8 May 2025

Written by MYTHEO

Key Takeaways

- Equity markets staged a strong rebound by month-end, recovering significantly from one of the deepest drawdowns seen this year.

- A sharp correction in the US dollar led to stronger performance in non-US assets and impacted portfolio returns.

- Reacting emotionally to market swings can lock in losses and cause missed opportunities when markets rebound.

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in April 2025.

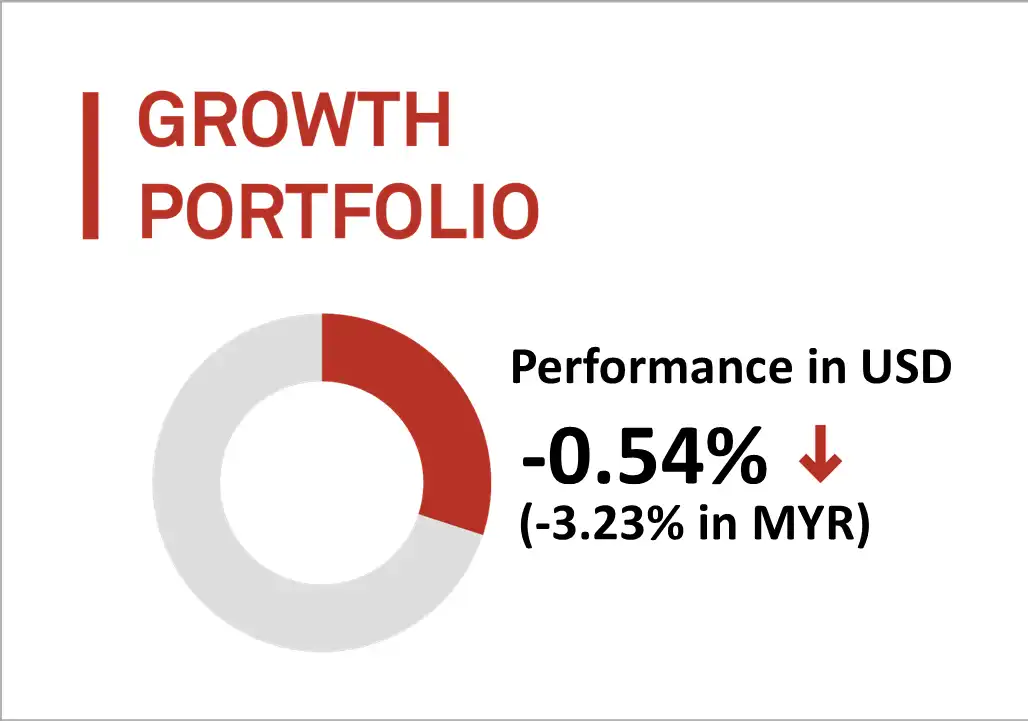

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 0.54% (down by 3.23% in MYR) in April 2025.

The reciprocal tariff announced by President Trump on “Liberation Day” sparked one of the biggest storms in global financial markets. Markets initially sold off sharply in reaction to the news but rebounded strongly just a few days later. By the end of the month, most losses had been recovered, and some assets even finished higher.

Currencies ended up being the dominant force driving market movements throughout the month. The US Dollar Index (DXY), which tracks the dollar’s performance against a basket of major global currencies, tumbled 4.55%, providing a substantial lift to non-US assets. As a result, the top three performing ETFs for the month were the Pacific ETF (VPL), Canada ETF (EWC), and Euro ETF (FEZ), posting gains of 4.24%, 4.17%, and 3.38%, respectively.

Meanwhile, US stocks struggled, particularly value stocks, which had previously been enjoying solid gains. The biggest laggards of the month were US Pure Value (RPV), Vanguard Value (VTV), and Mid-Cap Value ETFs (IWS), delivering returns of -4.29%, -3.65%, and -2.56% in US dollar terms.

Top 3 ETFs performance (Growth portfolio)

VANGUARD FTSE PACIFIC (VPL)

ISHARES MSCI CANADA (EWC)

SPDR EURO STOXX 50 (FEZ)

+4.24%

+4.17%

+3.38

Bottom 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE VALUE (RPV)

VANGUARD VALUE (VTV)

ISHARES RUSSELL MID-CAP VALUE (IWS)

-4.29%

-3.65%

-2.56%

Source: GAX MD Sdn Bhd, data in USD term for the month of April 2025.

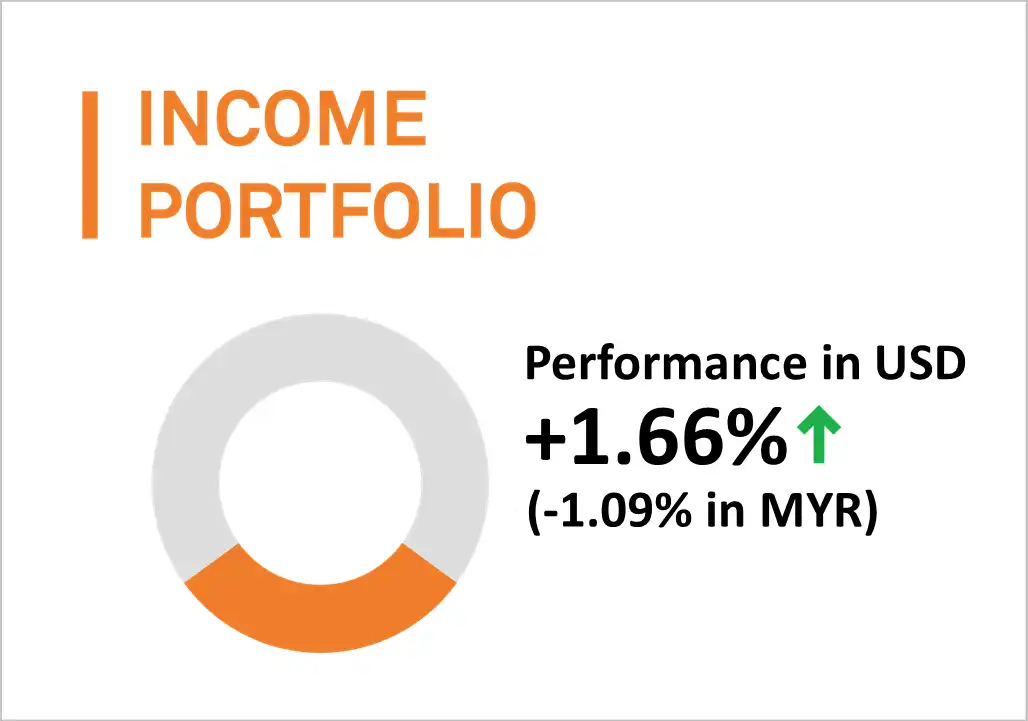

2. Income Portfolio

In April 2025, MYTHEO's Income Portfolio rose by 1.66% (a decrease of 1.09% in MYR).

In April 2025, the bond market saw a trend that similar to equities market. Like the growth portfolio, the non-US assets in the income portfolio also performed better than the US Assets. The top performer in the MYTHEO US Income portfolio was international treasuries (IGOV), which jumped 6.34%, driven by the European Central Bank’s rate cut on April 17 and a 4.72% rally in the euro (EUR) against the US dollar.

Emerging market bonds in local currencies (EMLC) also benefited from the weaker dollar, posting a solid 2.56% gain.

Meanwhile, most US income assets wrapped up the month in negative territory, despite a late decline in Treasury yields. Preferred shares (PFF) slipped 1.79%, while long-term US Treasuries (TLT) dropped 1.70%. Concerns over rising inflation and a weakening dollar dampened demand, making these assets less attractive.

Top 3 ETFs performance (Income portfolio)

ISHARES INTERNATIONAL TREASURY (IGOV)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

+6.34%

+2.56%

+1.06%

Bottom 3 ETFs performance (Income portfolio)

ISHARES US PREFERRED STOCK (PFF)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

-1.79%

-1.70%

-0.85%

Source: GAX MD Sdn Bhd, data in USD term for the month of April 2025.

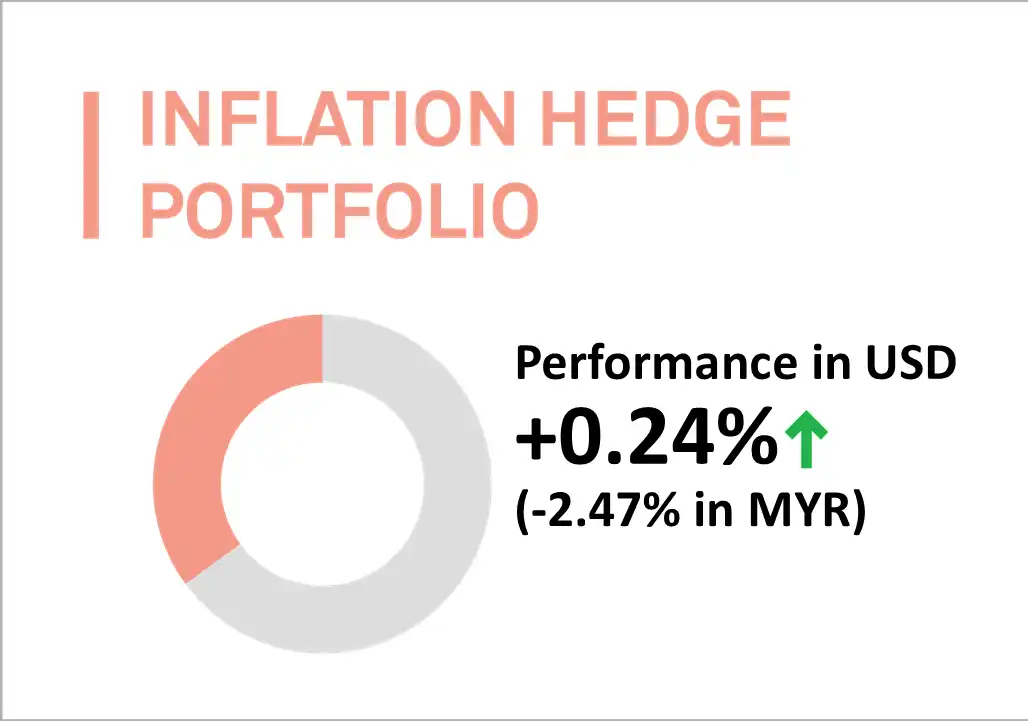

3. Inflation Hedge Portfolio

In April 2025, MYTHEO’s Inflation Hedge Portfolio recorded a gain of 0.24% (a loss of 2.47% in MYR).

The relatively weak US dollar was also a key factor influencing the performance of inflation-hedge portfolios in April. International real estate (RWX) and global infrastructure (IGF) both benefited from this currency dynamic, ending the month with strong gains of 6.62% and 3.15% respectively. Gold (IAU) rose by 5.44%, supported by increased investor interest amid heightened market volatility.

In contrast, the expectation of slowing global economic growth weighed on oil and metal prices. Crude oil faced additional pressure from expectations that the Organization of the Petroleum Exporting Countries (OPEC) would raise output. As a result, the crude oil ETF (DBO) dropped sharply by 16.19%, while the metals ETF (DBB) fell 7.35%.

The weak US dollar made US domestic assets less attractive, as reflected in the 5.12% drop in mortgage real estate (REM) during the month.

Top 3 ETFs performance (Inflation hedge portfolio)

SPDR DJ INTERNATIONAL REAL E (RWX)

ISHARES GOLD TRUST (IAU)

ISHARES GLOBAL INFRASTRUCTUR (IGF)

+6.62%

+5.44%

+3.15%

Bottom 3 ETFs performance (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

INVESCO DB BASE METALS F (DBB)

ISHARES MORTGAGE REAL ESTATE (REM)

-16.19%

-7.35%

-5.12%

Source: GAX MD Sdn Bhd, data in USD term for the month of April 2025.

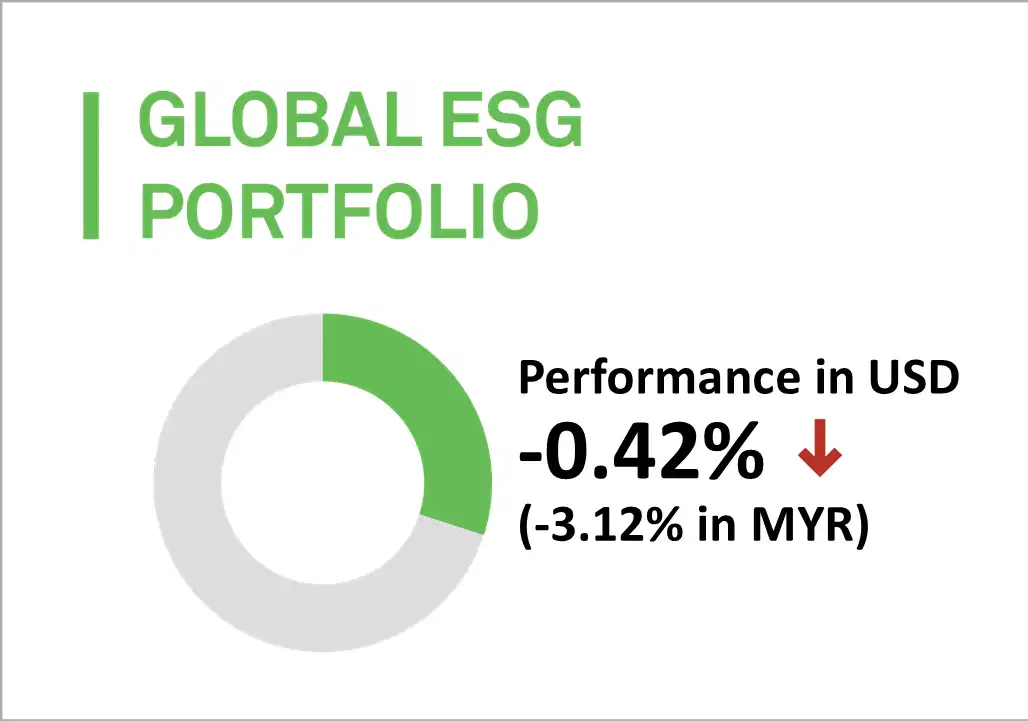

4. Global ESG Portfolio

MYTHEO’s Global ESG dropped by 0.42% (down by 3.12% in MYR) in April 2025.

Non-US assets continued to outperform US assets, a trend that has persisted since the beginning of the year. This was evident in the strong performance of the ESG Aware Europe, Australasia, and Far East ETF (ESGD), which gained 3.66%, and the ESG Aware Emerging Markets ETF (ESGE), which was up 0.60%.

Interestingly, within the US market, we saw a reversal in style performance. Value stocks, which had been outperforming growth stocks over the past few months, started to lag. In MYTHEO’s ESG portfolio, for instance, ESG Large-Cap Growth rose by 3.01%, while ESG Large-Cap Value was the worst performer, falling by 3.16%.

Top 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

+3.66%

+3.01%

+0.60%

Bottom 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

-3.16%

-0.68%

-0.03%

Source: GAX MD Sdn Bhd, data in USD term for the month of April 2025.

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was down by -1.28% (-3.95% in MYR) in April 2025.

The MYTHEO Essential Products portfolio had more winners than losers in April, with four ETFs posting positive returns compared to two that ended in the red. However, the overall portfolio return was negative, weighed down by significant losses in the Energy Select Sector ETF (XLE) and the Lithium & Battery Tech ETF (LIT). XLE fell by 13.86%, in line with a more than 18% decline in crude oil prices, driven by concerns over slowing economic growth and the potential for increased supply from the Organization of the Petroleum Exporting Countries (OPEC).

The LIT ETF was hit hard by President Trump’s announcement of a hefty 145% tariff on Chinese-made electric vehicles. Given that China accounts for over 70% of the global EV battery market, the move sparked investor concerns and dragged the ETF lower.

Top 3 ETFs performance (Essential products portfolio)

INVESCO S&P GLOBAL WATER IND (CGW)

FIRST TRUST GLOBAL WIND ENER (FAN)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

+5.78%

+4.66%

+3.06%

Bottom 3 ETFs performance (Essential products portfolio)

ENERGY SELECT SECTOR SPDR (XLE)

GLOBAL X LITHIUM & BATTERY (LIT)

FIRST TRUST WATER ETF (FIW)

-13.86%

-5.57%

+0.42%

Source: GAX MD Sdn Bhd, data in USD term for the month of April 2025.

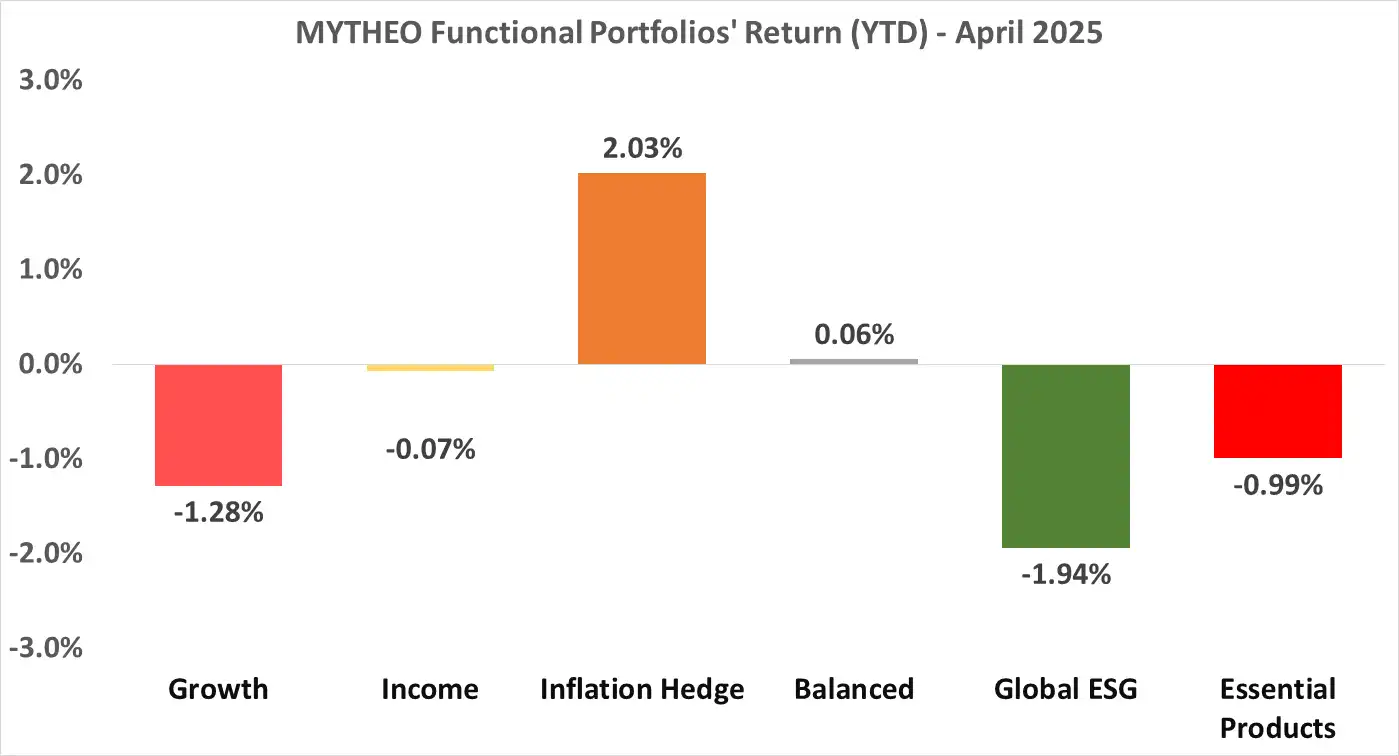

Chart 1: YTD 2025 Portfolio Return in % (MYR)

Source: GAX MD Sdn Bhd, February 2025

Note: Past performance is not an indication of future performance

Balanced allocation consists of 30% Growth, 47% Income and 23% Inflation Hedg

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio returns derive from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 47% to the Income portfolio and 23% to the Inflation Hedge Portfolio, the portfolio return in MYR for April would be -2.05%, calculated as follows: [(30% x -3.23%) + (47% x -1.09%) + (23% x -2.47%)].

Our Thoughts

April 2025 was anything but calm. Market volatility surged following President Trump’s surprise announcement of reciprocal tariffs on “Liberation Day”—a move that turned out far worse than many had anticipated. Initially, tariffs were imposed broadly, but on April 7, Trump paused them for all countries except China. Then, in another twist on April 12, he announced an exemption for smartphones, computers, and other electronic devices. We shared our full perspective on this tariff war in last month’s blog post:

GLOBAL MARKET SHIFT – HOW SMART INVESTORS STAY READY?

These rapid shifts in policy triggered one of the most dramatic market swings of the year. Equities initially plunged, only to rebound strongly later in the month. On April 7, the S&P 500 had fallen by as much as 11.83%, while the Nasdaq dropped 11.20% by April 8. Investors who panicked and exited the market during this period may have ended the month in the red—despite the fact that both indices recovered and finished April in positive territory. The S&P 500 rose 2.80%, and the Nasdaq gained 1.52%.

The bond market wasn’t spared either. The yield on the US 10-year Treasury began the month at 4.184%, dropped sharply to 3.86% by April 4, then spiked to 4.386% by April 11 due to speculation that China might start dumping US Treasuries. Yields eventually settled at 4.135% by month-end—just slightly below where they started.

One clear trend that carried through in April was the continued outperformance of non-US assets, largely fuelled by a sharp correction in the US dollar. The US Dollar Index (DXY)—which measures the Dollar against a basket of major currencies including the euro, Swiss franc, Japanese yen, Canadian dollar, British pound, and Swedish krona—tumbled by 4.55% over the month. This marked its steepest monthly decline since November 2022.

However, within the US market, the momentum flipped. “value” stocks, which had been leading for the first quarter of 2025, started lagging behind “growth” stocks for the first time this year.

For MYTHEO’s portfolios, the most notable impact came from currency movements. The US dollar depreciated by 2.71% against the Malaysian ringgit (MYR). If not for this currency headwind, the Income and Inflation Hedge portfolios would have posted gains of 1.66% and 0.24%, respectively.

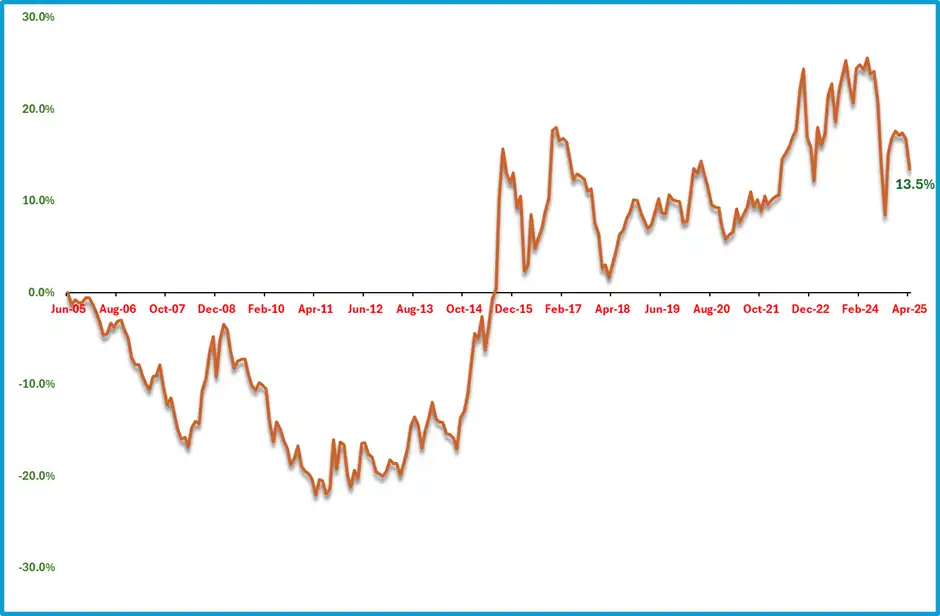

Currency fluctuations like these are nothing new. Just last year, the US dollar fell by 5.97% in August and 4.56% in September against the ringgit. Volatility is simply part of global investing. But when you zoom out and look at the long-term picture, the impact becomes much less significant. Since the ringgit was unpegged and allowed to float freely, the US dollar has appreciated by about 13.5%—an average of just 0.66% per year. While there have been many ups and downs along the way, the long-term effect of currency movements on overall portfolio performance has been relatively minor.

Chart 2: USD Return against MYR from July 2005 to April 2025

Source: GAX MD Sdn Bhd, February 2025

Note: Past performance is not an indication of future performance

April was a volatile month, marked by sharp moves across multiple asset classes but it also offered valuable lessons about investing:

- Don’t act out of panic.

Markets can swing sharply in both directions. Reacting emotionally during a downturn might mean missing out on the recovery that follows.

- Patterns don’t always hold.

Even if you spot a trend, there's no guarantee it will last. For instance, US “value” stocks outperformed “growth” stocks in the first quarter, but the pattern reversed in April. It's more important to focus on building a portfolio for long-term gains than to chase short-term trends

- Currency movements can be harsh in the short term but milder over time.

Most MYTHEO investments are in US dollar-denominated assets. While a weaker dollar can be painful in the short term for MYR-based investors, history shows that currency fluctuations tend to even out over the long run.

Discover how MYTHEO can enhance your portfolio diversification today and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.