Thursday, 9 January 2025

Written by MYTHEO

Global equity markets extended their bullish momentum in 2024, building on the strong gains of the previous year. The U.S. market stood out with exceptional performance, as major indices shattered records and delivered impressive gains.

The Dow Jones Industrial Average (DJIA) climbed 13.55%, surpassing the historic 40,000 milestone for the first time. Meanwhile, the Nasdaq 100 outperformed with a spectacular 28.86% gain, fuelled by the continued strength of technology stocks. This remarkable rally was underpinned by robust profit growth, relentless innovation, and investor confidence in the sector’s long-term potential.

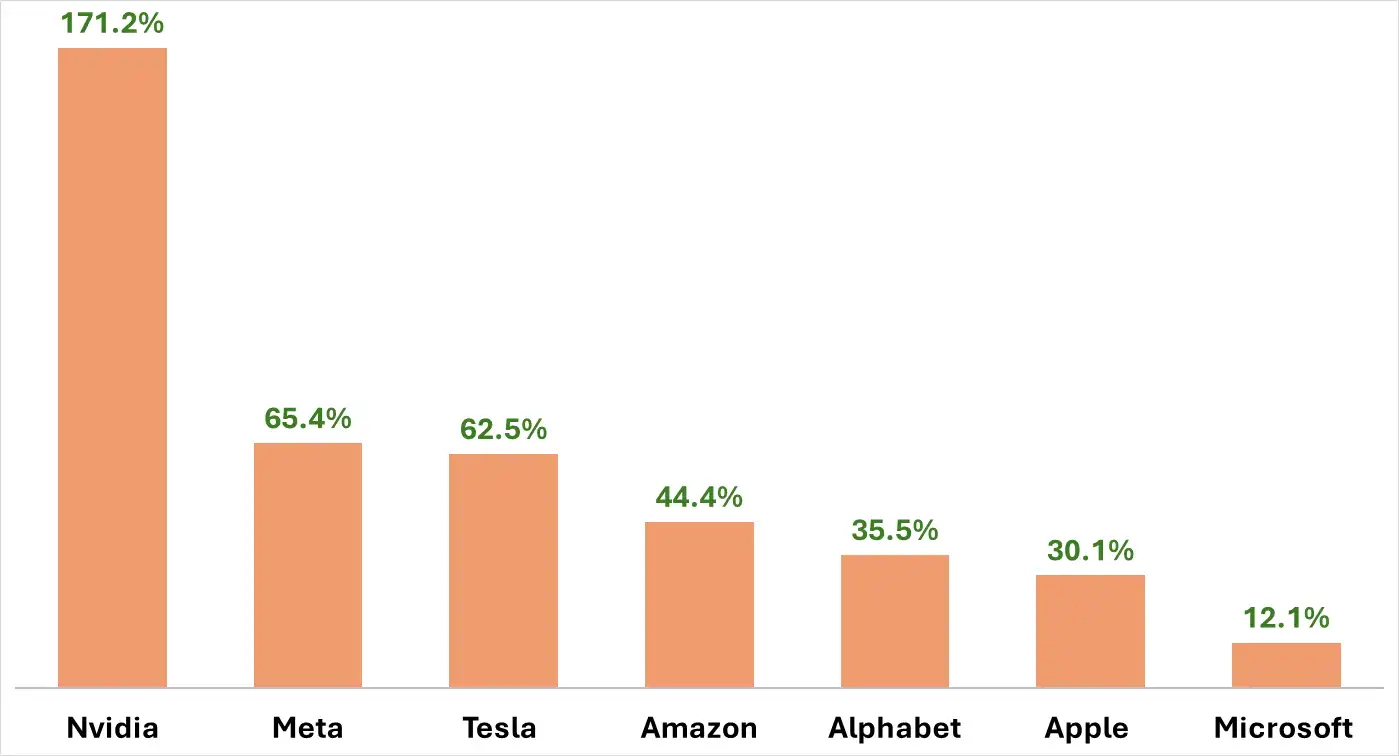

Driving much of the U.S. market’s stellar performance were the so-called “Magnificent Seven”: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Among them, NVIDIA emerged as the undisputed leader for 2024. The premier graphics chip manufacturer saw its stock price soar by an extraordinary 171%, nearly tripling in value.

Chart 1: Share Price Performance of the Magnificent Seven Stocks in 2024

Source: Gax MD, January 2024.

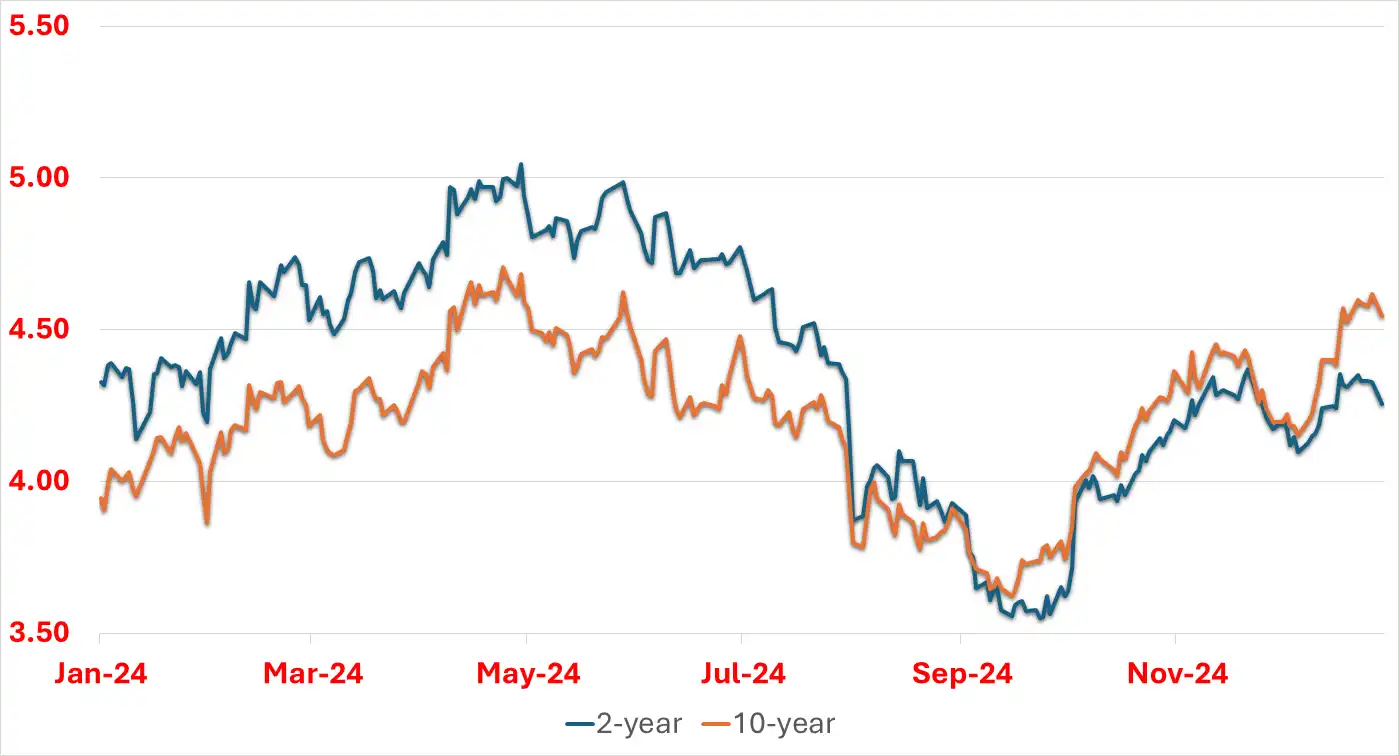

In 2024, after holding rates steady through the first five meetings of the year, the Federal Open Market Committee (FOMC) took action to ease monetary policy. At its sixth meeting in September, the committee implemented a 50 basis point (0.50%) rate cut, followed by two additional 25 basis point reductions in November and December. While these rate cuts had a modest positive impact on short-term Treasuries, the reaction in the broader treasury market was mixed. The 2-year Treasury yield ended the year at 4.254%, slightly lower than its opening level of 4.328%. In contrast, long-term Treasuries faced significant pressure. The 10-year Treasury yield surged to 4.545%, a sharp increase of more than 0.60% from its starting point of 3.944%. The primary driver of this upward movement in yields was the persistence of inflation, which continued to exceed the FOMC’s expectations. As of November 2024, inflation was recorded at 2.70%, remaining well above the committee’s target of 2.00%.

Chart 2: U.S. Treasury Yields Performance Throughout 2024

Source: Federal Reserve Economic Data (FRED), Dec 2024.

Furthermore, market concerns were compounded by the possibility of further inflationary risks, particularly in light of potential fiscal policy shifts under the incoming administration of President Donald Trump. Investors were wary of a combination of increased tariffs and tax cuts, both of which could drive inflation higher.

While the Federal Open Market Committee (FOMC) significantly influenced market dynamics in 2024, the Bank of Japan (BoJ) arguably caused some of the worst turbulence with its unexpected policy shifts. In a landmark decision, the Bank of Japan (BoJ) ended its long-standing yield curve control policy for Japanese government bonds—a strategy it had employed since 2016 to manage both short- and long-term interest rates. This shift signalled a move toward a more conventional monetary policy framework, aligning Japan’s approach more closely with other central banks by focusing on managing short-term interest rates.

The first major step came in March 2024, when the BoJ raised interest rates for the first time in 17 years. The increase, from -0.1% to a range of 0–0.1%, marked Japan’s formal departure from its negative interest rate policy. This historic decision was driven by the need to address rising domestic inflation. However, the BoJ’s actions did not stop there. In early August, the central bank delivered a second, unanticipated rate hike, which shocked global markets and ignited widespread volatility.

The August rate hike triggered a swift unwinding of carry trades, where investors had borrowed at Japan’s previously low rates to invest in higher-yielding assets elsewhere. The resulting wave of liquidations created ripple effects across global markets. On August 5, 2024, the Dow Jones Industrial Average (DJIA) and Malaysia’s KLCI recorded their largest single-day losses of the year, falling 4.53% and 4.63%, respectively.

This policy shift also led to a sharp sell-off in the U.S. dollar, which tumbled 5.97% against the Malaysian ringgit (MYR) in August, followed by an additional 4.56% decline in September.

The rise and fall in the global markets throughout 2024 were also shaped by ongoing geopolitical tensions and significant political developments. While the wars in the Middle East and Ukraine continued, their impact on financial markets was notably less severe compared to the prior two years. The key political event of the year was the U.S. presidential election, where Donald Trump secured a decisive victory.

The foreign exchange market also experienced significant volatility throughout the year. The U.S. dollar took a sharp tumble, plummeting to a low of 4.121—a dramatic 14.06% drop from its February peak of 4.7950. This wild ride was primarily fuelled by the unwinding of the Japanese yen carry trade, following the Bank of Japan’s unexpected policy shifts in August. But the story didn’t end there. The U.S. dollar staged a remarkable comeback in the final three months of the year, rallying to close at 4.4680, which reduced the year's overall loss to a mere -2.66%.

Chart 3: USD Performance against MYR in 2024.

Source: TradingView, January 2024

Adding to the U.S. dollar's weakness against the Malaysian ringgit (MYR) was Malaysia’s robust economic performance. Domestic economy posted an impressive 5.90% GDP growth in Q2 2024, exceeding even the most optimistic forecasts. The MYR’s appreciation was further supported by a surge in foreign direct investment (FDI), as global tech giants—including AWS, Microsoft, Google, and Oracle—all announced plans to establish data centres in Malaysia.

The urgent issue of climate change took centre stage in 2024, as extreme weather events disrupted agricultural production and drove commodity prices sharply higher. The global coffee and cocoa markets were among the hardest hit. Brazil faced its hottest year in seven decades, with severe drought conditions significantly impacting coffee yields. As a result, coffee prices surged by more than 70%. Meanwhile, excessive rainfall in Ghana and Ivory Coast—accounting for over 60% of global cocoa production—severely hampered output, causing cocoa prices to skyrocket by an extraordinary 185% compared to the previous year.

Looking Ahead: Navigating Uncertainty in 2025

Global markets are expected to remain highly volatile in 2025, driven by a confluence of macroeconomic and geopolitical factors. The U.S. market continues to stand out, fueled by the rapid rise of artificial intelligence (AI) and its transformative impact on the "Magnificent Seven" tech giants. However, uncertainty looms as central banks and political developments shape the investment landscape.

Adding to the uncertainty is the return of Donald Trump to the U.S. presidency in 2024. His administration’s bold economic initiatives, including significant corporate tax cuts and broad-based tariffs, are set to influence the global economic landscape in 2025. While tax cuts could temporarily bolster corporate earnings, the accompanying trade tensions risk fueling inflation and increasing market volatility. In this environment, maintaining a well-diversified investment portfolio becomes essential for managing risks and seizing potential opportunities.

U.S. Treasuries offer a prime example of how inflation concerns can present opportunities. Yields have climbed to their highest levels in decades, making them increasingly attractive to global investors despite inflation risks. For Malaysian investors in particular, the shift is significant. Historically, Malaysian government bond yields have maintained a premium over U.S. yields since 2007, but this trend reversed in late 2023. With U.S. Treasury yields now outpacing their Malaysian counterparts, they present an appealing option for those seeking enhanced returns in 2024 and beyond.

The Federal Reserve (FOMC) and the Bank of Japan (BOJ) were two of the most influential central banks shaping financial markets in 2024, and their impact is expected to remain significant in 2025. Market participants have lowered their expectations for U.S. interest rate adjustments, anticipating only two rate cuts throughout the year. However, the resurgence of inflation in the latter half of 2024 has introduced a fresh challenge. This inflationary trend could intensify as Donald Trump takes office, with his policies potentially adding further inflationary pressures.

In Japan, elevated inflation presents even greater challenges. The BOJ, which will meet eight times in 2024, maintains a long-term inflation target of 2%. However, November 2024’s inflation rate of 2.9%, up from 2.3% in October, highlights the steep uphill battle ahead. Following two rate hikes in 2024, additional hikes in 2025 appear inevitable as Japan grapples with persistent inflation. The potential for a significant unwind of the Japan carry trade, reminiscent of the turbulence seen in August 2024 might be repeated in 2025.

In 2024, the world experienced a series of major climate-related incidents—record high temperatures, extreme droughts, and devastating floods—that emphasized the urgency of adopting sustainable investment strategies. These extreme climate conditions and natural disasters not only disrupted markets but also underlined the critical need to address environmental challenges.

As we move into 2025, investors must prepare for a landscape characterized by rapid change and persistent uncertainty. The key to navigating these challenges lies in diversification—across asset classes, geography and sectors. By adopting a balanced and forward-looking approach, investors can position themselves to capitalize on opportunities while minimizing the impact of adverse developments.

Platforms like MYTHEO’s automatic diversification tools can help investors balance risk and capitalize on opportunities. By diversifying risks and assets allocation and leveraging MYTHEO’s AI-driven insights, investors can aim for consistent returns and enjoy peace of mind, even in challenging times.