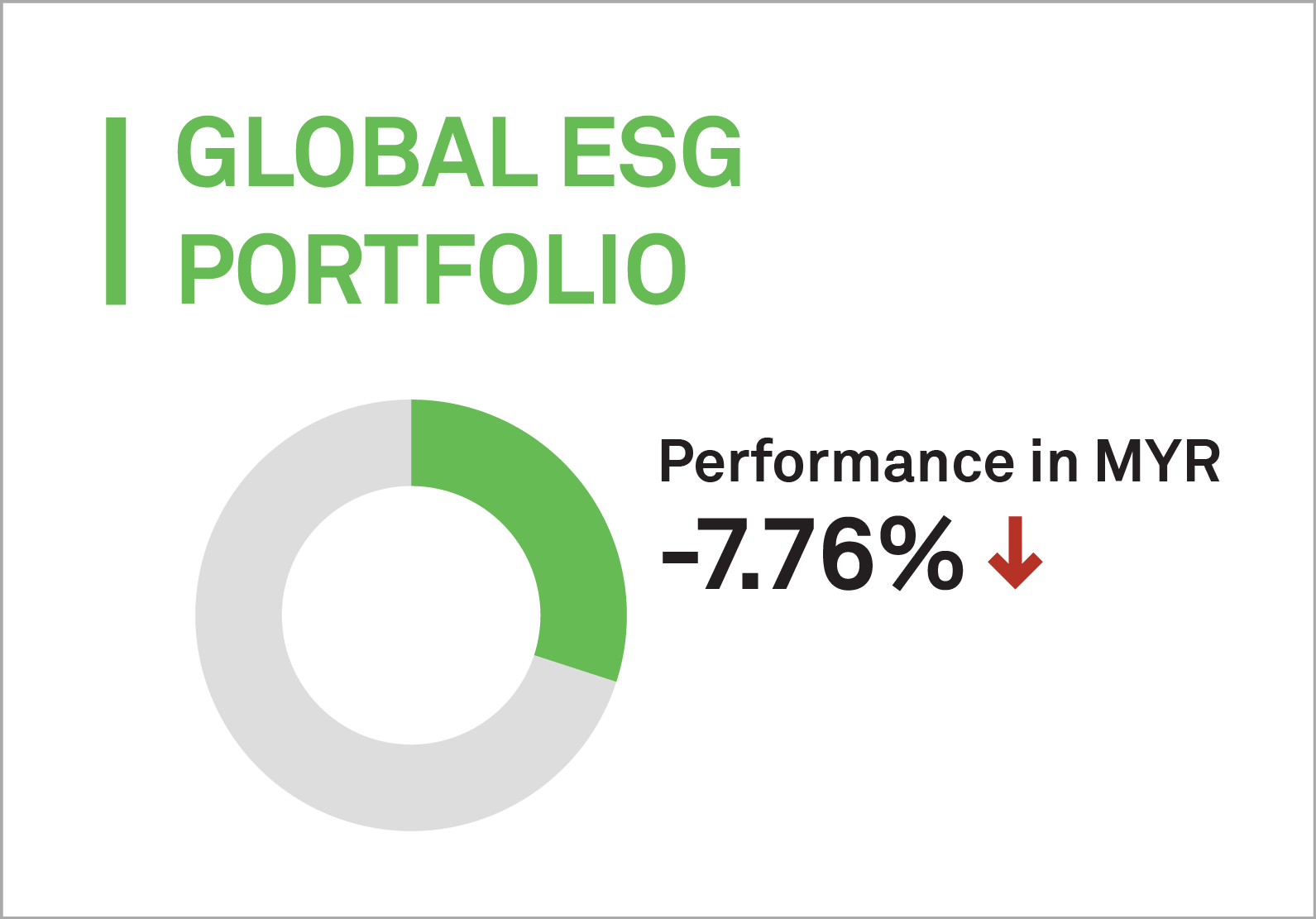

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio declined by 7.76%.

Top 3 ETFs (Global ESG portfolio)

ISHARESs ESG AWARE MSCI EM ETF (ESGE)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

-6.08%

-7.57%

-8.57%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

-10.50%

-8.81%

-8.72%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

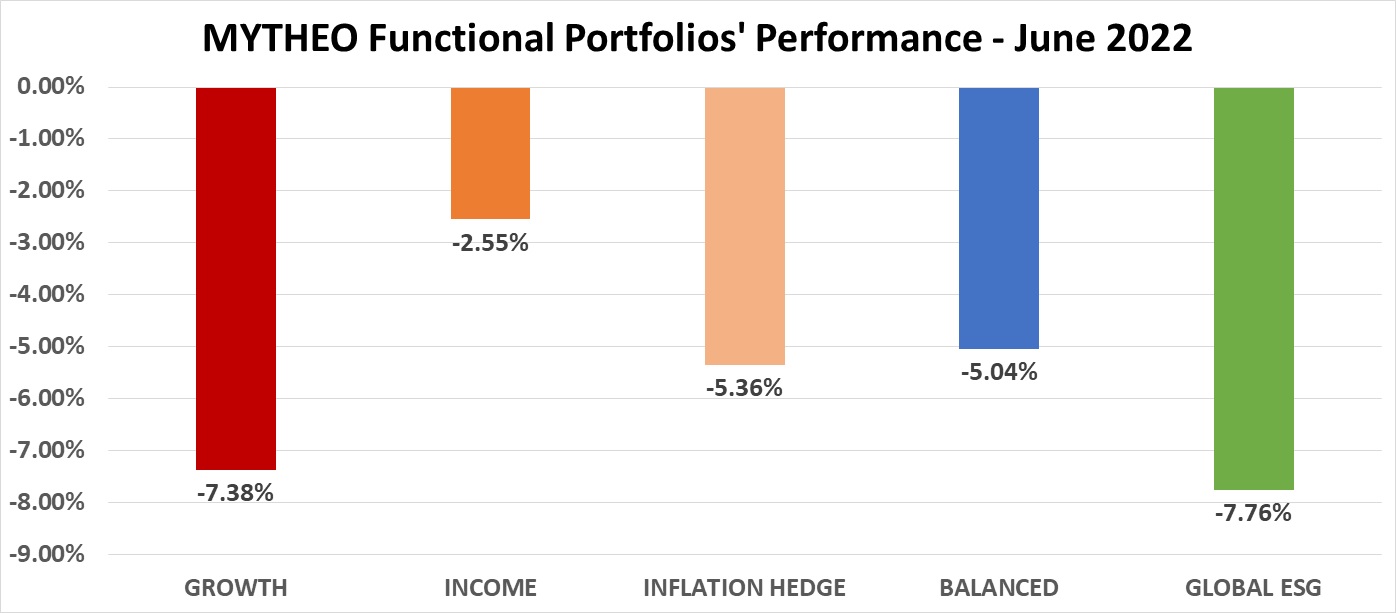

Chart 1: June 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, July 2022

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is -5.04% [(40% x -7.38%) + (40% x -2.55%) + (20% x -5.36%)]

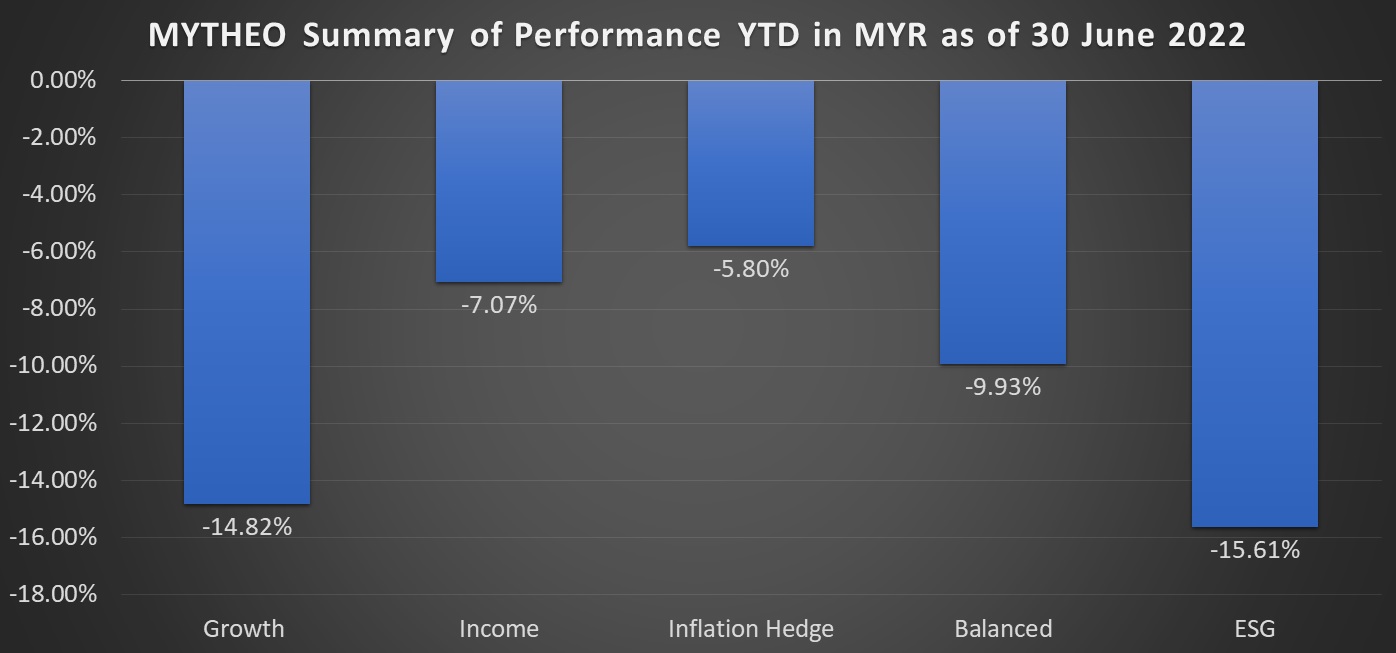

Chart 2: Summary of Performance YTD in MYR as of 30 June 2022

Source: GAX MD Sdn Bhd, July 2022

Note: Past performance is not an indication of future performance

Chart 2 above shows the cumulative performance of the functional portfolios since the beginning of 2022. The Growth portfolio registered a return of –14.82%, the Income portfolio was down by 7.07%, the Inflation Hedge portfolio dropped by 5.80% and ESG portfolio registered a negative return of 15.61%.

*Please note that this is the cumulative performance based on model portfolios in June 2022. Your portfolio performance may differ from the model portfolio as it is subject to any deposits and/or withdrawals, as well as asset allocations made during the month.

Our Thoughts

The first half of 2022 has proved to be an extraordinarily volatile and dangerous period in recent history. Latent inflationary pressures caused by monetary and fiscal responses arising from the Covid pandemic were significantly exacerbated by the conflict in Ukraine. The initial inflation shock was centered mainly on supply chain disruptions and food and energy prices, but as we predicted, has had a meaningful psychological impact on consumer sentiment.

This has led to a tough first half of the year, with global equities down around 20% and global bonds off around 10%, as of end-June. Meanwhile, US recession fears have dented commodity prices after hitting a multi-year peak in early June. We think the aggressive Fed policy, the turning of the liquidity tide, and slower economic growth ahead likely will keep pressure on markets in the second half of the year.

The first 6 months of the year have seen MYTHEO’s portfolios outperform the global equity and bond market. Despite the significant correction that we have seen in the asset markets, we think this is not a market likely to reward excessive risk-taking, and we continue to emphasize the importance of diversification across and within asset classes as well as the power of periodic rebalancing. Diversification is the key for all types of markets, having a well-balanced, diversified portfolio, with a risk profile consistent with your goals, and being prepared with a plan in the event of an unexpected outcome are keys to successful investing.

MYTHEO’s Omakase portfolio combines Growth, Income and Inflation Hedge functional portfolios based on your needs. It offers global diversification to protect against extreme fluctuations in any single asset class, diversifying your portfolio into alternative assets can also offer a cushion from the volatility in the equity market.

At MYTHEO, you can invest with peace of mind as we do the heavy lifting of helping you achieve your long-term financial goals so that you can focus and enjoy your life’s biggest moments.

This material is subjected to MYTHEO's Notice and Disclaimer.