08 August 2024

Written by MYTHEO

Key Takeaways

- Equity markets continued strong performance, with US Value-related counters doing better than market cap-equivalent Growth.

- Bank of Japan (BOJ) increased its key interest rate to approximately 0.25%, up from a range of zero to around 0.1%.

- Fixed income instruments yielded modest returns in July, as the US Federal Reserve maintained its target rate at 5.25-5.50%.

- Wind and clean energy-related stocks made a notable comeback this month, despite pressures on financing.

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in July 2024.

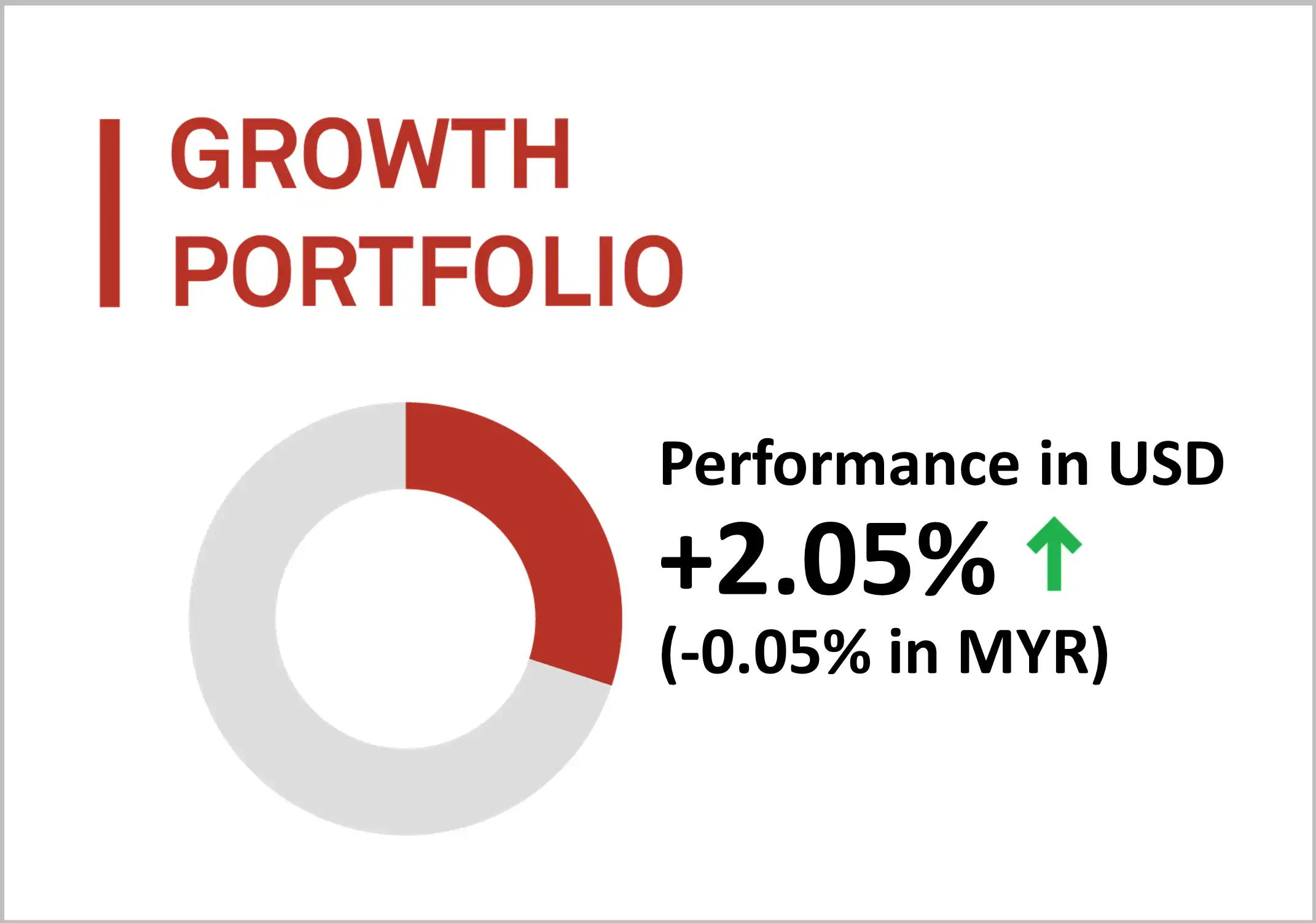

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 2.05% (down 0.05% in MYR) in July 2024.

For the month of July 2024, the portfolio did not shift by much and the US market remains as our largest investment exposure.

The portfolio’s allocation to Value ETF (about 20%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE VALUE (RPV)

ISHARES MSCI CANADA (EWC)

VANGUARD VALUE (VTV)

+5.95%

+4.93%

+4.74%

Bottom 3 ETFs performance (Growth portfolio)

SPDR EURO STOXX 50 (FEZ)

INVESCO S&P 500 PURE GROWTH (RPG)

INVESCO NASDAQ 100 ETF (QQQM)

+0.56%

-1.32%

-1.70%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2024.

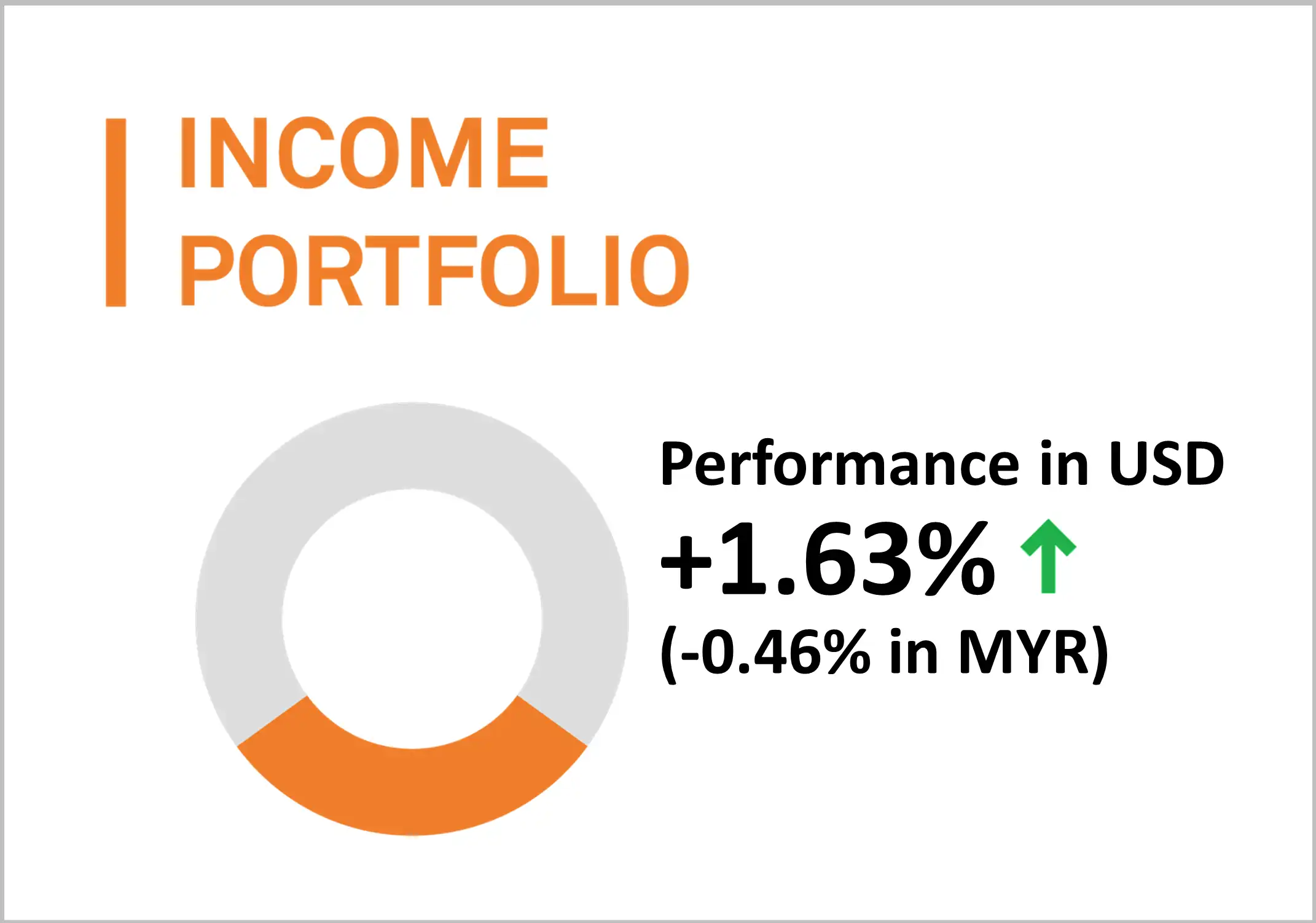

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gained of 1.63% (down by 0.46% in MYR) in July 2024.

For the month of July, the income portfolio underwent its quarterly reallocation, this involved shifting some medium to long-term treasury bonds to international treasury bonds based on their favourable risk-adjusted yields. Presently, the yield-to-maturity of the bond ETFs in the portfolio (excluding preferred stock) stands at approximately 4.67%.

The portfolio’s exposure to long-term treasury bond (about 10%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

+3.64%

+2.64%

+2.32%

Bottom 3 ETFs performance (Income portfolio)

ISHARES US PREFERRED STOCK (PFF)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES FLOATING RATE BONDS (FLOT)

+1.03%

+0.60%

+0.53%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2024.

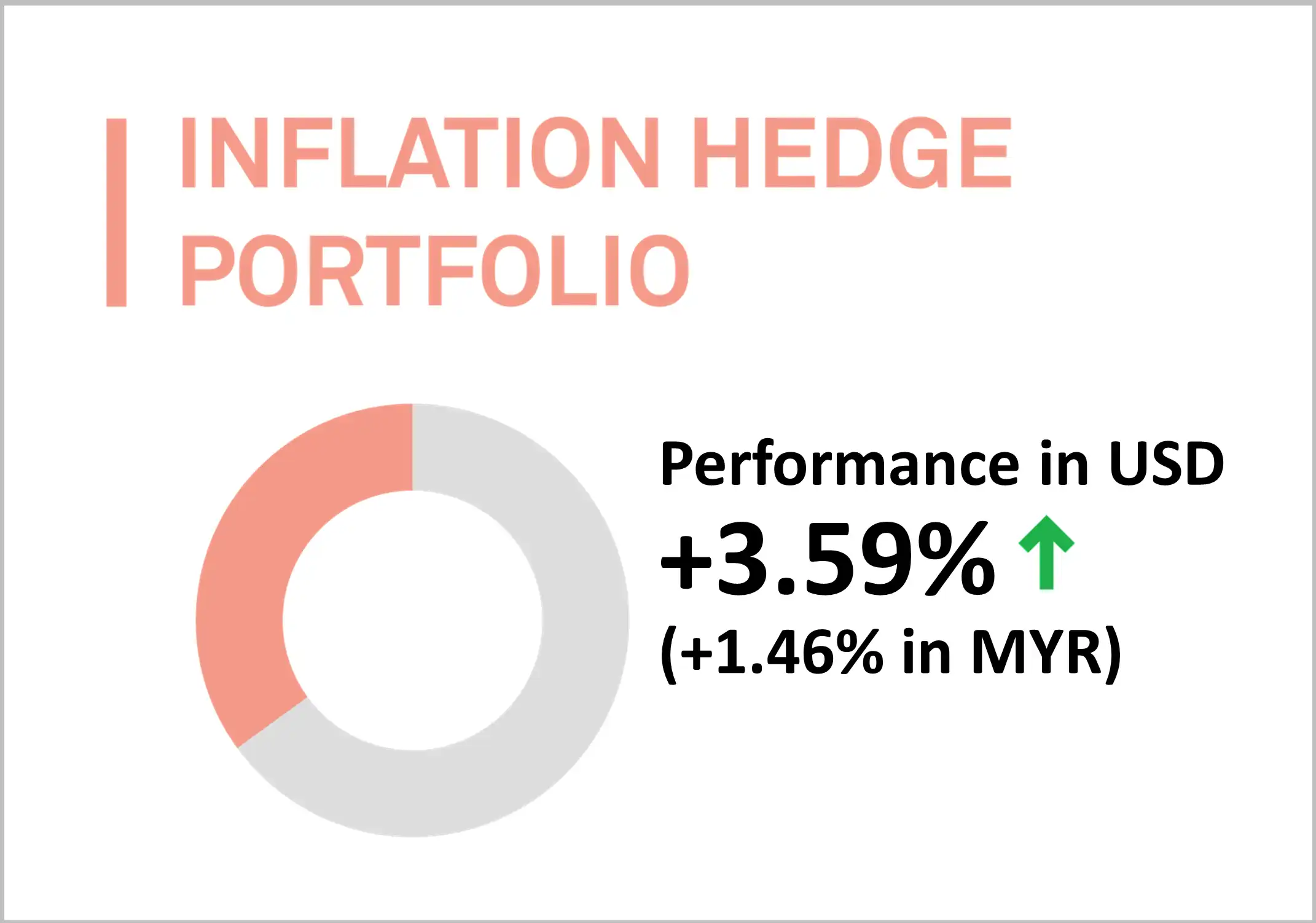

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in July 2024, up by 3.59% (up by 1.46% in MYR).

The core holdings of this portfolio are meticulously structured to prioritize resilience amid market volatility, particularly within equities and bonds. Emphasizing US real estate and inflation-linked bonds, the allocation to these assets is strategically designed to navigate fluctuations adeptly. US real estate, infrastructure, and base metals allocations are chosen for their ability to mitigate long-term inflation risks. Simultaneously, investments in inflation-linked bonds and gold offer added stability and diversification benefits, acting as buffers against the inherent turbulence of equity and bond markets.

The portfolio’s allocation to U.S real estate (about 30%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

ISHARES MORTGAGE REAL ESTATE (REM)

SPDR DJ INTERNATIONAL REAL (RWX)

+7.62%

+6.41%

+6.38%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES SILVER TRUST (SLV)

INVESCO DB OIL FUND (DBO)

INVESCO DB BASE METALS (DBB)

-0.68%

-2.46%

-6.36%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2024.

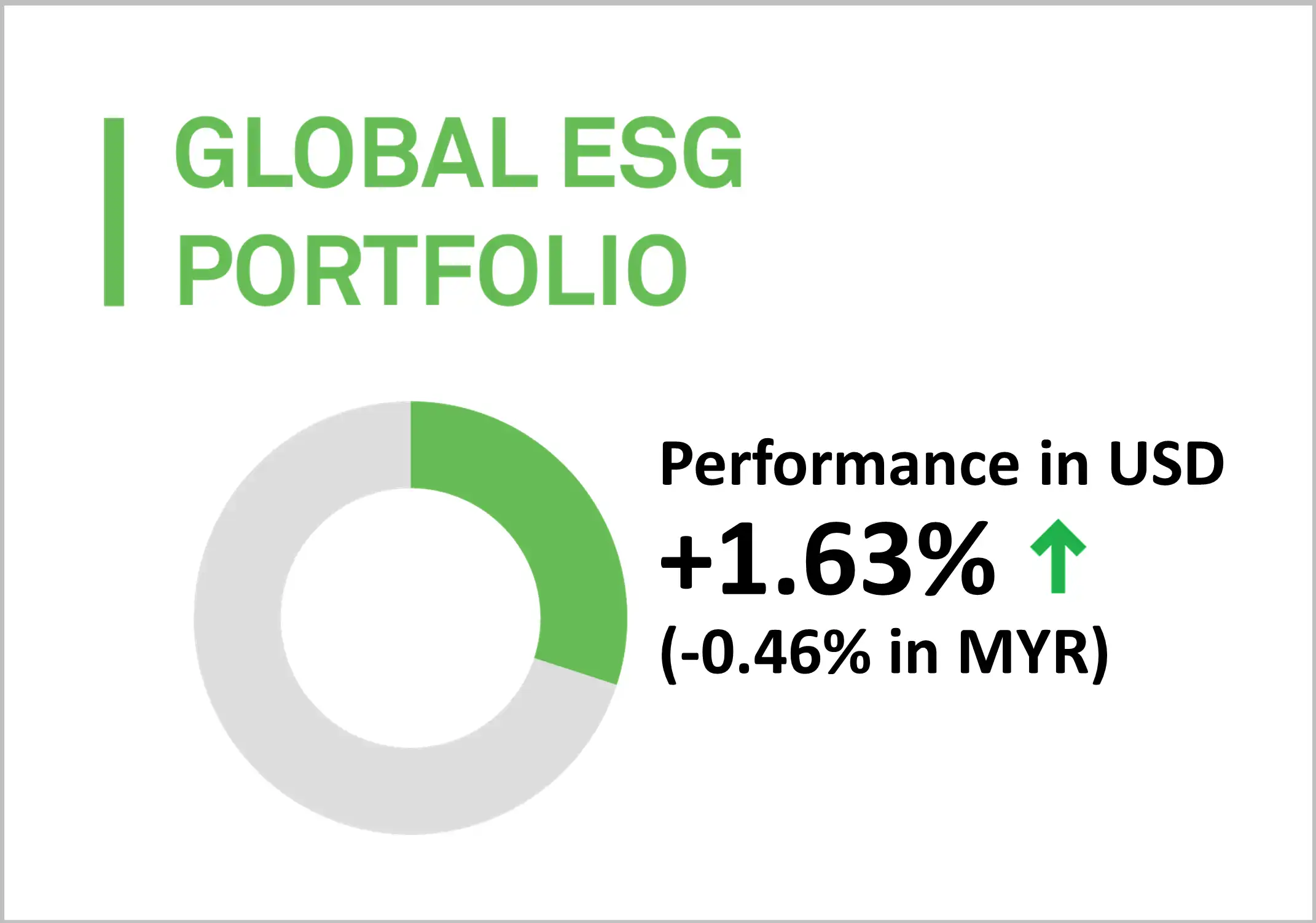

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 1.63% (down by 0.46% in MYR) in July 2024.

In line with the growth portfolio strategy, MYTHEO Global ESG portfolio exhibits a preference and exposure of around 60% to the US market. This substantial weighting is justified by the United States' prominent role in Environmental, Social, and Governance (ESG) investments, coupled with its well-established track record. By carrying a higher allocation to US markets, MYTHEO recognizes not only the maturity of these markets but also underscores its commitment to effective risk management strategies.

Top 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

+5.56%

+2.39%

+2.14%

Bottom 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

+1.64%

+1.04%

-2.17%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2024.

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was up by 4.20% (+2.05% in MYR) in July 2024.

The portfolio emphasis on ETFs reflecting pivotal themes of food, water, and energy, encompassing both new energy and traditional energy resources. With an allocation of around 60% to the US market, this strategic positioning is weighed to seize promising investment prospects arising from technological innovations and evolving business models within these sectors on a global scale.

Top 3 ETFs performance (Essential products portfolio)

INVESCO S&P GLOBAL WATER (CGW)

FIRST TRUST WATER ETF (FIW)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

+7.43%

+7.08%

+6.23%

Bottom 3 ETFs performance (Essential products portfolio)

ENERGY SELECT SECTOR SPDR (XLE)

ISHARES MSCI AGRICULTURE PRO (VEGI)

GLOBAL X LITHIUM & BATTERY ETF (LIT)

+2.26%

+1.46%

+0.93%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2024.

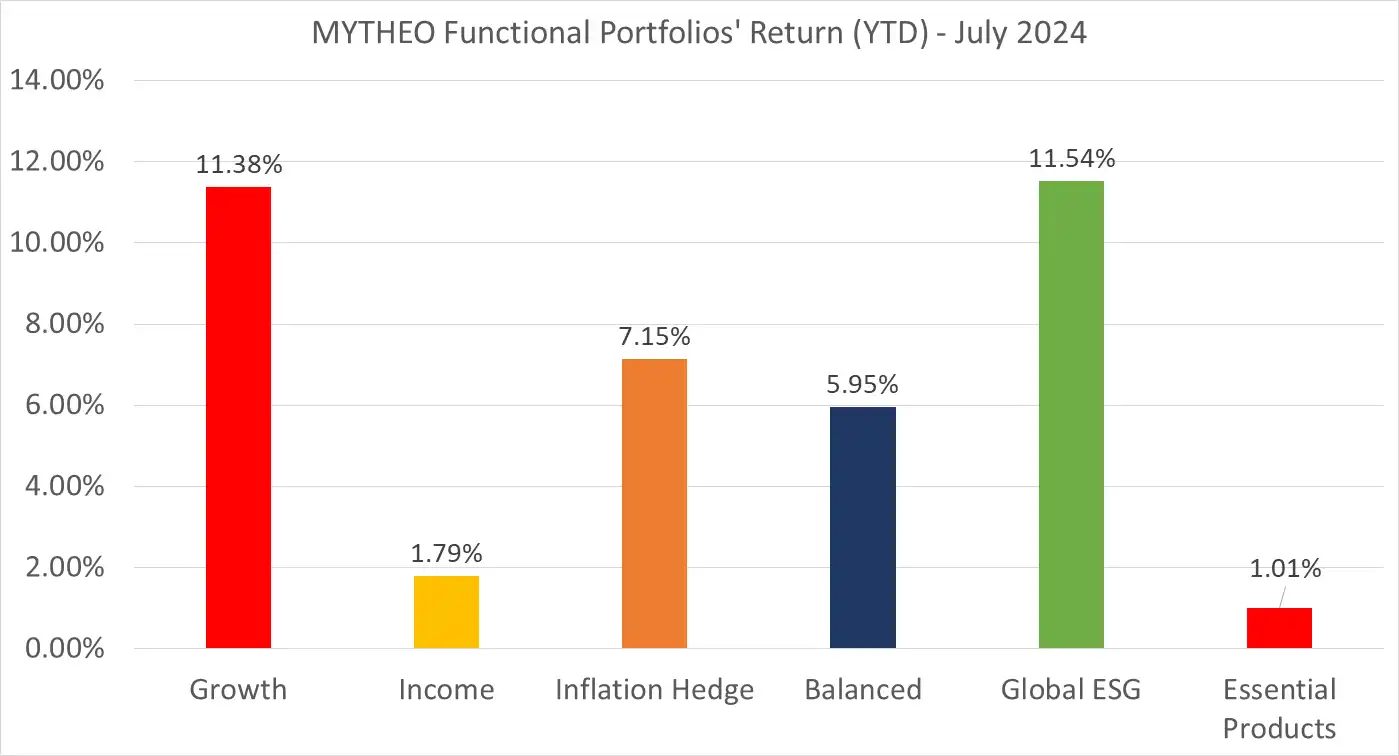

Chart 1: July 2024 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, August 2024

Note: Past performance is not an indication of future performance

Balanced allocation consists of 30% Growth, 47% Income and 23% Inflation Hedge

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio returns derive from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 47% to the Income portfolio and 23% to the Inflation Hedge Portfolio, the actual portfolio return in MYR for July would be +0.10%, calculated as follows: [(30% x -0.05%) + (47% x -0.46%) + (23% x +1.46%)].

Our Thoughts

In July 2024, global equities continued their strong performance, with the S&P 500 hitting new highs throughout the month. Notably, value-oriented indices outperformed their growth-focused counterparts across similar market capitalization ranges. In Asia, the Bank of Japan (BOJ) increased its key interest rate to approximately 0.25%, up from a range of zero to around 0.1%, acting to curb the yen's decline against the US dollar.

Fixed income instruments yielded modest returns in July, as the US Federal Reserve maintained its target rate at 5.25-5.50%. Federal Reserve Chair Jerome Powell indicated that interest rates might be reduced as early as September if the U.S. economy progresses as anticipated, suggesting that the central bank could be nearing the end of its more than two-year fight against inflation. As Fed rate cut narrative gains momentum, the Malaysian Ringgit strengthened by 2.06% against the US dollar over the month.

The anticipation of future rate cuts and low inflation can help the US economy to achieve a soft landing. Meanwhile, these has also stimulated inflows into REITS, as low interest rates generally lead to lower borrowing cost, which can enhance profitability for REITS given their typical heavy reliance on debt.

Wind and clean energy-related stocks made a notable comeback this month, despite pressures on financing, global investment in clean energy is set to reach almost double the amount going to fossil fuels in 2024, helped by improving supply chains and lower costs for clean technologies

As market dynamics continue to evolve, MYTHEO remains committed in providing investors with options aligned with their financial goals. As a digital investment platform, MYTHEO is prepared to support you in achieving your long-term financial objectives through diversified investments, seamlessly and cost-effectively. Discover how MYTHEO can enhance your portfolio diversification today, and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.