8 January 2024

Written by MYTHEO

Key Takeaways

- December 2024 saw a global equity market sell-off, but major tech stocks remained resilient.

- The FOMC rate cut was neutral, but the market declined due to a more hawkish interest rate outlook.

- Financials, real estate, and infrastructure sectors were most affected due to their high sensitivity to interest rate changes

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in December 2024.

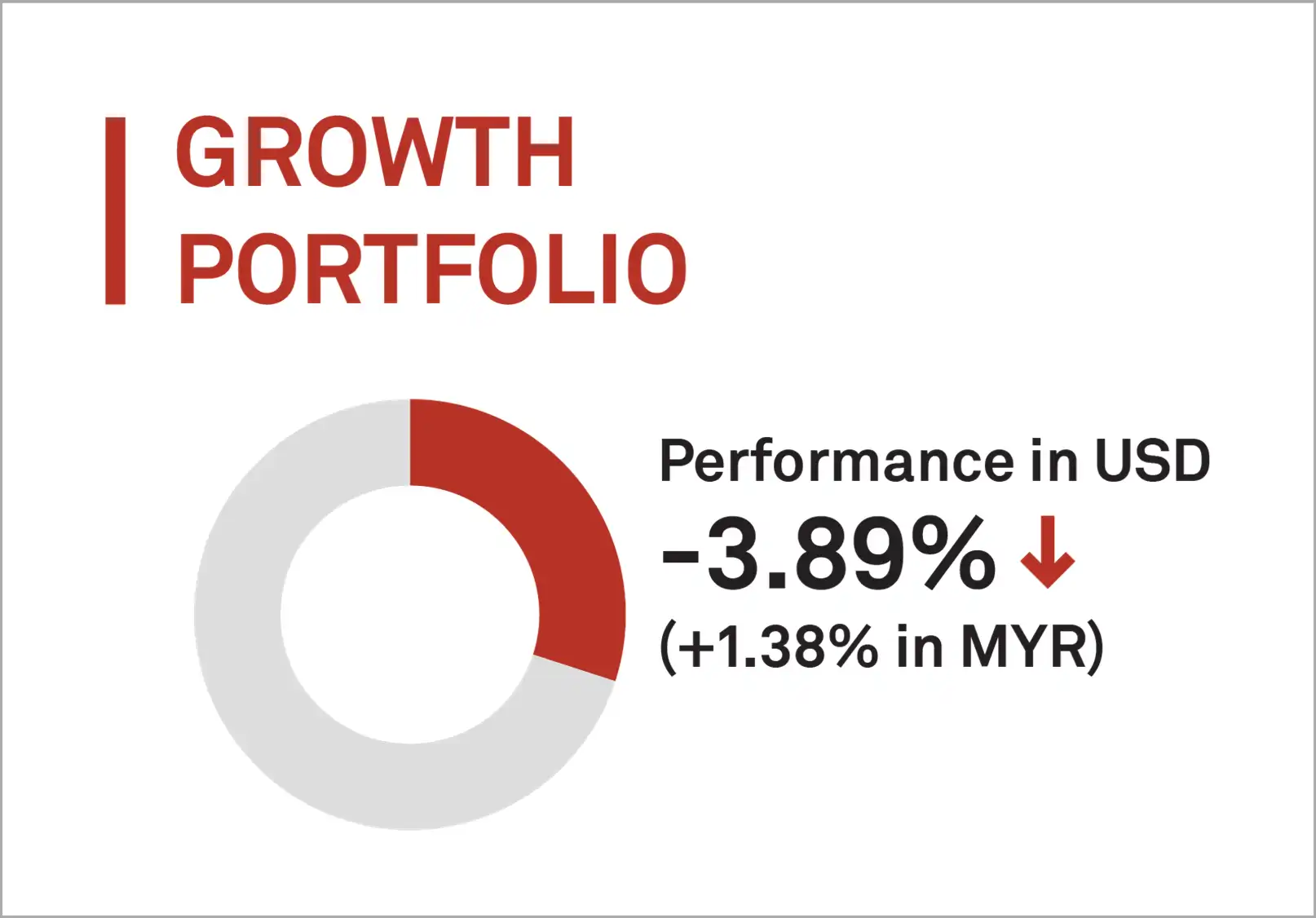

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 3.92% (down by -3.31% in MYR) in December 2024.

The market entered panic mode after the Federal Open Market Committee (FOMC) cut interest rates but indicated that future cuts would be reduced due to stronger economic growth and rising inflation. This led to a massive sell-off across the board.

Negative market sentiment significantly impacted MYTHEO’s growth portfolio. Unlike the previous month, where seven out of nine ETFs in our portfolio ended with positive returns, December saw only one ETF out of nine finishing the month positively.

ETFs focusing on "value" companies experienced greater losses compared to general market performance. Value stocks, which refer to companies traded at relatively low valuations compared to the broader market. Two such ETFs in our portfolio—Vanguard Value (VTV) and Invesco S&P 500 Pure Value (RPV)—declined by over 6.0%.

The primary driver of this drop was the heavy allocation to the financial sector, which comprises over 25% of VTV's holdings and more than 32% of RPV's. Financial stocks faced sharper price corrections in December due to a less favourable outlook. Slower interest rate cuts may dampen the banking sector's lending business, while higher treasury yields could result in larger mark-to-market losses on banks' treasury holdings.

Additionally, the portfolio’s exposure to Canada (EWC) was impacted by country-specific negative news. Leadership instability arose following the resignation of the finance minister, increasing pressure on Prime Minister Justin Trudeau to step down.

The Nasdaq 100 ETF (QQQM), which includes the 100 largest non-financial companies listed on the Nasdaq Stock Market, was the sole ETF in MYTHEO’s growth portfolio to end the month with a positive return. The "Magnificent Seven" stocks—Apple, NVIDIA, Microsoft, Alphabet, Amazon, Tesla, and Meta—continue to demonstrate remarkable resilience despite the negative market sentiment. mong the members of the Magnificent Seven, only Microsoft and NVIDIA posted losses of -0.46% and -2.86% respectively, while the remaining members closed the month with positive gains.

Top 3 ETFs performance (Growth portfolio)

INVESCO NASDAQ 100 ETF (QQQM)

SPDR EURO STOXX 50 (FEZ)

VANGUARD FTSE EMERGING MARKETS (VWO)

+0.06%

-0.70%

-3.42%

Bottom 3 ETFs performance (Growth portfolio)

VANGUARD VALUE (VTV)

ISHARES MSCI CANADA (EWC)

INVESCO S&P 500 PURE VALUE (RPV)

-6.87%

-6.86%

-6.77%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2024.

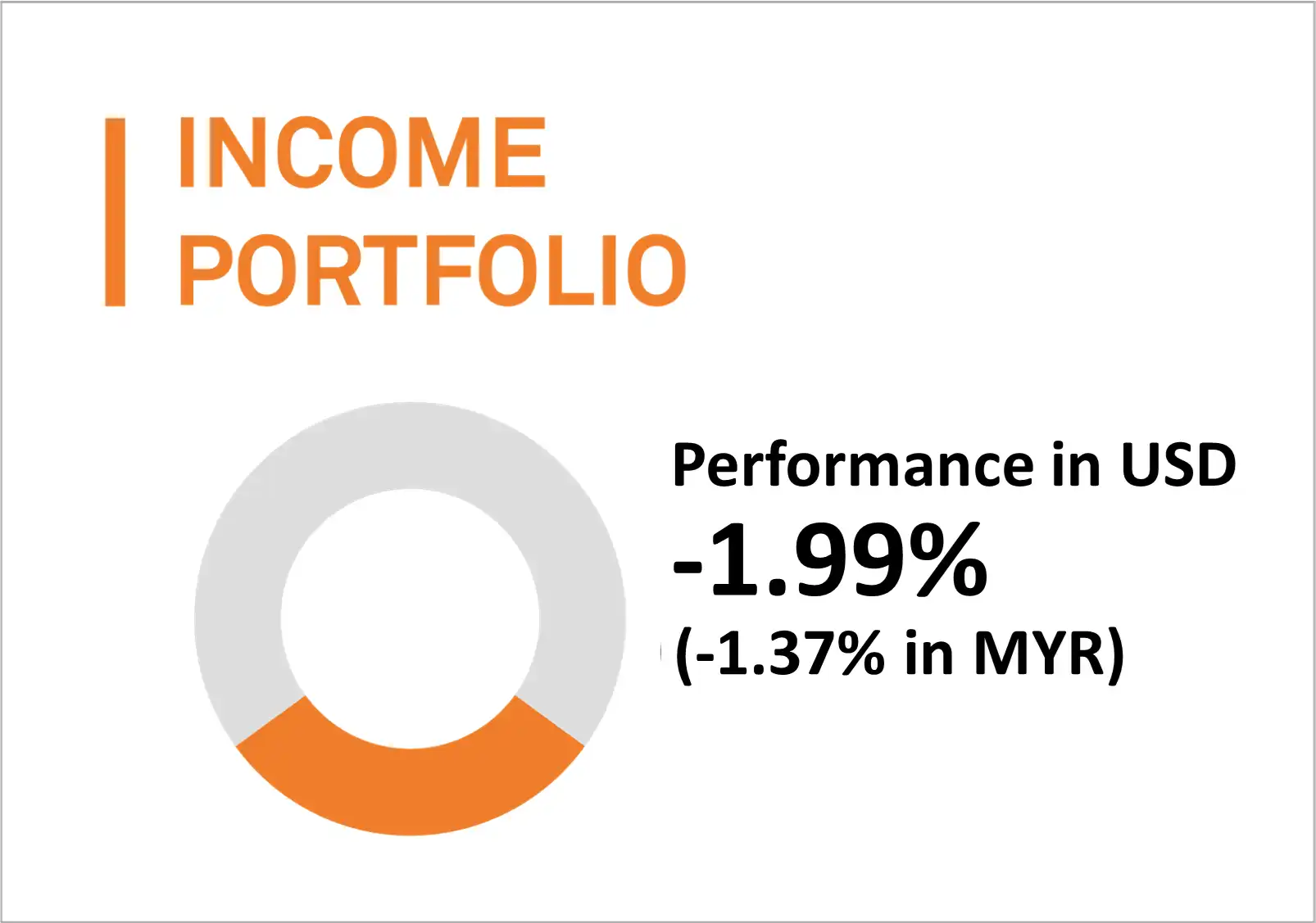

2. Income Portfolio

In December 2024, MYTHEO's Income Portfolio experienced a negative return of -1.99% (a decline of -1.37% in MYR).

The portfolio faced significant challenges due to a sharp increase in U.S. Treasury yields. The 10-year Treasury yield surged by almost 40 basis points (0.40%), negatively impacting long-duration instruments and securities with equity-like characteristics.

As a result, the iShares 20+ Year Treasury Bond ETF (TLT) emerged as the worst performer, as long-term bonds are highly sensitive to fluctuations in bond yields. Similarly, preferred shares (PFF) were adversely affected due to their partial equity-like traits, which made them vulnerable to the weak performance of the equity market.

On the other hand, the Floating Rate Bond ETF (FLOT) was the only fund within the Income Portfolio to deliver positive returns. Floating rate bonds are resilient in a rising interest rate environment because their coupons are typically tied to benchmark rates. As interest rates increase, the coupons of these bonds are adjusted upward, helping to preserve their capital value.

Two other ETFs that demonstrated relative resilience were the Senior Loan ETF (SRLN) and the Short-Term Corporate Bond ETF (IGSB). These ETFs primarily focus on shorter maturities, making them less sensitive to interest rate fluctuations. SRLN typically holds loans with an average tenor of less than 90 days, while IGSB invests exclusively in corporate bonds with maturities of up to five years.

Top 3 ETFs performance (Income portfolio)

ISHARES FLOATING RATE BONDS (FLOT)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES SHORT-TERM CORPORATE (IGSB)

+0.02%

-0.31%

-0.58%

Bottom 3 ETFs performance (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES US PREFERRED STOCK (PFF)

ISHARES INTERNATIONAL TREASURY (IGOV)

-6.88%

-4.38%

-3.71%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2024.

3. Inflation Hedge Portfolio

In December 2024, MYTHEO’s Inflation Hedge Portfolio recorded a decline of 4.22% (a decline of -3.61% in MYR)

In December, the Inflation Hedge Portfolio's performance was driven by heightened risk-averse sentiment and a broad sell-off in the equity markets. The portfolio reflected the differing dynamics of different asset classes. Commodities-related assets were more resilient due to their strong positive correlation with inflation, while interest rate-sensitive assets faced weaknesses, reflecting a more challenging macro environment.

The Real Estate and Mortgage sectors were the hardest hit among all asset classes due to their high sensitivity to interest rate movements. Investors' tempered expectations of interest rate cuts led to a less optimistic outlook for the property market, which in turn dampened demand for mortgages. Consequently, the worst-performing holdings in the portfolio were US Real Estate (IYR) and US Mortgage Real Estate, which declined by 9.57% and 8.49%, respectively.

On a more positive note, higher inflation supported commodities-related assets within the portfolio. Both Agriculture (DBA) and Oil (DBO) posted marginal gains of 0.34% and 0.07%, benefiting from their traditional role as inflation hedges.

Top 3 ETFs performance (Inflation hedge portfolio)

INVESCO DB AGRICULTURE F (DBA)

INVESCO DB OIL FUND (DBO)

ISHARES GOLD TRUST (IAU)

+0.34%

+0.07%

-1.28%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

ISHARES MORTGAGE REAL ESTATE (REM)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

-9.57%

-8.49%

-7.85%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2024.

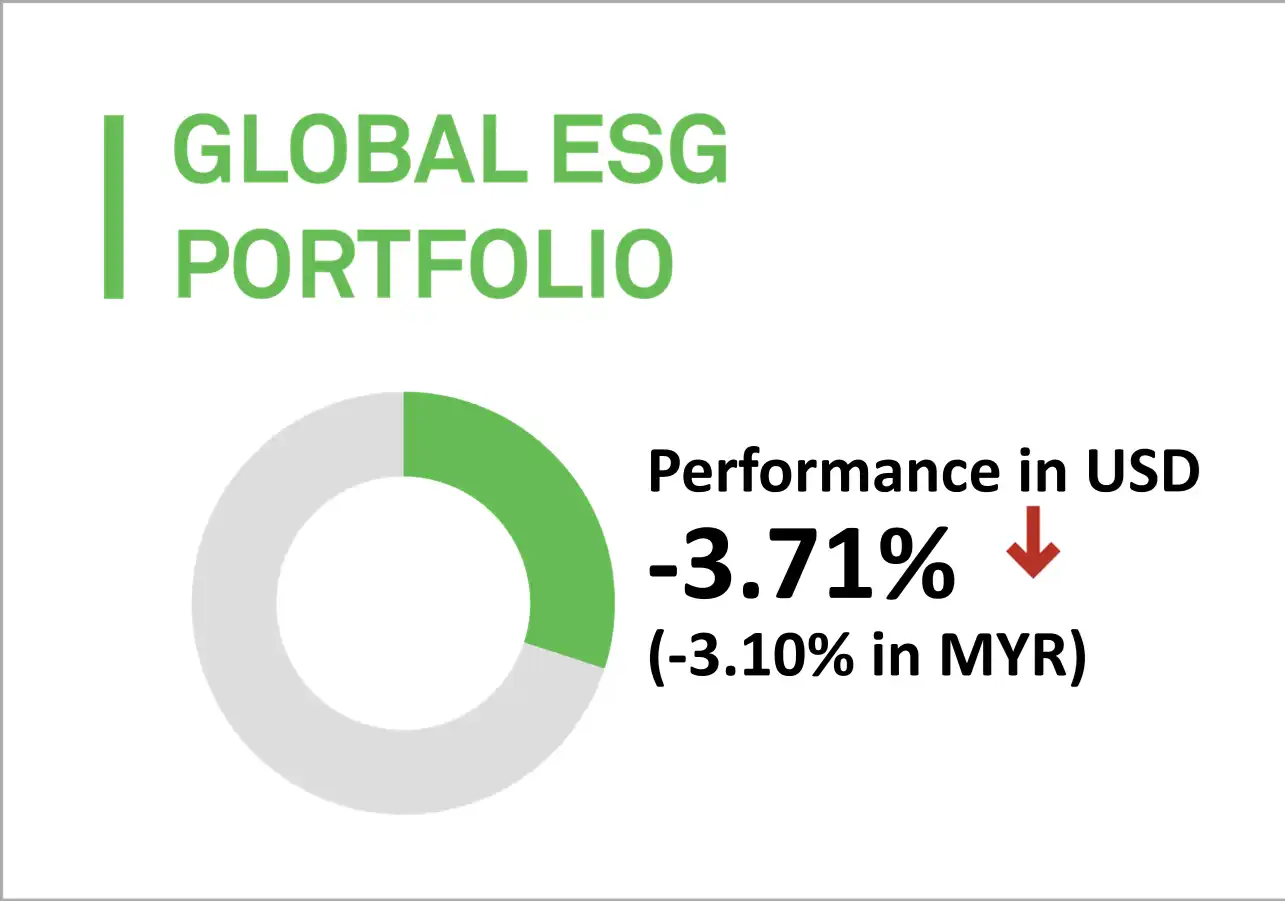

4. Global ESG Portfolio

MYTHEO’s Global ESG down by 3.71% (down by -3.10% in MYR) in December 2024.

All exposures within the portfolio experienced negative returns. Similar to MYTHEO’s growth portfolio, ETFs with a larger component of US growth stocks were more resilient, buoyed by the performance of the "Magnificent Seven" stocks.

In contrast, ETFs with exposure to “value” stocks underperformed, dragged down by the negative outlook for financial stocks. These stocks are expected to be negatively impacted by a smaller-than-expected interest rate cut in the US and wider mark-to-market losses arising from the devaluation of treasury holdings amid a sharp rise in treasury yields over the past months.

Exposure outside the US, such as in Europe, Australia, Asia and the Far East (EAFE), and Emerging Markets (ESGE), underperformed largely due to the appreciation of the US Dollar.

Top 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

-2.43%

-2.81%

-3.38%

Bottom 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

-9.14%

-4.05%

-3.52%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2024.

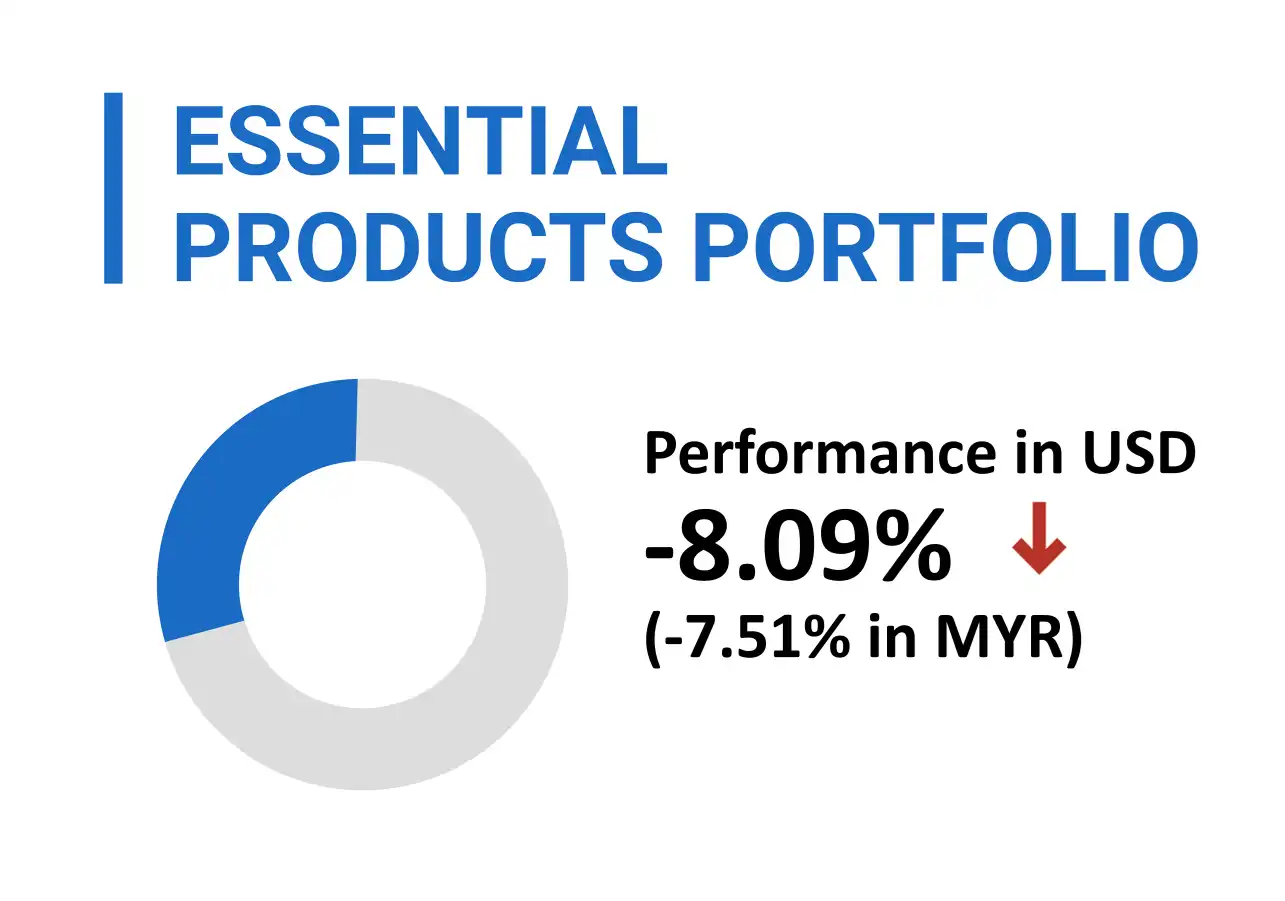

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was down by -8.09% (-7.51% in MYR) in December 2024.

All the ETFs in the essential portfolios experienced a minimum 7.33% correction in share price. These portfolios primarily invest in companies that build and own large infrastructure, which is capital-intensive and often requires significant capital investment.

These companies typically issue long-term bonds to fund their projects, making them more sensitive to changes in bond yields. Higher treasury yields may force them to offer higher yields to attract investors, leading to increased overall operational costs.

However, it's important to remember that most companies investing in infrastructure plan for the long term—often more than ten years. While short-term variables might affect these companies, they tend to benefit from healthy cash flow as their projects mature.

Top 3 ETFs performance (Essential products portfolio)

FIRST TRUST GLOBAL WIND ENER (FAN)

FIRST TRUST WATER ETF (FIW)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

-7.33%

-7.50%

-7.85%

Bottom 3 ETFs performance (Essential products portfolio)

ENERGY SELECT SECTOR SPDR (XLE)

VANECK AGRIBUSINESS ETF (MOO)

INVESCO S&P GLOBAL WATER IND (CGW)

-10.30%

-10.30%

-8.86%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2024.

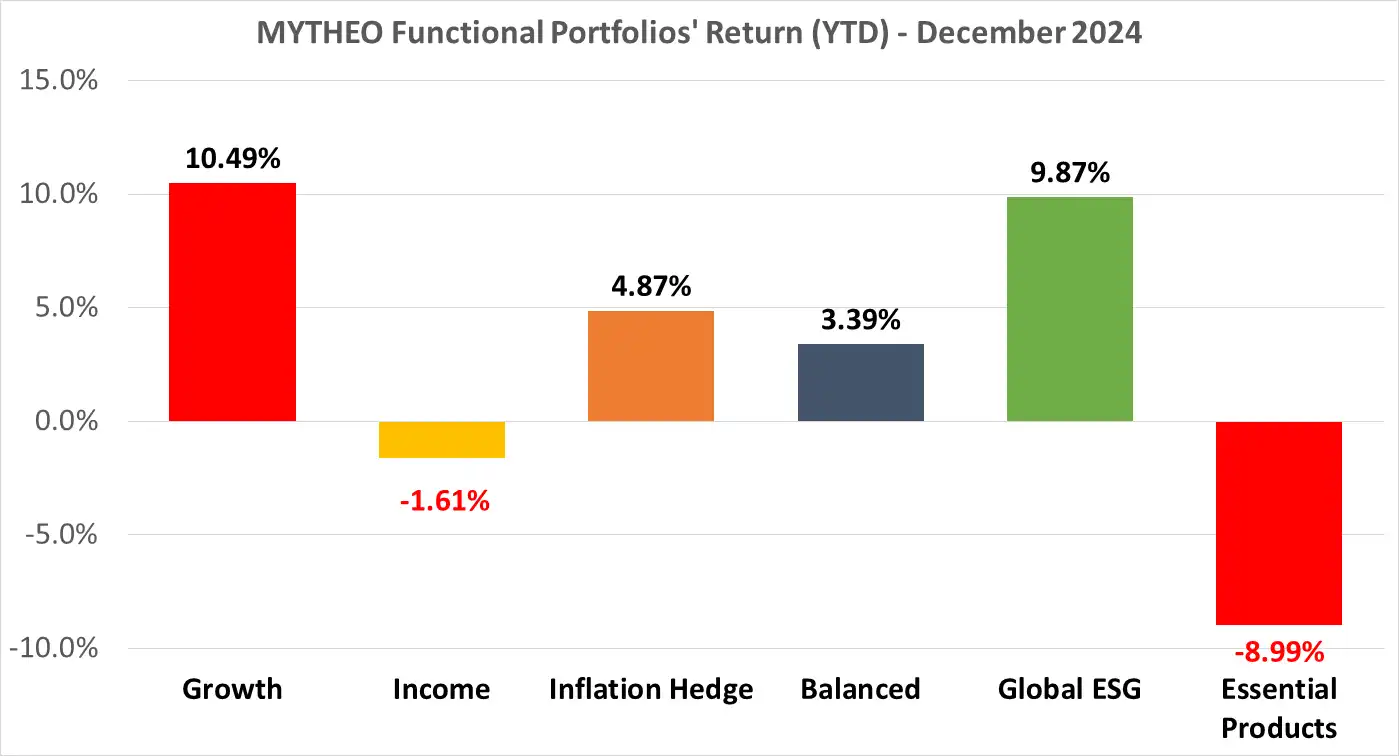

Chart 1: Year 2024 Portfolio Return in % (MYR)

Source: GAX MD Sdn Bhd, December 2024

Note: Past performance is not an indication of future performance

Balanced allocation consists of 30% Growth, 47% Income and 23% Inflation Hedge

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio returns derive from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 47% to the Income portfolio and 23% to the Inflation Hedge Portfolio, the actual portfolio return in MYR for December would be -2.95%, calculated as follows: [(30% x -3.31%) + (47% x -1.37%) + (23% x -2.47%)].

Our Thoughts

December 2024 was one of the weakest months of the year for financial markets, with the sell-off only surpassed by the steep losses recorded in August. The S&P 500 fell by 2.50%, and the Dow Jones 30 Index declined by 5.25% over the month.

Bucking the trend, however, was the Nasdaq Index, which saw a modest increase of 0.48% in December. This resilience was largely due to the continued strength of the "Magnificent Seven" technology stocks. Notably, only Microsoft and Nvidia experienced declines, with Microsoft down by just 0.46% and Nvidia by 2.86%, both of which were milder compared to the overall market performance.

While the downturn in August 2024 was largely driven by the unwinding of the Japan carry trade following the Bank of Japan's (BoJ) surprise interest rate hike, December's sell-off was primarily influenced by developments from the US Federal Open Market Committee (FOMC).

On December 18, 2024, the FOMC announced a widely anticipated 25-basis-point (0.25%) rate cut, bringing the federal funds rate to a range of 4.25%-4.50%. This marks the third consecutive rate cut by the Fed, following a 50-basis-point reduction in September and a 25-basis-point cut in November.

While the rate cut itself was well within market expectations and had a neutral impact on the market, panic only set in following comments made by Fed Chairman Jerome Powell during the post-meeting press conference.

Specifically, he indicated that the Fed now anticipates only two rate cuts in 2025, a sharp departure from the four cuts projected in September. He also revealed that the cut is necessary following stronger than expected economic growth and hotter than expected inflation in the US.

The Summary of Economic Projections published by FOMC on the same day revealed that FOMC. The Fed increased its GDP growth forecast from 2.0% estimates made in September 2024 to 2.5% for 2024 and for the core inflation it is revised higher from 2.2% to 2.5%.

The prospect of just two rate cuts in 2025 implies that the Fed may leave rates unchanged in six of its eight scheduled meetings. Markets now expect the Fed to maintain the current policy rate at its January meeting as it continues to assess incoming economic data.

The expectation that interest rates will remain higher for longer has a negative impact on the overall market. However, several sectors are more affected than others, especially the Financials, Real Estate, and Infrastructure sectors, which are particularly sensitive to movements in interest rates and bond yields.

While the sharp losses in December were painful for many investors, they are a normal occurrence for those who participate in financial markets and are part of the investing journey. Investing is rarely a linear process, and periods of turbulence are inevitable. Chairman Powell’s comments may have caused initial unease in the market, but they reflect a diplomatic effort to provide forward guidance and mitigate the risk of more severe disruptions.

The rapid shift in the Fed’s economic outlook over the past three months highlights the challenges even the most influential central banks face in accurately forecasting economic trends. This highlights the importance of avoiding overreliance on short-term market predictions and focusing instead on staying invested and diversified. A disciplined, long-term approach is crucial for navigating fluctuations and achieving sustainable returns.

We will be releasing a report on a review on the performance of MYTHEO for the year 2024 and our market views for 2025.

As market dynamics continue to evolve, MYTHEO remains committed in providing investors with options aligned with their financial goals. As a digital investment platform, MYTHEO is prepared to support you in achieving your long-term financial objectives through diversified investments, seamlessly and cost-effectively. Discover how MYTHEO can enhance your portfolio diversification today, and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.