December 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in December 2023.

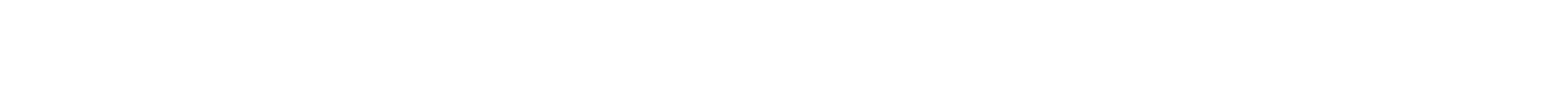

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 4.49% (up 3.10% in MYR) in December 2023.

For the month of December 2023, the portfolio did not shift by much and the US market remains as our largest investment exposure.

The portfolio’s allocation to the US Large Cap Value ETF (about 20%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE VALUE (RPV)

ISHARES MSCI CANADA (EWC)

VANGUARD FTSE PACIFIC (VPL)

7.78%

6.27%

5.75%

Bottom 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE GROWTH (RPG)

ISHARES MSCI UNITED KINGDOM (EWU)

VANGUARD FTSE EMERGING MARKETS (VWO)

4.47%

4.37%

3.30%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2023.

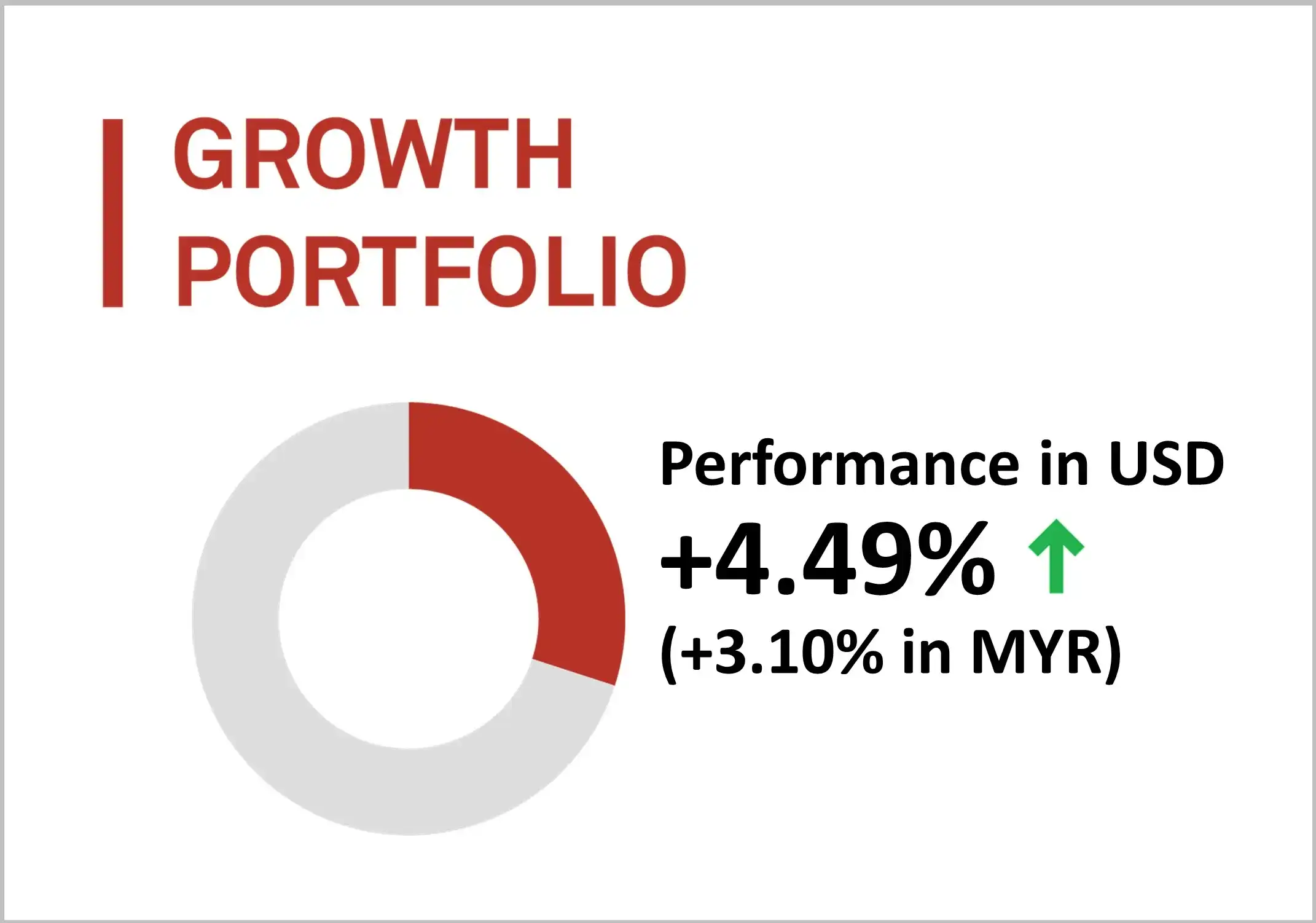

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gain of 2.86% (up by 1.49% in MYR) in December 2023.

For the month of December 2023, the income portfolio continued to hold significant levels of short-term duration corporate bonds and investment grade bonds that balanced out longer-term US Treasury holdings. The current yield-to-maturity of the ETFs in the portfolio is around 5.99%.

The portfolio’s exposure to Long Duration Treasury Bonds (about 18%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

8.69%

4.88%

2.88%

Bottom 3 ETFs performance (Income portfolio)

ISHARES SHORT-TERM CORPORATE (IGSB)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES FLOATING RATE BONDS (FLOT)

1.85%

1.79%

0.52%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2023.

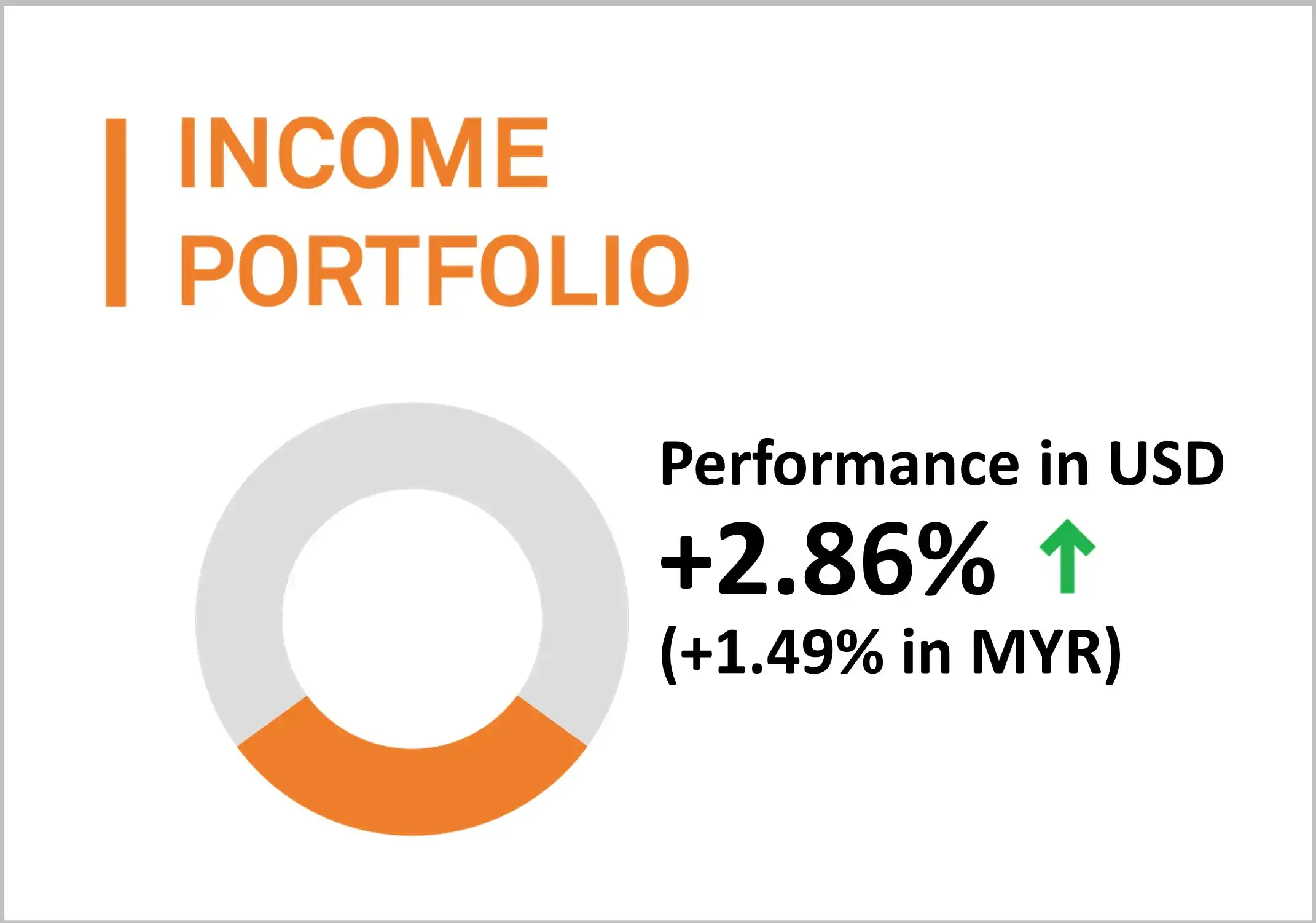

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in December 2023, up by 3.22% (+1.85% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to US real estate (about 30%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

ISHARES US REAL ESTATE ETF (IYR)

SPDR DJ INTERNATIONAL REAL ETF (RWX)

+10.45%

+8.98%

+8.94%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES GOLD TRUST (IAU)

ISHARES SILVER TRUST (SLV)

INVESCO DB OIL FUND (DBO)

+1.27%

-5.84%

-5.99%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2023.

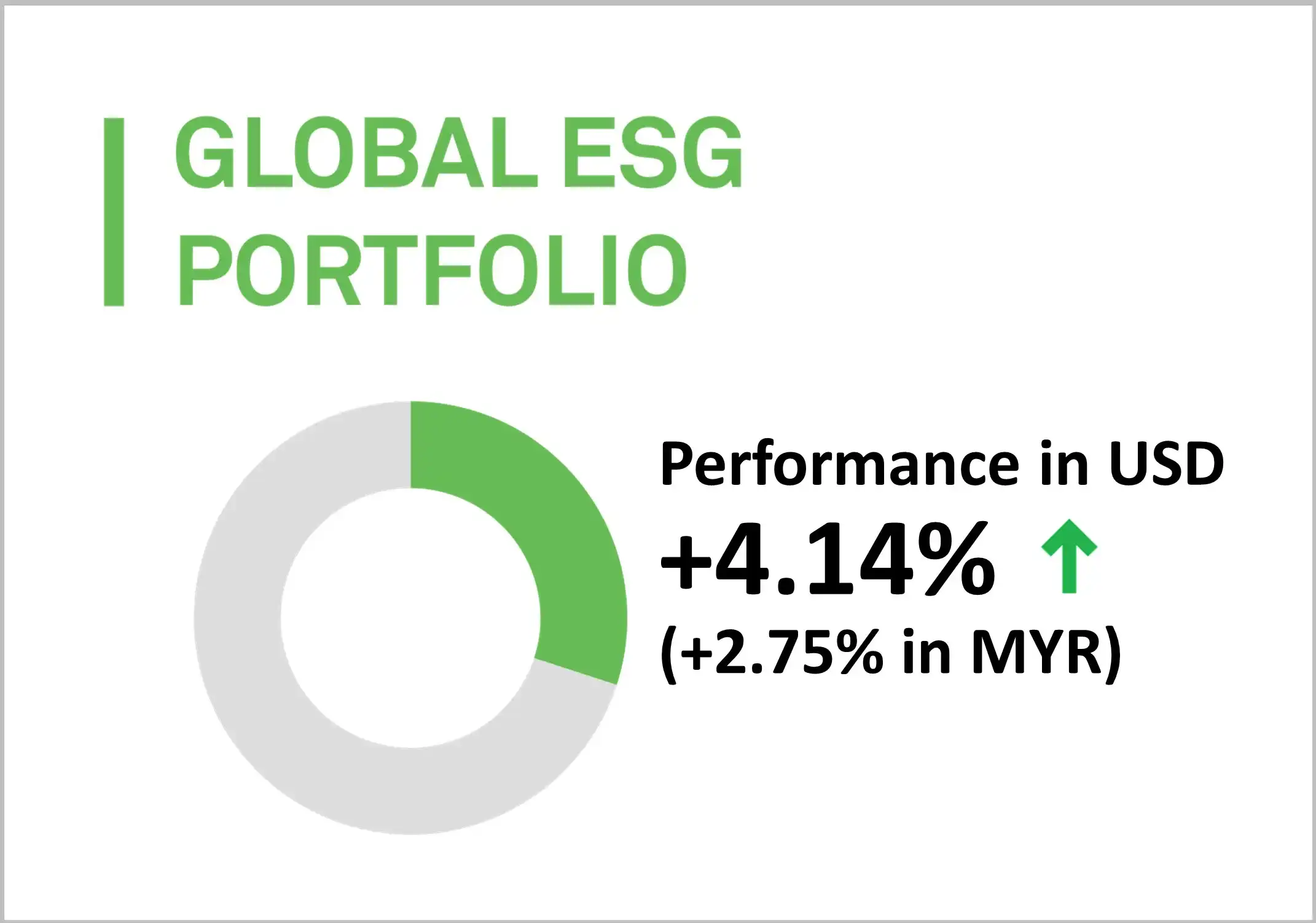

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 4.14% (+2.75% in MYR) in December 2023.

Similar to the growth portfolio, the preference and exposure to US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record. As such, MYTHEO portfolio consists a higher weighting in US markets in addition to better risk management compared to investment in newer and more volatile emerging markets.

Top 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

+6.28%

+5.23%

+5.23%

Bottom 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

+4.79%

+4.74%

+3.66%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2023.

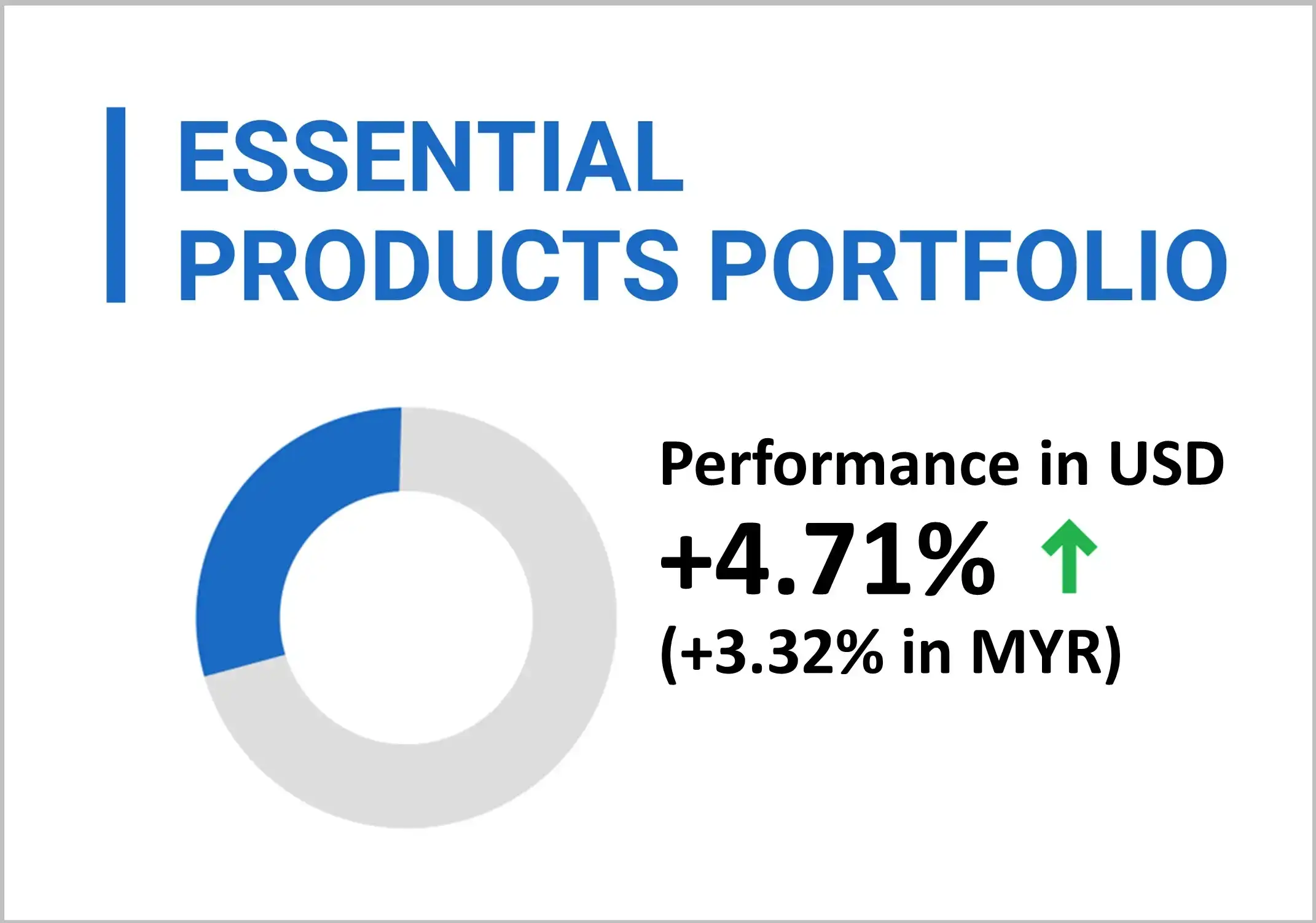

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio is up by 4.71% (+3.32% in MYR) in December 2023.

MYTHEO's Essential Products portfolio was launched on 9 November 2023 strategically crafted to invest in a diversified range of equity ETFs focusing on key themes such as water-related, food-related, energy resources, and renewable energy.

Top 3 ETFs performance (Essential products portfolio)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

FIRST TRUST GLOBAL WIND ENER (FAN)

FIRST TRUST WATER ETF (FIW)

+10.45%

+9.21%

+7.90%

Bottom 3 ETFs performance (Essential products portfolio)

INVESCO S&P GLOBAL WATER IND (CGW)

ISHARES MSCI AGRICULTURE PRO (VEGI)

ENERGY SELECT SECTOR SPDR (XLE)

+6.55%

+5.61%

+0.08%

Source: GAX MD Sdn Bhd, data in USD term for the month of December 2023.

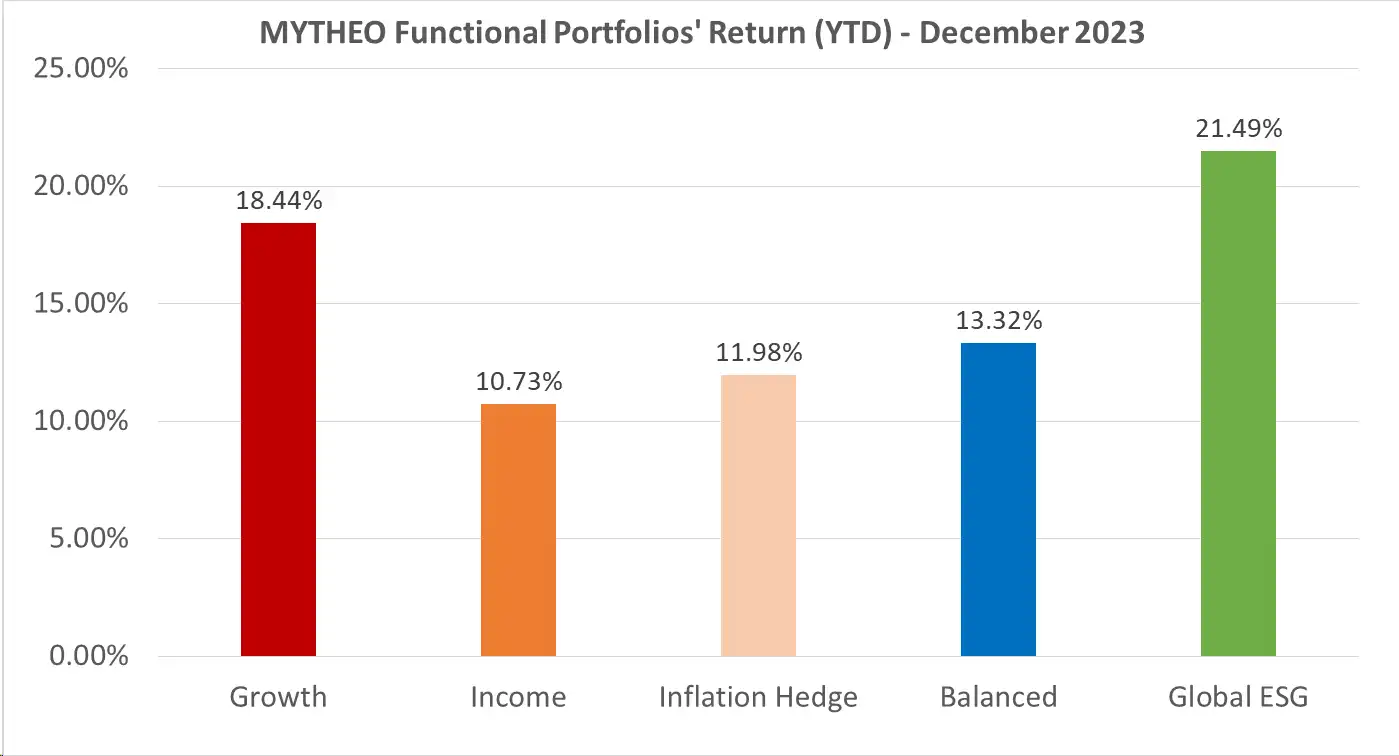

Chart 1: December 2023 -Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, January 2024

Note: Past performance is not an indication of future performance

Balanced allocation has been revised to consist of 30% Growth, 45% Income and 25% Inflation Hedge

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 30% of their investment in Growth, 45% in Income and 25% in Inflation Hedge, the actual portfolio return in MYR for December is +2.06% [(30% x 3.10%) + (45% x 1.49%) + (25% x 1.85%)]

Our Thoughts

The US Dollar (USD) weakened further against the Malaysian Ringgit (MYR) in December 2023 by -1.3% to MYR 4.5950, compared to MYR 4.6570 as of the 30th of November 2023. This has had a minor negative impact on the performance of the portfolio in Ringgit. Overall, the USD contributed to 4.4% of MYR portfolio returns in 2023.

The decline of the USD in the final months of 2023 coincided with a general improvement of sentiment towards risker assets. This is due to the US Federal Reserve holding the fed funds rate of 5.25%-5.5% in the near term, while lowering these rates in the longer term as per expectations in the dot plot. In the US, the “Magnificent Seven” stocks helped pull the growth-oriented S&P 500 to new heights in 2023, while ETFs related to Europe and emerging markets such as India, Mexico and Brazil also gave strong annual returns of above 25%. Conversely, Chinese ETFs continued to struggle with losses beyond -10%.

For bonds, the halt of rapid and steep rate hikes up to the third quarter allowed longer termed US Treasuries and bonds to recover their value just as significantly. Even the 20+ years US Treasury ETF was able to breach into positive annual returns territory of 2.8% in 2023 by jumping 8.7% in December 2023. Overall, short term and high-yielding fixed income securities came out on top in 2023 with returns going above 10% under the new high interest rate environment.

Within real assets, US real estate staged a partial recovery, with the iShares US Real Estate ETF moving up by 11.9% in 2023 after the tumble of -25.5% in 2022. More uncommonly, the safe haven of gold also gave 2023 returns of 12.8%, perhaps showing that it remains attractive in both risk-on and risk-off environments. Conversely, energy-related counters including those in oil and green energy stumbled on energy demand in 2023 that was weaker than expected, as well as on pressure on income-generating stocks and financing costs.

As market conditions evolve, MYTHEO remains committed to providing investors with choices that align with your financial goals. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subject to MYTHEO’sNotice and Disclaimer.