11 September 2024

Written by MYTHEO

Key Takeaways

- The US Dollar (USD) continued its depreciation against the Malaysian Ringgit (MYR), declining by 6.73%

- Global Equities rebound to fresh highs after a sharp sell-off at the start of the month;

- The Federal Reserve signals that the Fed will begin its easing cycle in September 2024;

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in August 2024.

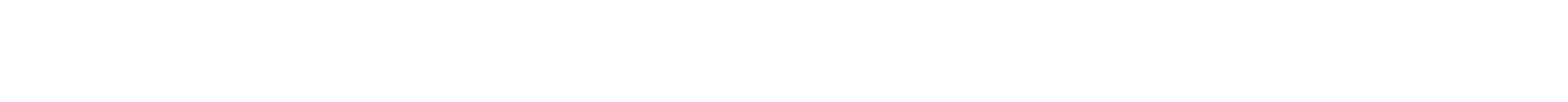

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 1.57% (down 5.26% in MYR) in August 2024.

In August 2024, the portfolio saw minimal adjustments. The allocation to the Invesco NASDAQ 100 ETF (QQQM) was slightly reduced from 17% to 15.30%, marking a decrease of 1.70%, while the exposure to the SPDR Euro STOXX 50 ETF (FEZ) increased from 3.64% to 4.37%, reflecting a 0.70% rise. Despite these changes, the U.S. market continues to represent the largest portion of the portfolio.

The portfolio’s allocation to Vanguard Value ETF (VTV) of about 20% was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

SPDR EURO STOXX 50 ETF (FEZ)

ISHARES MSCI CANADA ETF (EWC)

ISHARES MSCI UNITED KINGDOM ETF (EWU)

+4.41%

+4.03%

+3.50%

Bottom 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE VALUE ETF (RPV)

INVESCO NASDAQ 100 ETF (QQQM)

VANGUARD FTSE EMERGING MARKETS ETF (VWO)

+1.26%

+1.20%

+0.97%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2024.

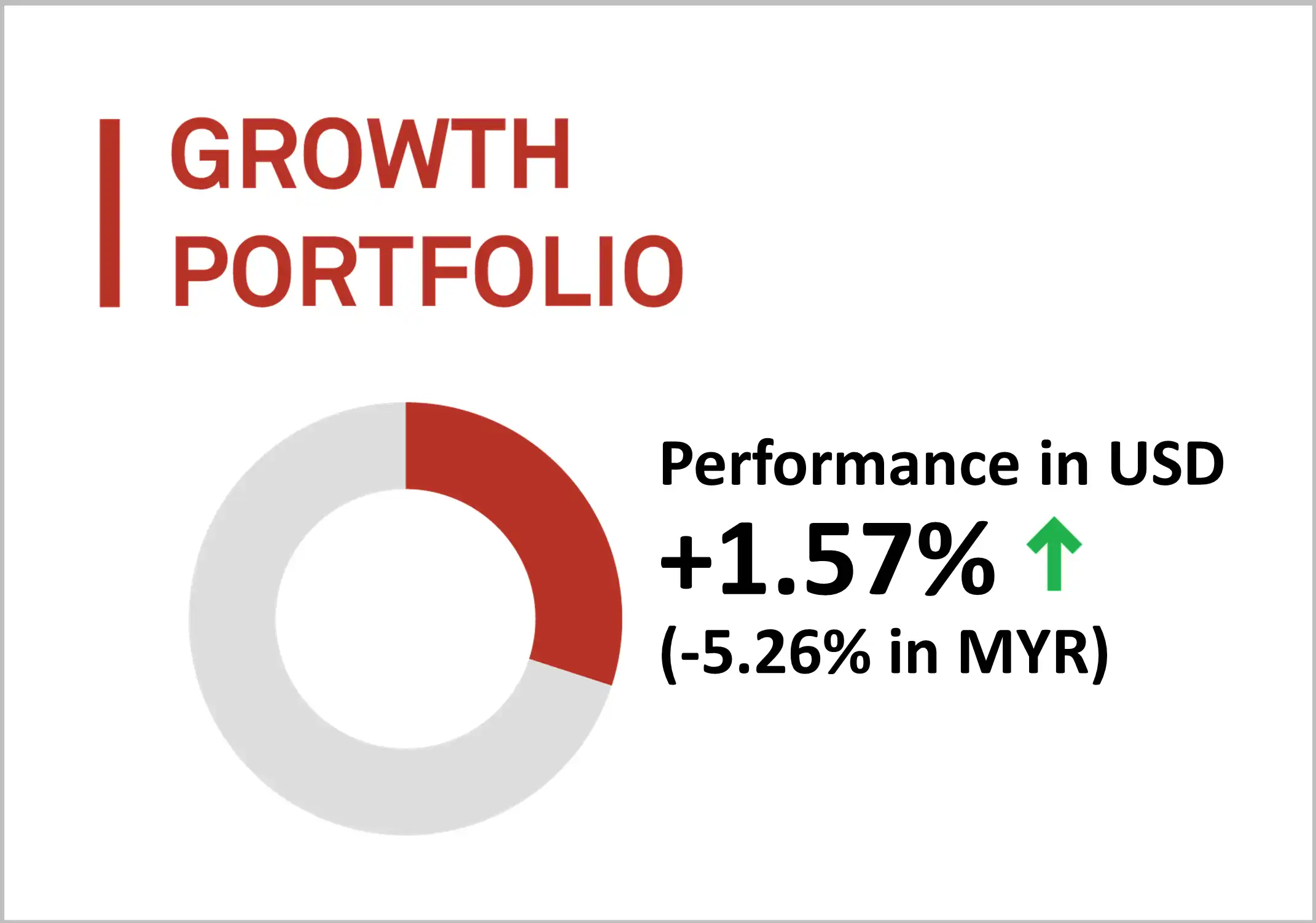

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gained of 1.13% (down by 5.67% in MYR) in August 2024.

In August 2024, the income portfolio maintained a substantial allocation to short-duration corporate and investment-grade bonds, which helped stabilise the risk exposure from its longer-term U.S. Treasury holdings. This balanced approach not only mitigated interest rate risk but also enhanced yield optimisation across the portfolio. As a result, the overall yield of the income portfolio was improved without compromising its stability. The current yield-to-maturity of the bond ETFs in the portfolio, excluding preferred stock, is approximately 4.76%, reflecting a strategic focus on yield enhancement while managing risk effectively.

The portfolio’s exposure to iShares 20+ Year Treasury Bonds ETF (TLT) of about 10% was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

MARKET VECTORS EMERGING MARKETS ETF (EMLC)

ISHARES INTERNATIONAL TREASURY BOND ETF (IGOV)

ISHARES US PREFERRED STOCK ETF (PFF)

+2.87%

+2.86%

+2.57%

Bottom 3 ETFs performance (Income portfolio)

ISHARES 3-7 YEAR TREASURY BONDS ETF (IEI)

SPDR BLACKSTONE/GSO SENIOR LOAN ETF (SRLN)

ISHARES FLOATING RATE BONDS ETF (FLOT)

+1.16%

+0.97%

+0.42%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2024.

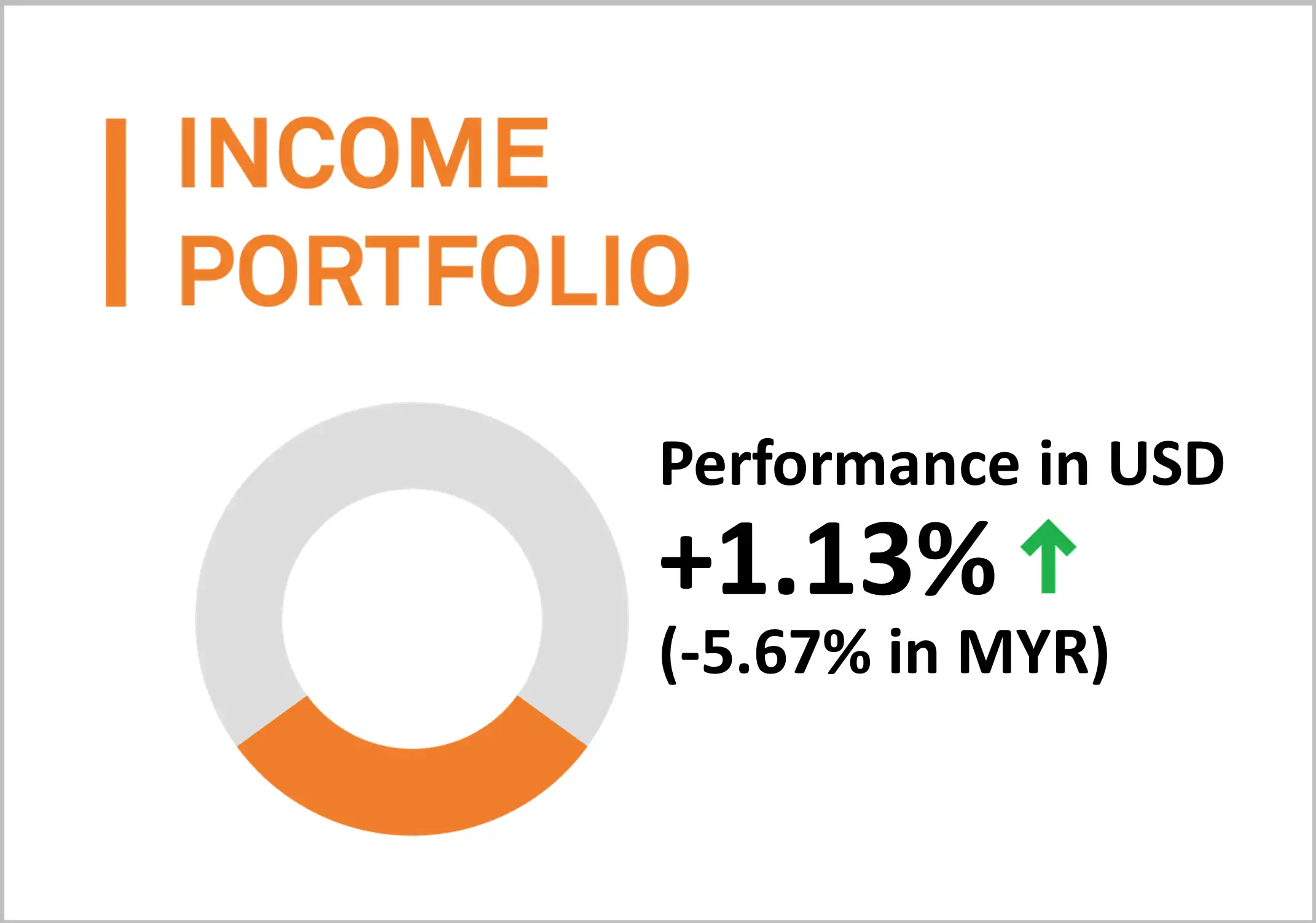

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in August 2024, up by 2.50% (down by 4.40% in MYR).

The core holdings of this portfolio are meticulously structured to prioritize resilience amid market volatility, particularly within equities and bonds. Emphasizing US real estate and inflation-linked bonds, the allocation to these assets is strategically designed to navigate fluctuations adeptly. US real estate, infrastructure, and base metals allocations are chosen for their ability to mitigate long-term inflation risks. Simultaneously, investments in inflation-linked bonds and gold offer added stability and diversification benefits, acting as buffers against the inherent turbulence of equity and bond markets.

The portfolio’s allocation to iShares U.S Real Estate ETF (IYR) of about 30% was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

SPDR DOW JONES INTERNATIONAL REAL ESTATE ETF (RWX)

ISHARES US REAL ESTATE ETF (IYR)

ISHARES GLOBAL INFRASTRUCTURE ETF (IGF)

+6.38%

+5.40%

+4.51%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES TIPS BOND ETF (TIP)

ISHARES SILVER TRUST (SLV)

INVESCO DB OIL FUND (DBO)

+0.80%

-0.15%

-5.05%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2024.

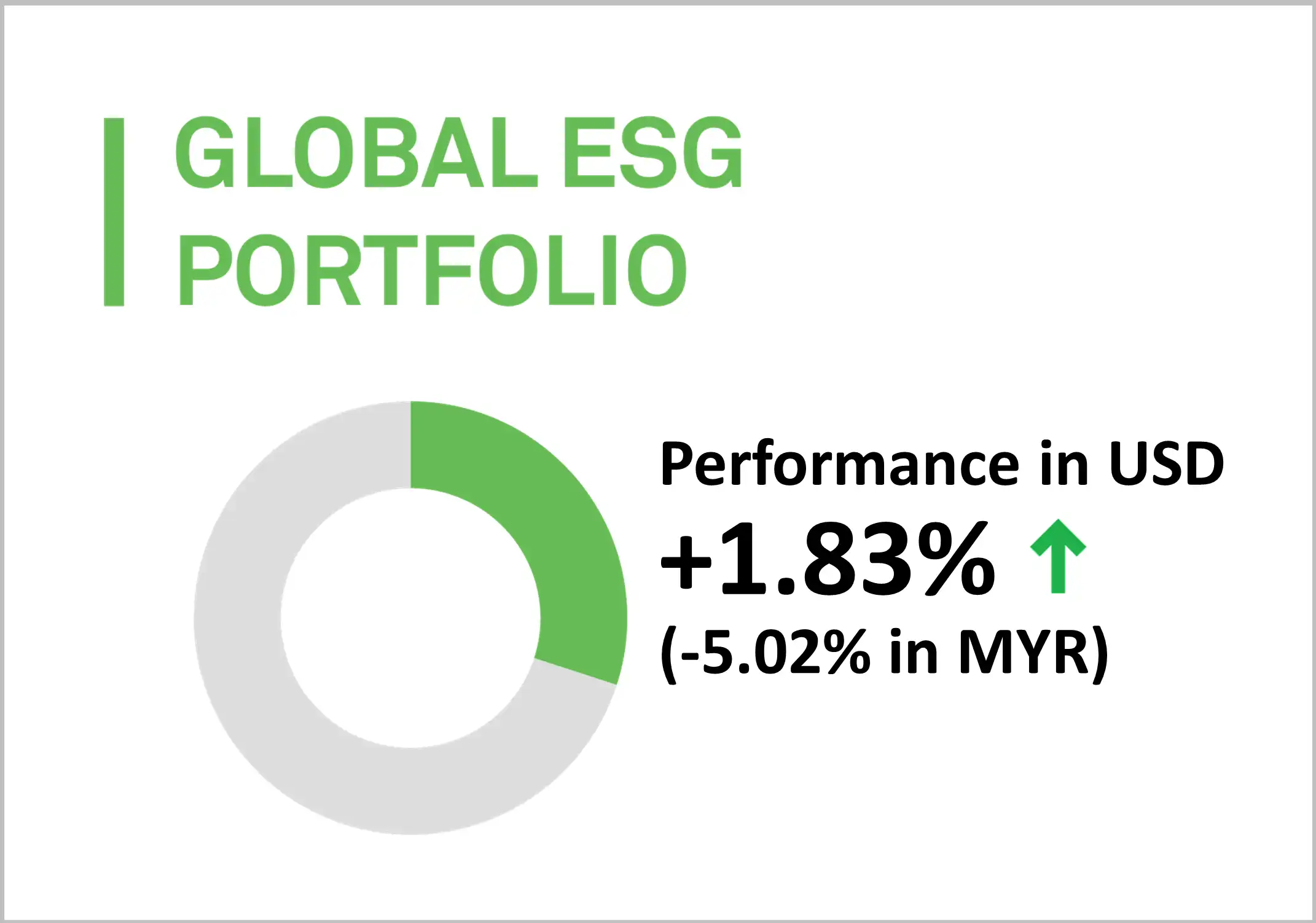

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 1.83% (down by 5.02% in MYR) in August 2024.

In line with the growth portfolio strategy, MYTHEO Global ESG portfolio exhibits a preference and exposure of around 60% to the US market. This substantial weighting is justified by the United States' prominent role in Environmental, Social, and Governance (ESG) investments, coupled with its well-established track record. By carrying a higher allocation to US markets, MYTHEO recognizes not only the maturity of these markets but also underscores its commitment to effective risk management strategies.

Top 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

+3.33%

+3.08%

+2.28%

Bottom 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

+2.28%

+1.81%

+1.24%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2024.

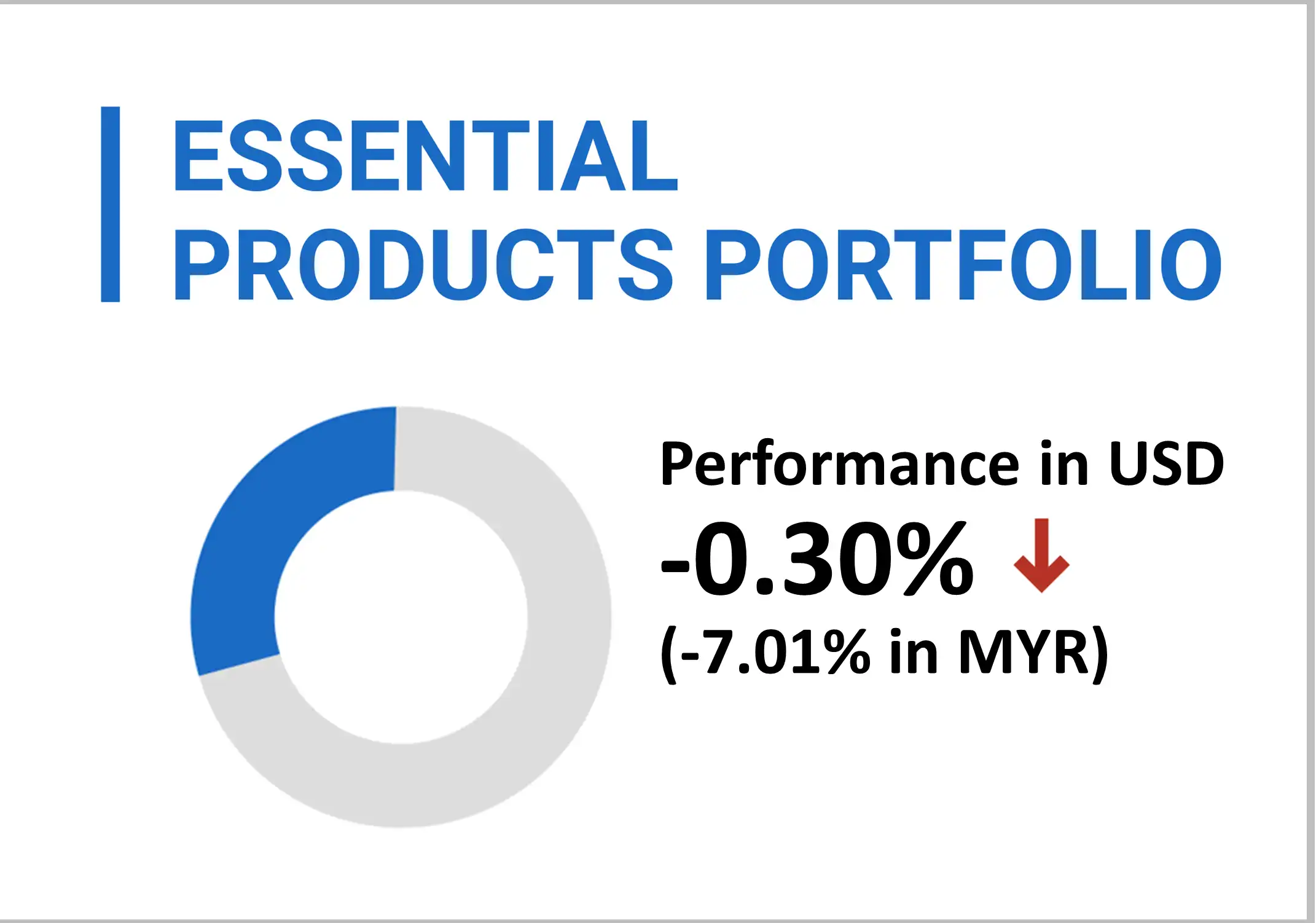

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was down by 0.30% (-7.01% in MYR) in August 2024.

The portfolio emphasis on ETFs reflecting pivotal themes of food, water, and energy, encompassing both new energy and traditional energy resources. With an allocation of around 60% to the US market, this strategic positioning is weighed to seize promising investment prospects arising from technological innovations and evolving business models within these sectors on a global scale.

Top 3 ETFs performance (Essential products portfolio)

VANECK AGRIBUSINESS ETF (MOO)

ISHARES MSCI AGRICULTURE PRODUCERS ETF (VEGI)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

+2.24%

+1.59%

+0.99%

Bottom 3 ETFs performance (Essential products portfolio)

FIRST TRUST GLOBAL WIND ENERGY ETF (FAN)

ENERGY SELECT SECTOR SPDR FUND (XLE)

GLOBAL X LITHIUM & BATTERY TECH ETF (LIT)

-0.61%

-2.07%

-3.22%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2024.

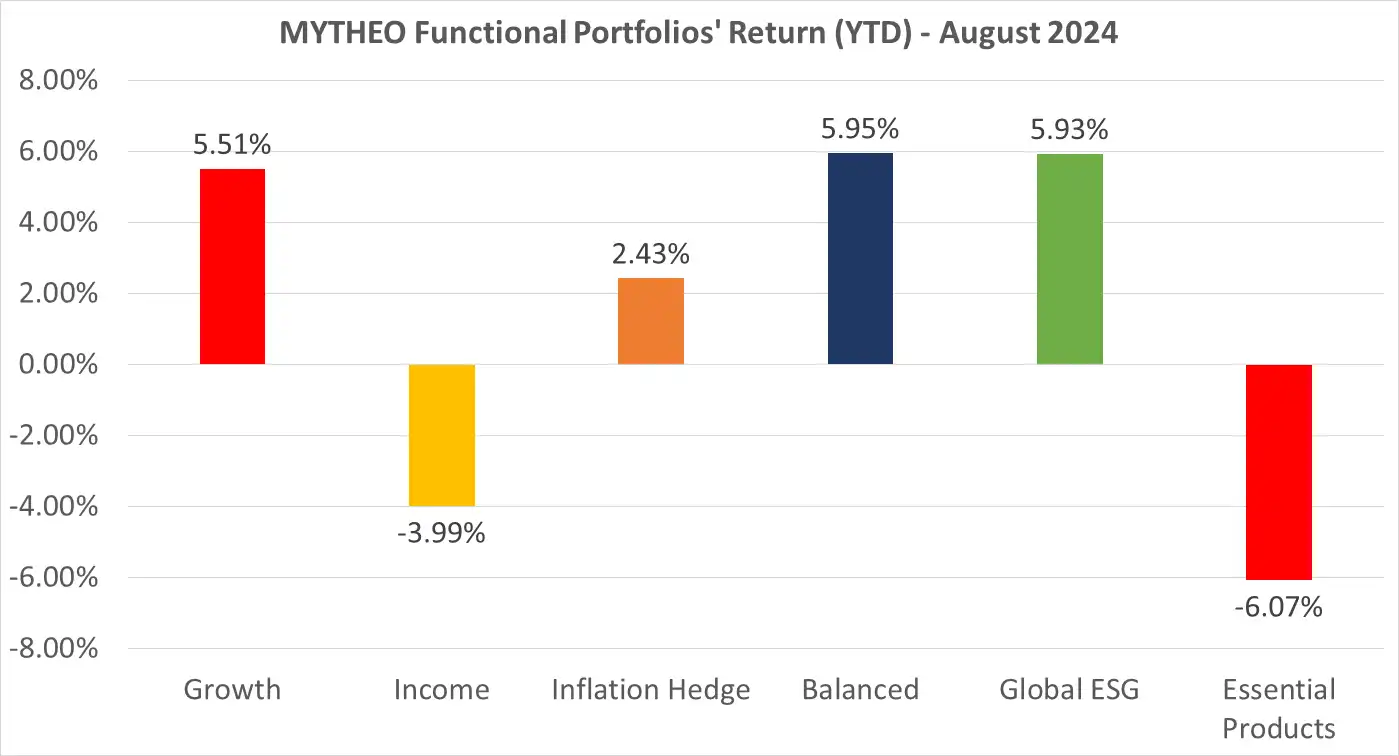

Chart 1: August 2024 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, September 2024

Note: Past performance is not an indication of future performance

Balanced allocation consists of 30% Growth, 47% Income and 23% Inflation Hedge

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio returns derive from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 47% to the Income portfolio and 23% to the Inflation Hedge Portfolio, the actual portfolio return in MYR for August would be -5.26%, calculated as follows: [(30% x -5.26%) + (47% x -5.68%) + (23% x -4.40%)].

Our Thoughts

In August 2024, the US Dollar (USD) continued its depreciation against the Malaysian Ringgit (MYR), declining by 6.73% from MYR 4.6200 to MYR 4.3090 as of July 31, 2024. This significant drop adversely impacted the portfolio's performance when measured in Ringgit terms, eroding gains from US based assets. The weakening of the USD was further exacerbated by heightened market expectations of impending rate cuts by the U.S. Federal Reserve, which also led to its broader decline against other major regional currencies.

Global equities advanced in August 2024, although the month began with heightened volatility. U.S. markets, particularly the Dow Jones Industrial Average, reached new highs multiple times, reflecting strong performance across key sectors. In contrast, Japan's Nikkei 225 suffered its steepest single-day drop in history, plummeting over 4,400 points, or 12%. This historic decline was sparked by the Bank of Japan's unexpected announcement of a rate hike, which sharply strengthened the Yen and triggered widespread sell-offs across the Japanese stock market, leading to a severe market rout.

The fixed income markets continued to deliver solid performance, supported by softening economic indicators and growing anticipation of the Federal Reserve's upcoming interest rate cuts. After maintaining its benchmark interest rate within the 5.25%-5.50% range since July 2023—following an aggressive rate hike cycle that started 18 months earlier in response to soaring inflation—the Fed now signals a shift toward easing monetary policy. Inflation, as measured by the Fed’s preferred gauge, has dropped significantly from its mid-2022 peak of 7% to 2.5% by July 2024, reflecting a successful effort to contain price pressures. However, the labour market has shown signs of cooling, with the unemployment rate rising from 3.5% to 4.2%, accompanied by a noticeable slowdown in monthly job creation, adding further support for rate cuts.

Both international and U.S. real estate ETFs reached one-year highs as the real estate sector has recently gained attention due to rising expectations of global rate cuts. The Federal Reserve is anticipated to lower rates in September, while the European Central Bank has already begun easing its monetary policy.

As market dynamics continue to evolve, MYTHEO remains committed in providing investors with options aligned with their financial goals. As a digital investment platform, MYTHEO is prepared to support you in achieving your long-term financial objectives through diversified investments, seamlessly and cost-effectively. Discover how MYTHEO can enhance your portfolio diversification today, and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.