12 February 2025

Written by MYTHEO

Key Takeaways

- The stock market delivered a strong performance despite President Donald Trump beginning his second term with a bold move—announcing tariffs. However, the actual tariffs imposed were far less damaging than the market initially feared.

- We see the trade war as the biggest risk this year, but MYTHEO’s portfolio is expected to remain resilient due to its high exposure to the US market.

- The panic sell-off triggered by the launch of Deepseek appears to be an overreaction. Deepseek will deepen AI competition, likely driving further investment in the sector and fueling an upcycle that benefits existing semiconductor players.

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in January 2025.

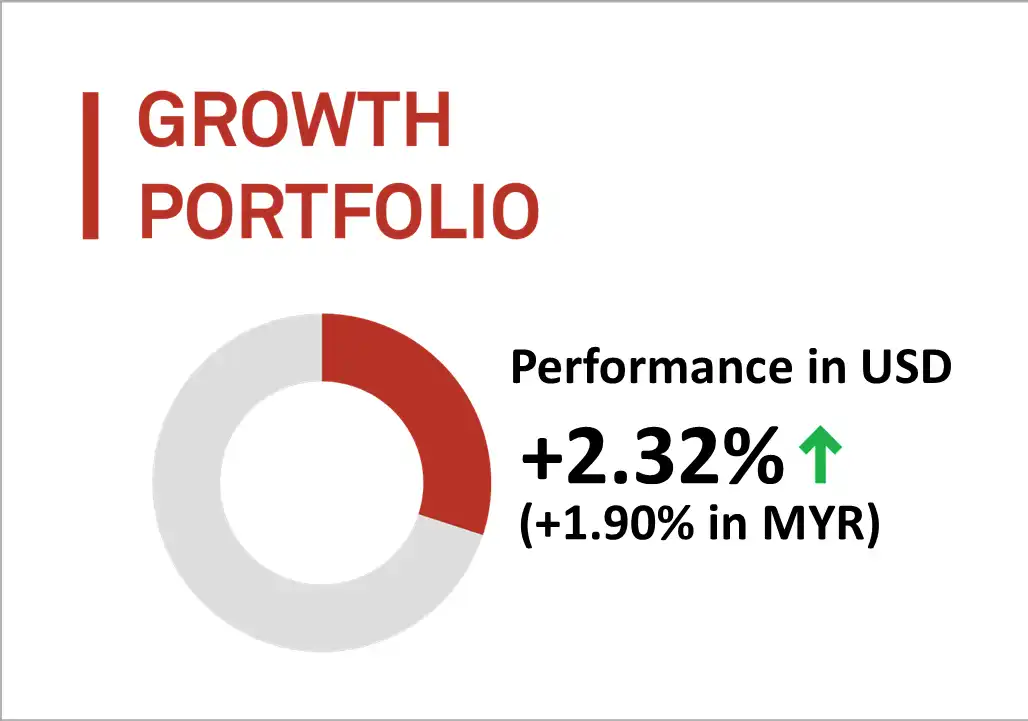

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 2.32% (up by 1.90% in MYR) in January 2025.

The Growth portfolio closed January 2025 on a positive trajectory, buoyed by diminishing geopolitical tensions following a ceasefire in the Middle East and a smoother-than-expected start to Donald Trump’s presidency. Contrary to initial market concerns, Trump’s early policies proved less disruptive than anticipated, helping to restore investor confidence. All the ETF held within MYTHEO’s Growth portfolio delivered positive return in January.

Investor sentiment toward risk assets improved notably, particularly in markets that remained unaffected by Trump’s tariff policy. European equities, as represented by the SPDR EURO STOXX 50 ETF (FEZ), and UK equities, tracked by the iShares MSCI United Kingdom ETF (EWU), outperformed their US counterparts.

Also, within the US, investors exhibited a greater appetite for risk by rotating out of large-cap growth stocks in favour of mid-cap growth equities, fuelling a strong rally in the iShares Russell Mid-Cap Growth ETF (IWP). Notably, every ETF held within MYTHEO’s Growth portfolio delivered a positive return in January, underscoring the resilience of the portfolio amid shifting market dynamics.

Top 3 ETFs performance (Growth portfolio)

SPDR EURO STOXX 50 (FEZ)

ISHARES RUSSELL MID-CAP GROWTH (IWP)

ISHARES MSCI UNITED KINGDOM (EWU)

+7.8%

+5.2%

+4.6%

Bottom 3 ETFs performance (Growth portfolio)

VANGUARD FTSE EMERGING MARKETS (VWO)

INVESCO NASDAQ 100 ETF (QQQM)

VANGUARD FTSE PACIFIC (VPL)

+0.6%

+1.0%

+2.3%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2025.

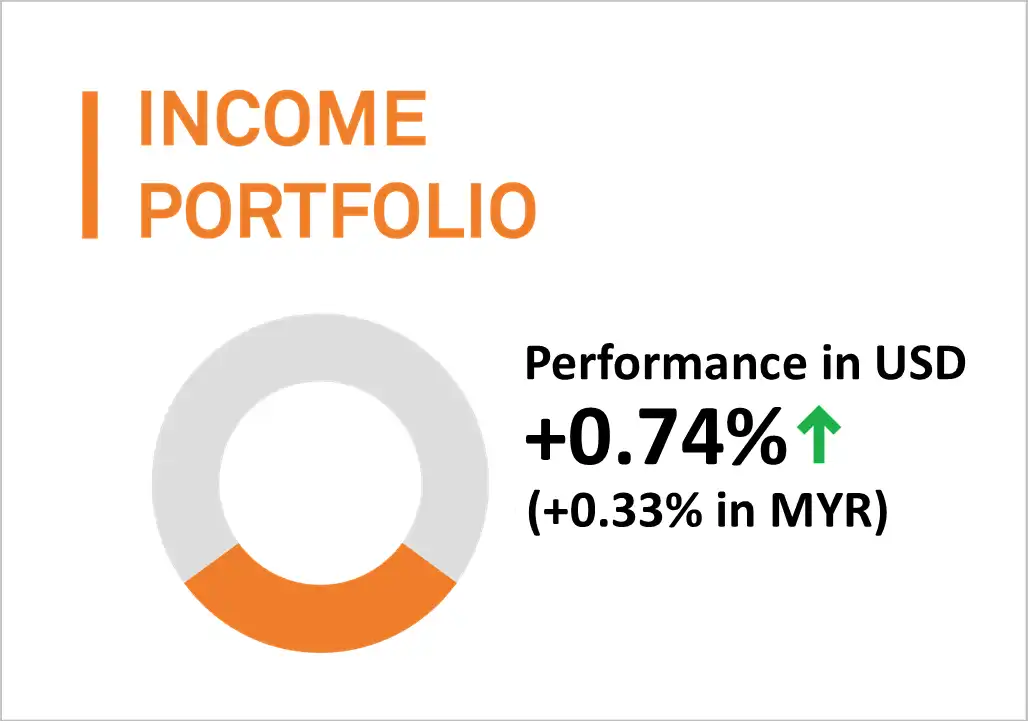

2. Income Portfolio

In January 2025, MYTHEO's Income Portfolio experienced a positive return of 0.74% (an increase of 0.33% in MYR).

US Treasury yields experienced significant volatility in January, with a sharp spike in the middle of the month. On January 13, 2025, the 10-year US Treasury yield surged to a high of 4.792% before reversing and closing the month at 4.542%, providing much-needed relief to the market.

Despite high volatility in bond yields, investor risk appetite remained strong, with a clear preference for higher-risk assets over the safer alternatives. Throughout the month, investors also showed a growing inclination toward non-US assets over US counterparts.

This environment led to strong performance in emerging market bonds denominated in local currencies (EMLC) which emerged as the top performer in MYTHEO’s Income portfolio, delivering a 1.70% return. Other strong contributors included preferred shares (PFF), which exhibit both fixed-income and equity characteristics, as well as short-term high-yield bonds (SJNK).

Only two out of the ten ETFs within MYTHEO’s Income portfolio ended January in negative territory, both of which held government bonds. The first is the TLT, which tracks long-term US Treasury securities with over 20 years left to maturity. The second is IGOV, the ETF that primarily invested in international government bonds, with significant exposure to Japanese and European sovereign debt.

Top 3 ETFs performance (Income portfolio)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES US PREFERRED STOCK (PFF)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

+1.7%

+1.2%

+1.0%

Bottom 3 ETFs performance (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES INTERNATIONAL TREASURY (IGOV)

ISHARES IBOXX INVESTMENT GRADE (LQD)

-0.4%

-0.3%

+0.2%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2025.

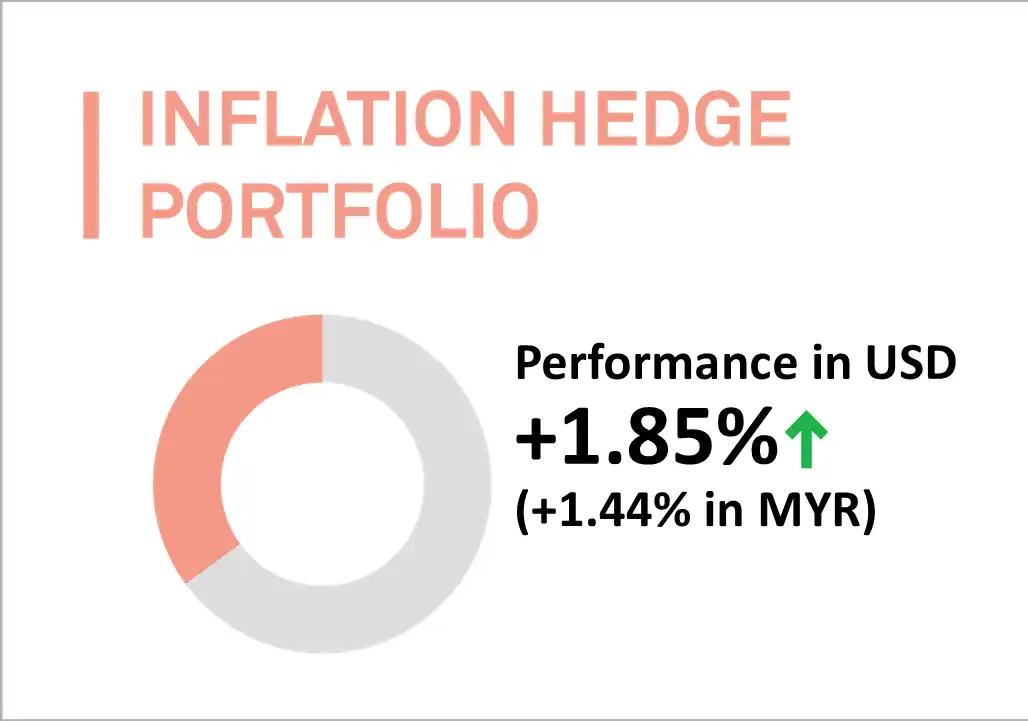

3. Inflation Hedge Portfolio

The Inflation Hedge Portfolio delivered solid performance in January, driven by a rebound in precious metals. The Silver ETF (SLV) and the Gold ETF (IAU) surged by 8.7% and 7.2%, respectively, as investors sought safe-haven assets to hedge against rising uncertainty, including fears of a potential broader trade war.

The Mortgage Real Estate ETF (REM) rose 5.9%, recovering most of its losses from the previous month after inflation concerns eased. This came after the Federal Reserve, in its final meeting of the year, acknowledged that inflation had “made progress toward” its 2% target, reinforcing expectations of maintaining a loose monetary policy.

Only two of the eleven ETFs in the portfolio ended the month in negative territory. The global clean energy ETF (ICLN) declined following the US withdrawal from the Paris Agreement, a global accord aimed at addressing climate change. US is the fifth-largest contributor to the Green Climate Fund—providing approximately 8.5% of its total funding. This decision raised concerns that other nations might follow suit, creating uncertainty in the clean energy sector.

Meanwhile, the Metal ETF (DBB) fell after reports indicated a sharp increase in Chinese steel exports. Data showed that China’s steel exports surged by 25% in 2024, raising fears of a potential oversupply in the market, especially as demand in both China and Europe remained weak.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES SILVER TRUST (SLV)

ISHARES GOLD TRUST (IAU)

ISHARES MORTGAGE REAL ESTATE (REM)

+8.7%

+7.2%

+5.9%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

INVESCO DB BASE METALS F (DBB)

ISHARES TIPS BOND ETF (TIP)

-0.7%

-0.7%

+1.1%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2025.

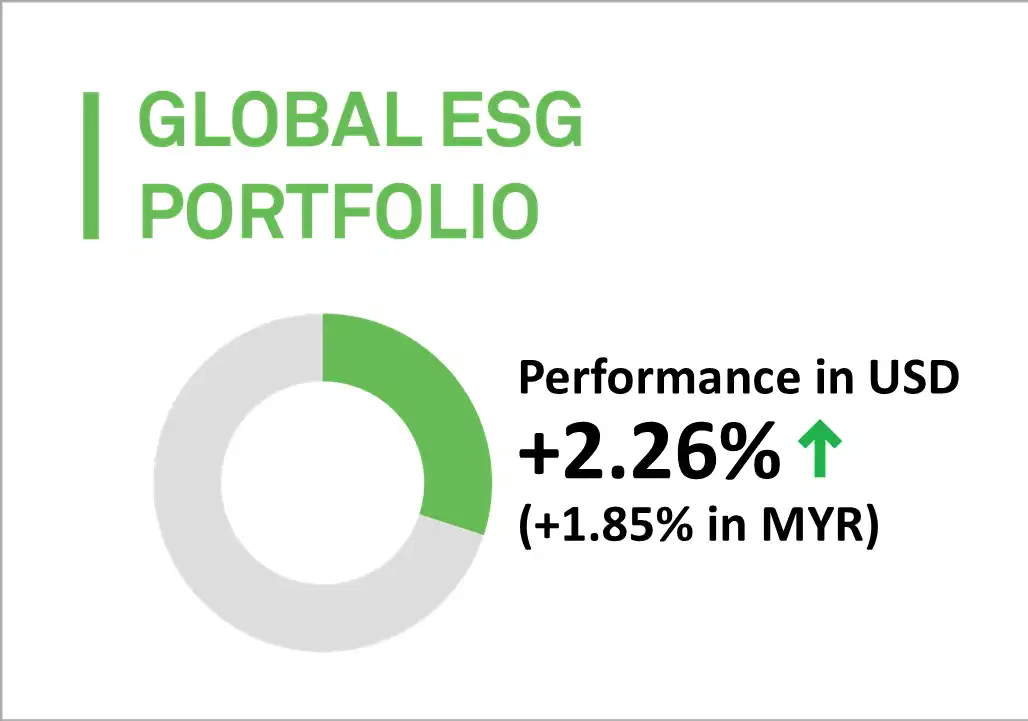

4. Global ESG Portfolio

MYTHEO’s Global ESG up by 2.26% (up by 1.85% in MYR) in January 2025.

The Environmental, Social, and Governance (ESG) investment landscape hit by big negative news following President Donald Trump's executive order to withdraw the US from the Paris Accord. Despite this negative development, MYTHEO’s Global ESG portfolio remained resilient, with none of its holdings experiencing a material impact. The fund's broad diversification and strong correlation to the overall equity market helped mitigate any adverse effects.

In line with broader equity trends, MYTHEO’s Global ESG portfolio exhibited performance characteristics similar to its Growth and Income Portfolio. Non-US assets outperformed their US counterparts. The iShares ESG Aware MSCI EAFE ETF (ESGD), which invests in the markets across Europe, Australia, Asia, and the Far East, emerged as the portfolio’s top performer, delivering a monthly return of 4.1%. Similarly, the ESG Aware MSCI Emerging Markets ETF (ESGE) ranked among the top three performers, driven by robust returns from key emerging markets such as Brazil and China.

Within the US equity space, value ESG stocks outpaced growth ESG stocks, largely due to a sell-off in growth stocks following the launch of DeepSeek R1. ESG large-cap value stocks (NULV) gained 3.9%, significantly outperforming ESG large-cap growth stocks (NULG), which posted a modest return of 0.7%.

Top 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

+4.1%

+3.9%

+2.5%

Bottom 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

+0.7%

+1.7%

+2.0%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2025.

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was up by 2.16% (1.75% in MYR) in January 2025.

The Essential Products portfolio began the year on a positive note, buoyed by the strong performance of agriculture-related investments. The agriculture producer ETF (VEGI) rose by 7.8%, while the ETF investing in companies engaged in agri-chemicals, animal health, fertilizers, and seeds (MOO) increased by 7.5%.

This robust performance is linked to the exceptional results of certain commodities such as coffee and cocoa. Some producers might enjoy record profits and be encouraged to spend more, which could have a positive ripple effect across other value chains in the agriculture sector

On negative side, Global clean energy stocks (ICLN) declined following President Trump's announcement of the US withdrawal from the Paris Accord. Additionally, metal stocks (DBB) fell due to concerns over metal supply, as exports from China grew sharply despite weak steel demand domestically and in Europe.

Top 3 ETFs performance (Essential products portfolio)

ISHARES MSCI AGRICULTURE PRO (VEGI)

VANECK AGRIBUSINESS ETF (MOO)

ENERGY SELECT SECTOR SPDR (XLE)

+7.8%

+7.5%

+3.4%

Bottom 3 ETFs performance (Essential products portfolio)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

INVESCO DB BASE METALS (DBB)

ISHARES TIPS BOND ETF (TIP)

-0.7%

-0.7%

+1.1%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2025.

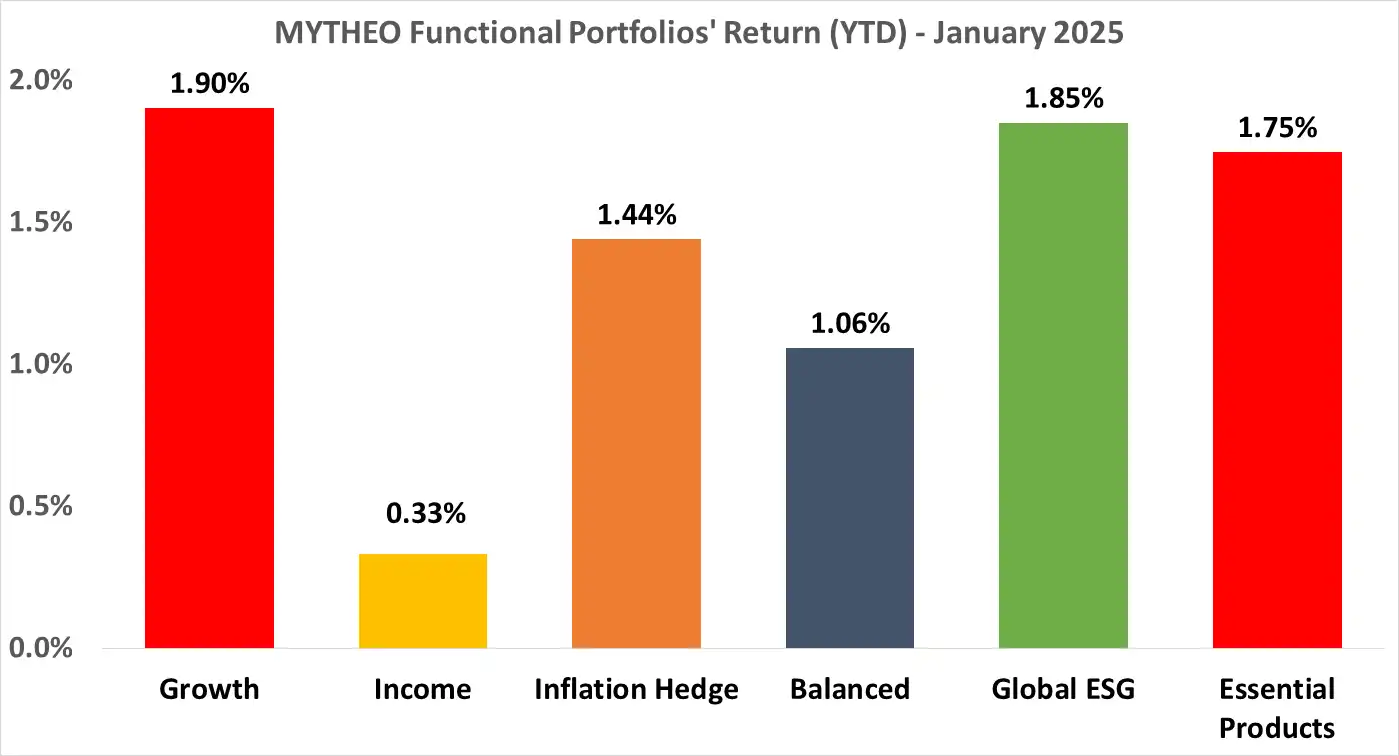

Chart 1: Year 2024 Portfolio Return in % (MYR)

Source: GAX MD Sdn Bhd, February 2025

Note: Past performance is not an indication of future performance

Balanced allocation consists of 30% Growth, 47% Income and 23% Inflation Hedge

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio returns derive from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 47% to the Income portfolio and 23% to the Inflation Hedge Portfolio, the actual portfolio return in MYR for December would be 1.06%, calculated as follows: [(30% x 1.90%) + (47% x 0.33%) + (23% x 1.44%)].

Our Thoughts

On January 20, President Donald Trump commenced his second term with a bold move by imposing a 25% tariff on imports from Canada and Mexico. The market reacted positively to this decision, as investors had braced for more severe measures, such as sweeping tariffs on Chinese goods. As a result, the stock market experienced an upswing, closing the month on a high note. The S&P 500 index climbed 2.70%, while the Nasdaq Composite index rose 2.05%.

The only significant market downturn occurred on January 27, following the surprise unveiling of DeepSeek R1, an advanced AI model developed by the Chinese firm DeepSeek. The model, reportedly comparable to OpenAI’s ChatGPT but capable of running on less sophisticated chips, triggered a steep sell-off in hardware-focused technology stocks. On that day, shares of Nvidia, Broadcom, Taiwan Semiconductor Manufacturing Company (TSMC), and AMD plummeted by 16.97%, 17.40%, 13.33%, and 6.37%, respectively, as investors worried about potential disruptions to the demand for high-performance AI chips. However, DeepSeek’s direct competitors, such as Microsoft and Alphabet, saw relatively modest declines of 2.14% and 4.20%, respectively.

The US dollar (USD) also had a volatile month. It began at 4.4600 against the Malaysian ringgit (MYR), climbed to a peak of 4.5080 on January 13, and then dropped to 4.3750 as equity markets rallied. However, renewed trade tensions—sparked by Trump’s tariffs on Canada, Mexico, Colombia, and China—drove a sharp rebound, with the dollar closing at 4.4500, down just 0.44% from the previous month.

Similarly, US Treasury yields saw significant swings. The 10-year Treasury yield spiked above 4.80% in the middle of the month before retreating at the end, with little change at 4.537%.

The Federal Open Market Committee (FOMC) held its first meeting of the year, but policymakers kept interest rates steady as expected, making it a non-event for the market.

Meanwhile, in Japan, the Bank of Japan (BoJ) raised interest rates to 0.50% on January 24—the highest level since the 2008 financial crisis. Unlike the rate hikes in July 2024, which triggered market volatility, this decision was met with relative calm, reflecting the market’s preparedness for the shift.

Regarding the trade war, we see it as the single biggest risk to the market this year. However, Trump appears to be taking a more calculated and strategic approach to avoid massive disruptions to the US economy. Most of MYTHEO’s portfolio remains tilted toward the US market, which is likely to be the most resilient should trade tensions escalate. For a deeper analysis on the trade war and its implications, we encourage readers to check out our dedicated article on this topic: Trump’s Trade War: A “Beautiful” Strategy or Economic Gamble?

As for DeepSeek, we believe the panic sell-off on January 27 was an overreaction. The emergence of DeepSeek is part of the natural competitive evolution in the AI sector. New players will continue to enter, and existing firms will make announcements on their progress in the coming months. Rather than a long-term threat, this competition is likely to drive further investment in AI, fueling an upcycle that benefits existing semiconductor players. To explore more insights on DeepSeek and its potential impact, we invite readers to read our in-depth article on this development: DeepSeek Shakes Up AI Rally: A Threat to Chip Giants or Just Another Hype Cycle?

As market dynamics continue to evolve, MYTHEO remains committed in providing investors with options aligned with their financial goals. As a digital investment platform, MYTHEO is prepared to support you in achieving your long-term financial objectives through diversified investments, seamlessly and cost-effectively. Discover how MYTHEO can enhance your portfolio diversification today, and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.