Thursday, 25 May 2023

From the Desk of the Portfolio Managers at MYTHEO

March 2023 provided an interesting case for diversification for two asset classes, namely equities (or stocks) and bonds.

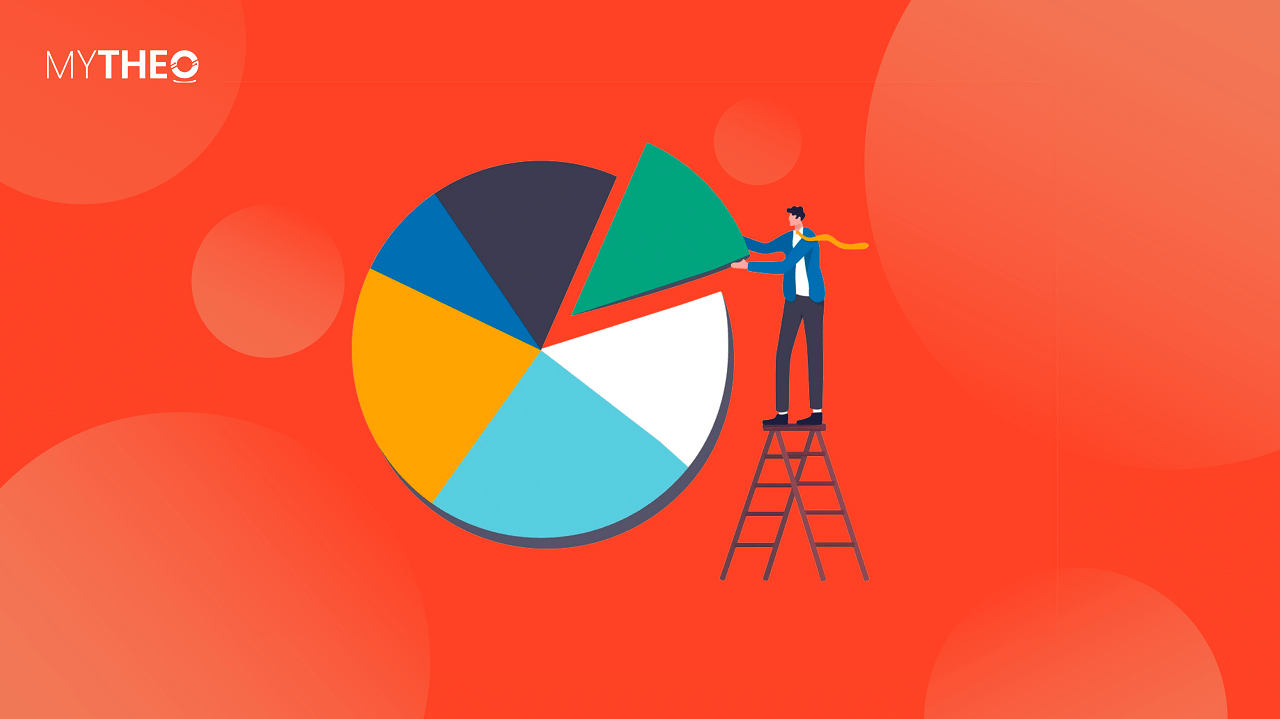

Diversification within Equities Helps Mitigate the Impact of a Bank Run

The chart below shows the impact of the collapse on a part of the US stock market during the failures of Silvergate Bank, Silicon Valley Bank and Signature Bank. Naturally, the banks directly affected have had a severe decline in share price. Note however that other more major banks and a representative of the US financial sector began experiencing stabilisation and even a partial recovery after the news broke, as the concern focused more towards small-to-medium sized banks with liquidity risks. In the tech-heavy Nasdaq 100 as represented by the Invesco QQQ Exchange Traded Fund (ETF), the monthly performance was even positive, stressing the importance of diversification in investing.

Source: GAX MD Sdn Bhd, April 2023. Performance in USD

Note: Past performance is not an indication of future performance

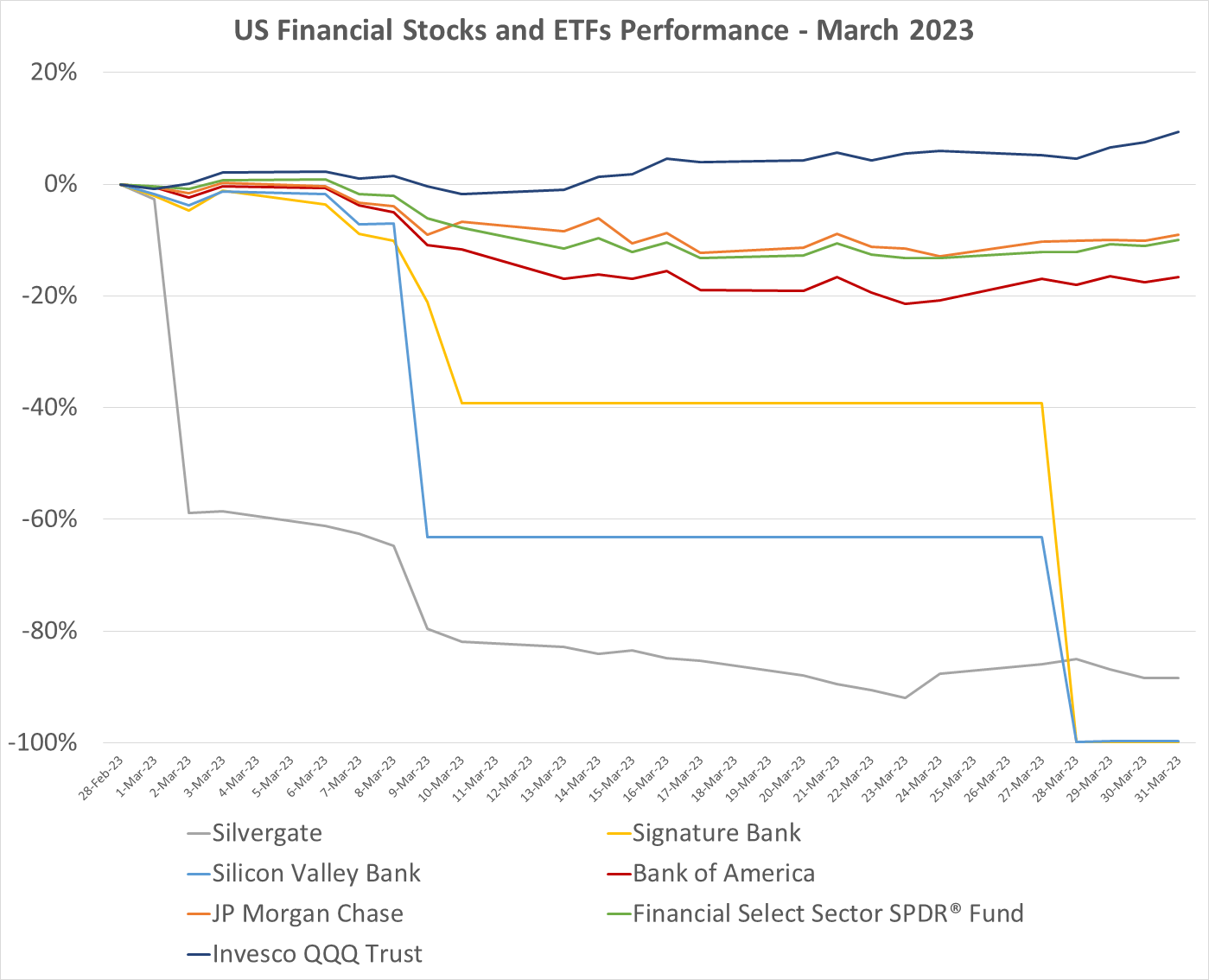

Multi-Asset, Multi-Regional Diversification for Bonds Helps Mitigate the Impact of a Bond “Default”

Adding on to this, the takeover of Credit Suisse, a major global financial institution by UBS on the behest of the Swiss government resulted in Additional Tier 1 (AT1) bondholders losing more than shareholders (legal battles to ensue), yet global bonds in general also had a good month.

To illustrate, below is another chart, showing a sharp drop in Credit Suisse ADR share price. Note the stabilisation and partial recovery yet again in the prices of the broader representative European financial sector ETF, as well as the broader representative AT1 ETF. Expanding to the largest possible diversification of bonds to a global scale, a Global Aggregate Bond fund even returned more than 3% in the month.

Source: GAX MD Sdn Bhd, April 2023. Performance in USD unless stated

Note: Past performance is not an indication of future performance

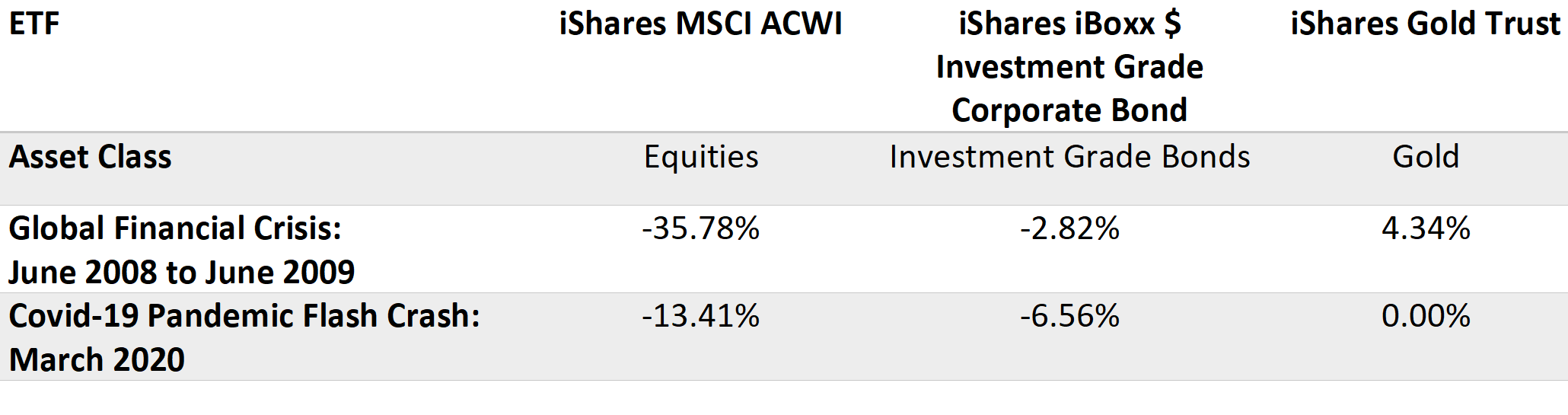

Cross-Asset Diversification in Crises

Looking backwards, you can see the varied movements in ETFs representing different asset classes during times of crisis. It is impossible to predict to what degree which asset class will be impacted: in 2008-2009, you would lose almost triple in a year what you did in the March 2020 flash crash for equities, but the situation is reversed in the case of the bond ETF, where you lose triple in a month that which you would lose over the other year-long crisis.

Source: GAX MD Sdn Bhd, April 2023. Performance in USD

Note: Past performance is not an indication of future performance

Diversification allows for the moderation of such losses, averaging out the bad with those which perform better, be it across regions like the US, Europe or Asia, or across asset classes like equities, bonds and commodities.

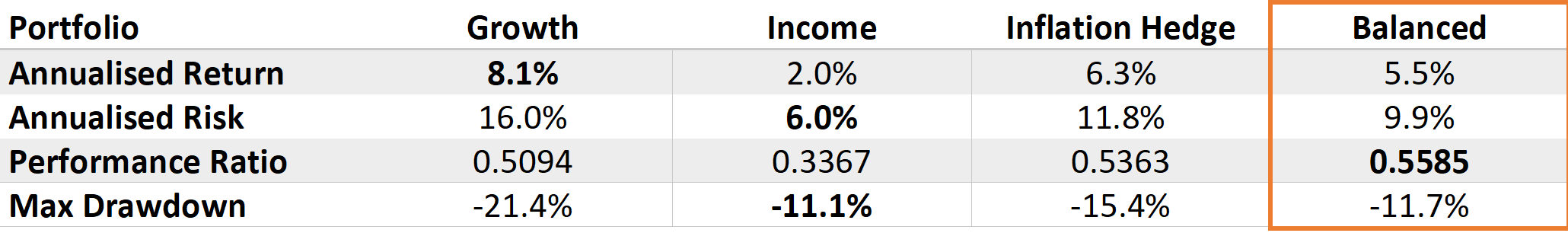

Mitigating Risks with Portfolio Diversification

Below is a table of simulated performance statistics for the three functional portfolios that MYTHEO employs, for the period starting end-March 2019 to end-March 2023. This is coupled with the performance statistics of a simulated Balanced portfolio comprising 33% Growth, 32% Income and 35% Inflation Hedge. Despite not giving a better annualised return than Growth or Inflation Hedge, the Balanced portfolio is able to reduce volatility within the portfolio throughout the Covid-19 Pandemic and this high inflation/high interest rate period.

Source: GAX MD Sdn Bhd, April 2023. Performance in MYR

Note: Past performance is not an indication of future performance

As such, the negative impacts of events are reduced such that the maximum losses endured are significantly lower than the outperformers, thus increasing the certainty of a more positive outcome when unlocking the value of your portfolio in your later years.

Investors who are looking for a more defensive approach to investing may consider investing in MYTHEO USD Trust Portfolio. The current net interest rate for this portfolio is 4.08% p.a. and is subject to change depending on the Federal Reserve's monetary policy and the Federal Open Market Committee's (FOMC) decision on the federal funds rate. This portfolio will be a great place to park your investment funds while waiting for opportunities to emerge.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.